Risk Factors Keep on Rolling

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Big wheel keep on turning

Proud Mary keep on burning

And we’re rolling, rolling

Rolling on the river

(John Fogerty and Credence Clearwater Revival, 1969, with an iconic cover by Ike & Tina Turner, 1971)

I last wrote about risk factor diversification last July, and it is well past time to revisit this important topic.

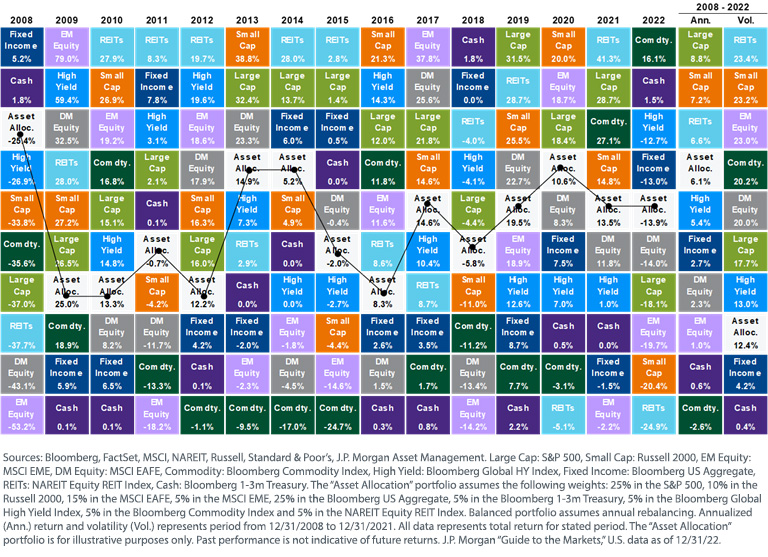

As a reminder, most investors are familiar with the visual of an asset class “performance quilt,” which highlights the importance of asset class diversification.

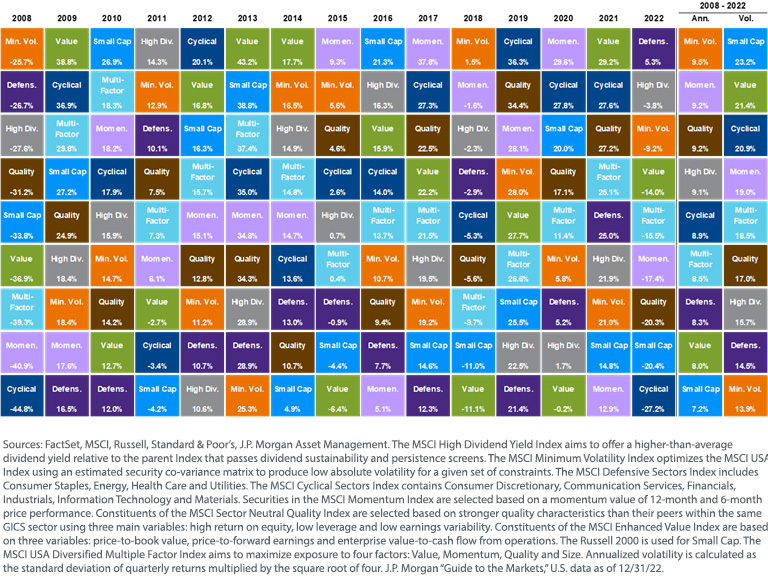

But, as regular readers know, what we believe is as important as asset class diversification is risk factor diversification. And risk factor performance can be as difficult to forecast as asset class performance.

2022 Risk Factor Review

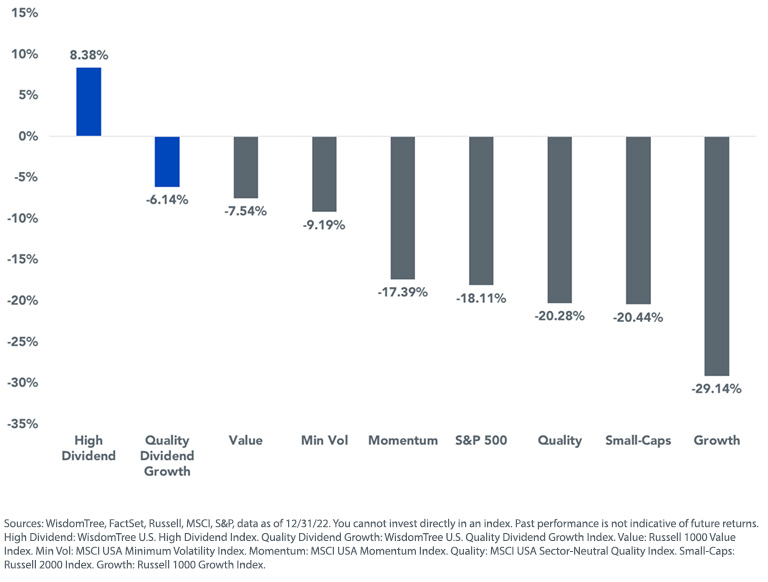

2022 witnessed one of the greatest factor rotations in history, as growth fell to earth and value roared back to life. The performance difference between the growth and value factors was one of the widest dispersions ever. We see that dividends also delivered significant outperformance.

