Why Can’t You Just Get It through Your Head, It’s Over, It’s Over Now

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Why can’t you just get it through your head?

It’s over, it’s over now

Yes, you heard me clearly now I said

It’s over, it’s over now

(Boz Scaggs, from the Silk Degrees album, 1976)

Over the past few months, we’ve received many inbound calls from advisors asking us when the current rotation out of growth and into value will be “over”—as if it is a one-year phenomenon. Let’s examine that.

First, 2022, without a doubt, witnessed a massive rotation out of the growth stocks that led the market for most of the previous 10 years and into value stocks. The so-called “FAANGM” stocks (Facebook [Meta], Apple, Amazon, Netflix, Google [Alphabet], and Microsoft) were decimated over the course of the year.

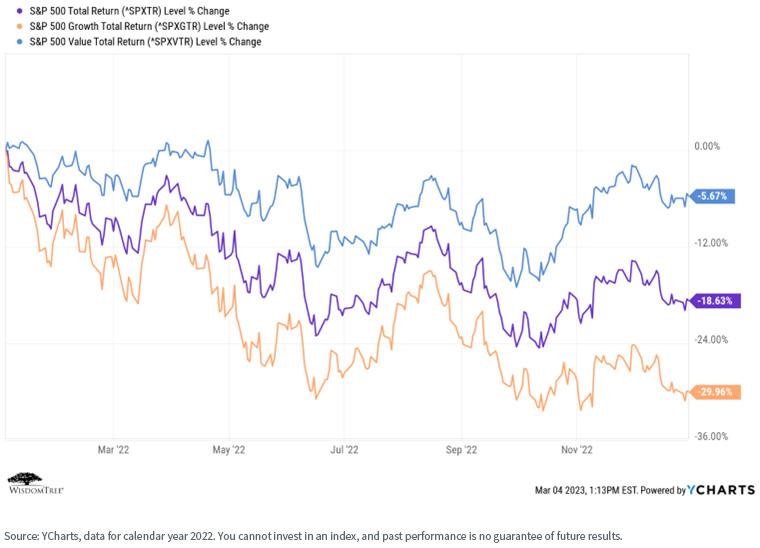

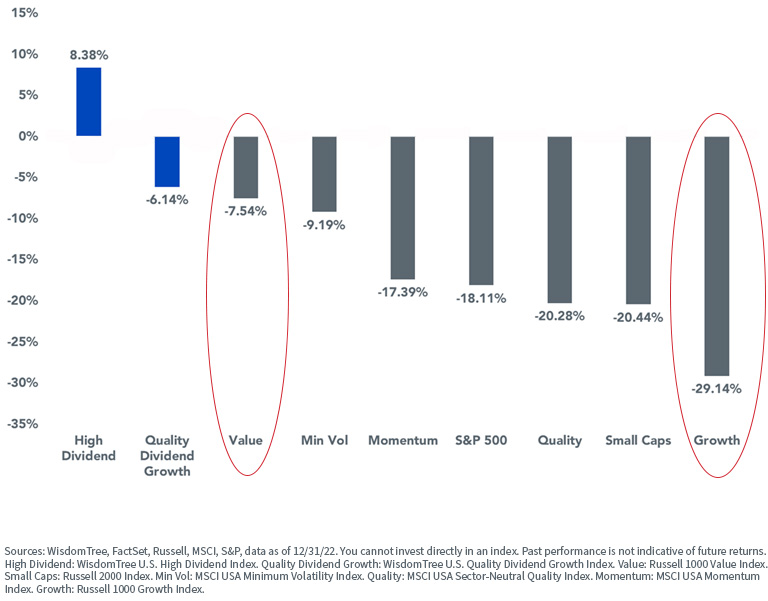

Meanwhile, value stocks dramatically outperformed growth stocks—to the tune of one of the widest performance dispersions in history (two charts).

For definitions of indexes in the chart above, please visit the glossary.