While the chart above indicates that small caps underperformed, the chart uses the Russell 2000 as the comparison Index. If we use the higher-quality S&P 600 Index instead, we see a different story.

On a different front, non-U.S. investing also rebounded in 2022, as both EAFE and EM markets outperformed the U.S., despite the headwind of a strong dollar rally for most of the year.

What About 2023?

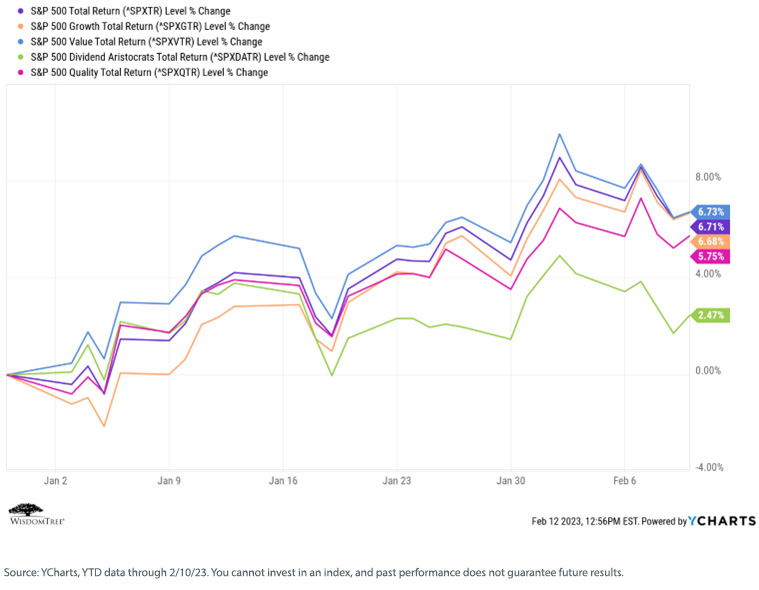

As we move through the first two months of 2023, we see much more volatile factor performances as the markets react to different economic reports and Fed actions/comments. Growth has mostly kept pace with value, while dividends are lagging.

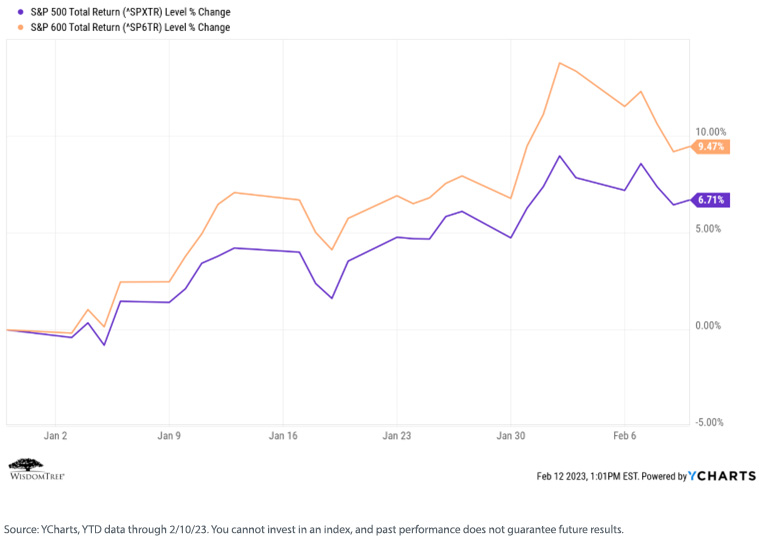

At the same time, small caps have maintained and even widened their advantage over large caps.

Despite this increased “factor volatility,” we continue to believe that value and dividends will outperform over the remainder of the year, and further out into the future as well. Factor rotations, such as we witnessed in 2022, tend not to be one-year phenomena but rather multi-year cycles.

We further believe that quality will become increasingly important as we head into an uncertain economic environment marked by generally rising interest rates, a slowing economy and increased market volatility. We believe that investors will once again focus on companies that exhibit stronger earnings, cash flows and balance sheets and therefore have a greater ability to protect their margins.