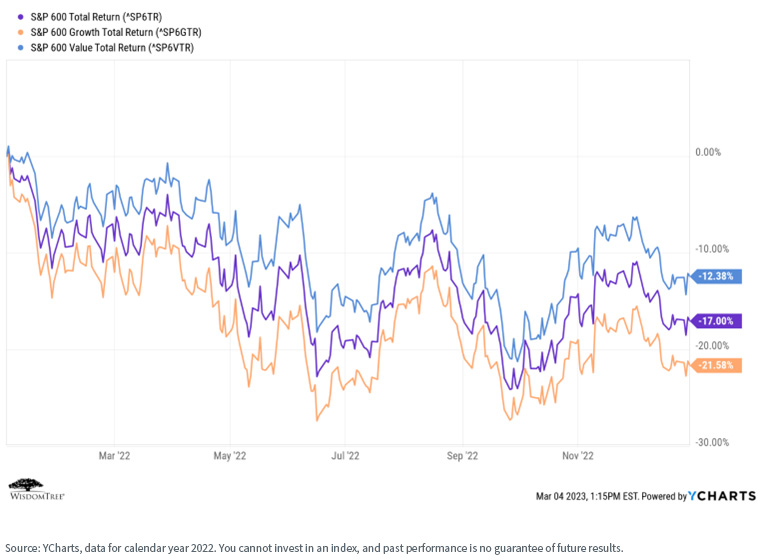

This performance gap was also remarkable in small- and mid-cap stocks.

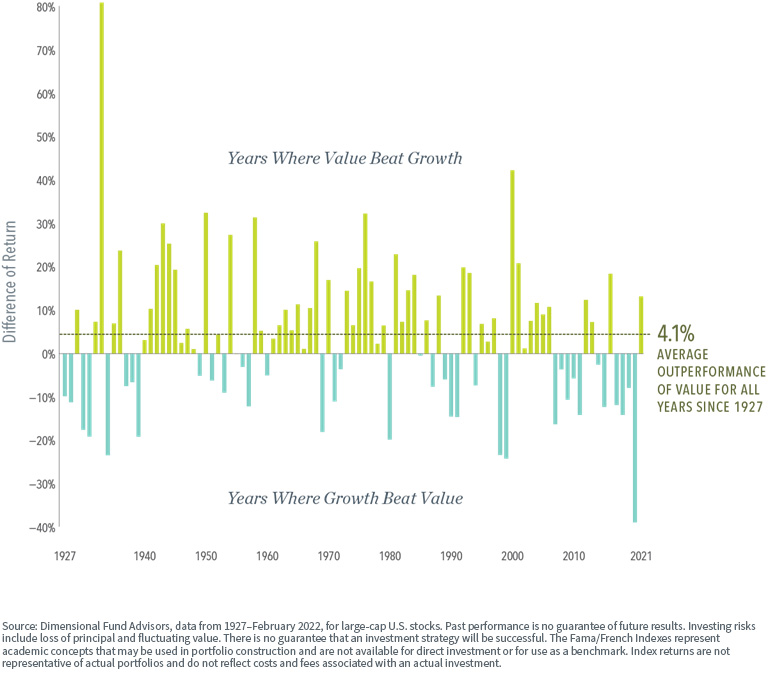

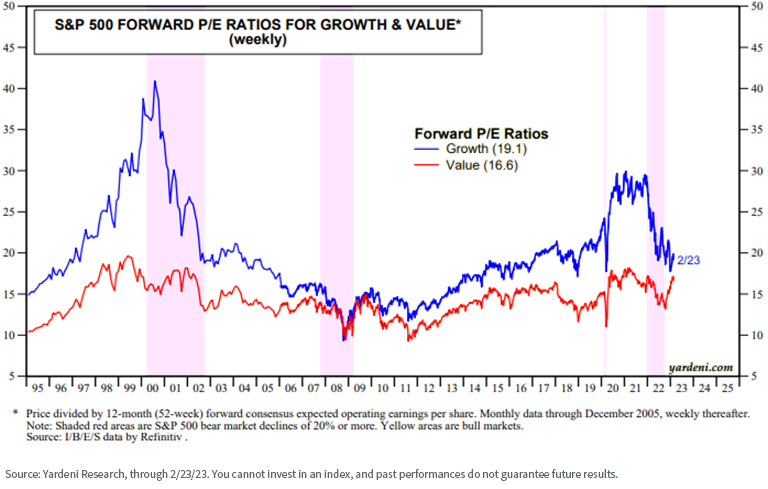

History suggests this outperformance tends to be a multi-year cycle, not a one-time phenomenon, and, in fact, the “value outperforms” regimes have tended to last longer than the “growth outperforms” regimes.

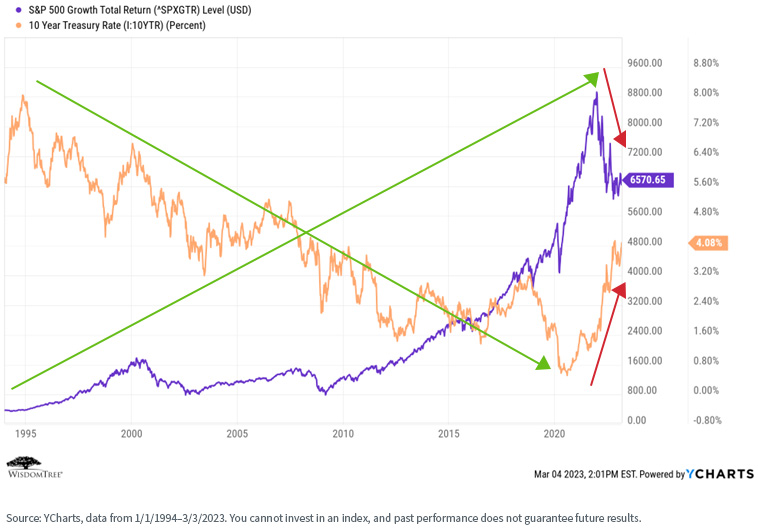

Given Fed policy and the current trend in interest rates, we see no reason to expect growth stocks to “recover” anytime soon, due to the historical inverse relationship between the two.

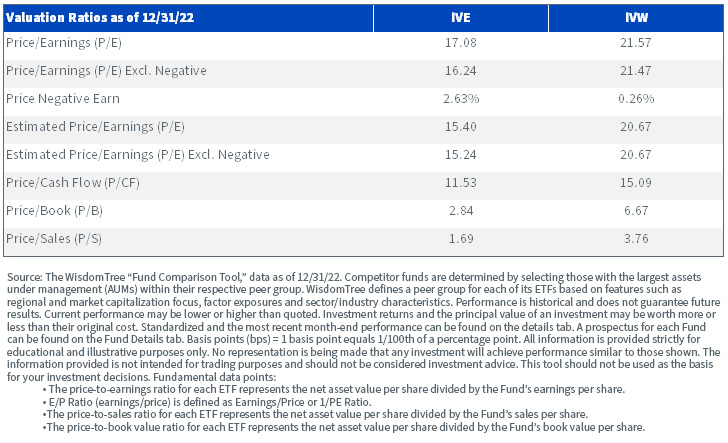

Finally, despite the performance gap of 2022, valuation metrics still favor value stocks for fundamentally minded investors. Here we use two large iShares ETFs, IVE and IVW, as proxies for the S&P 500 Value and Growth Indexes, respectively.

Conclusions

Many WisdomTree products and most of our Model Portfolios have a distinct value tilt embedded into them—value is one of our fundamental “DNA” characteristics.

This stood us well in 2022, as value strongly rotated back into the “market lead” throughout the year.

Given the historical multi-year cycles in the value/growth rotation, we believe we are still in the “early innings” for value. 2023 year-to-date has been more volatile, with investors and the growth factor reacting strongly to real and perceived Fed interest rate decisions, but we believe this is a volatile short-term trend and not a “re-rotation” back into growth over any extended period of time.

In other words, we think the long reign of growth stocks over value stocks “is over, it’s over now.”

Our product suite is positioned well for this value market cycle, and we remain very comfortable with our Model Portfolio positioning as well, with its tilts toward value, dividends, size and quality.

You can learn more about our Model Portfolio allocations on the WisdomTree Model Adoption Center.

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.