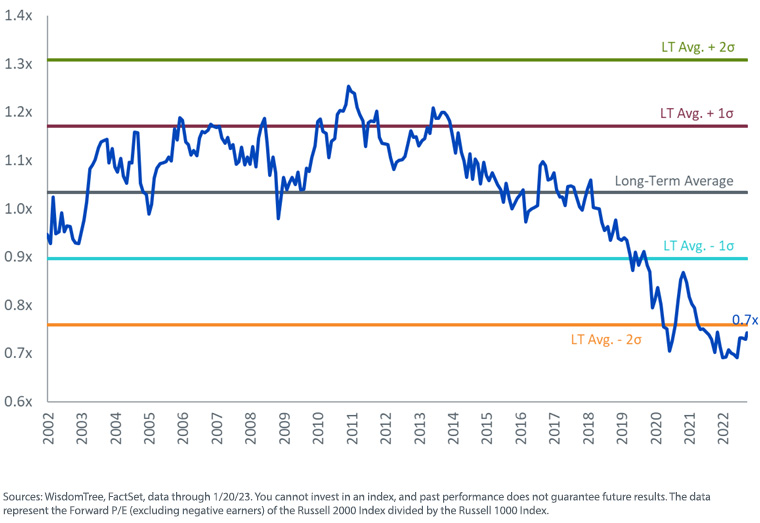

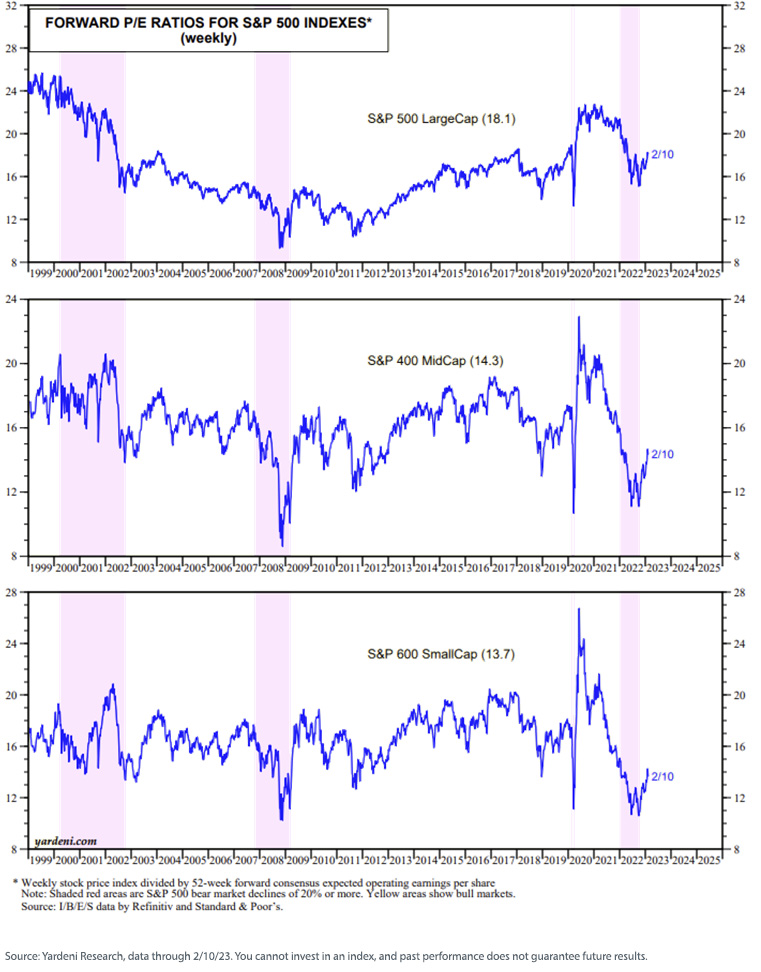

For valuation-driven (and therefore longer-term) investors, U.S. small-cap stocks continue to present an interesting opportunity. Despite the narrowing of the gap between large- and small-cap valuations, small caps remain attractively valued on a comparative basis.

Russell 2000 Fwd. P/E (ex. Negative Earners) vs. Russell 1000

Conclusions

Given the factor tilts inherent in many, if not most, WisdomTree strategies (dividends, value, size and quality), we remain comfortable with the positioning and allocations within our Model Portfolios. Most of our models are benefiting from these factor tilts and have beaten their respective benchmarks over the past 12–15 months.

Given the difficulty in forecasting asset class and risk factor performances, however, we intentionally diversify our portfolio at both of those levels.

As a reminder, all publicly available WisdomTree Model Portfolios have certain common characteristics:

- They are global in nature;

- They are diversified at both the asset class and risk factor levels;

- They are ETF-focused to optimize fees and taxes; and

- We charge no strategist fee.

We are an open-architecture shop (that is, all our models include both WisdomTree and third-party products) for many reasons: (a) it’s the right thing to do, (b) it’s what end clients assume and advisors expect and (c) it allows us to build more risk factor-diversified portfolios.

We like the factor tilts currently embedded in our Model Portfolios, as we believe dividends, value and quality will shine as we move through 2023. We also believe size is showing distinct signs of rotating back into favor.

Financial advisors can learn more about the WisdomTree lineup of Model Portfolios by visiting our Model Adoption Center.

Important Risks Related to this Article

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.