Three Possible Catalysts for a Small-Cap Recovery

One of our key expectations for equity markets in 2023 is an eventual recovery in U.S. small caps, which have had an inordinate amount of recession risk priced into their valuations since the middle of last year. Once the Fed begins to slow its aggressive rate hike campaign and eventually pivots toward policy easing, risk assets like small caps may catch a tailwind from improved sentiment and a broader equity market recovery.

Below are three potential catalysts that may precede small-cap outperformance based on current readings of the broader market.

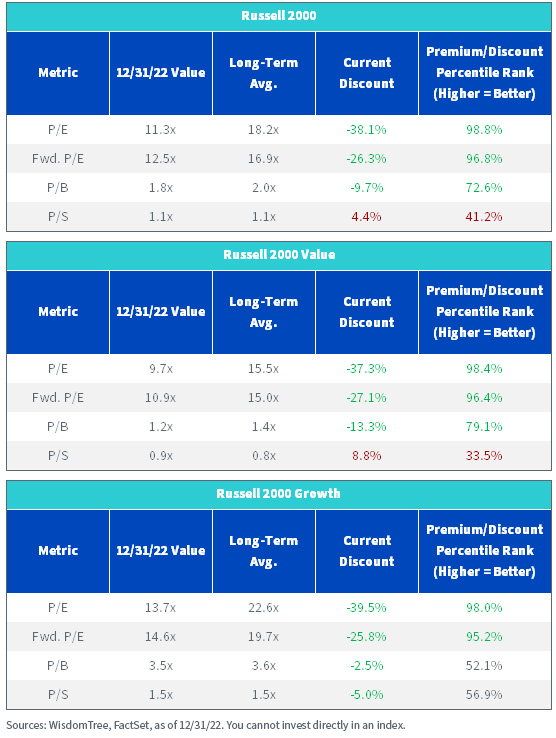

1. Deep Discounts Relative to History

In early 2021, the price-to-earnings (P/E) and forward P/E ratios (both excluding negative earners) of the small-cap core, value and growth markets peaked, with most rising comfortably above their long-term averages. Since then, valuations have compressed, with both measures across all three investment styles remaining about two standard deviations below their long-term averages.

These are historically deep discounts, as both metrics across the three styles are within the top 5% of cheapest valuations since the beginning of our data history in 2002. Similarly, multiples this low have not been observed since the depths of the global financial crisis in early 2009, which presaged an enduring, secular bull market thereafter.

2. Deep Discounts Relative to Larger Brethren

Valuations relative to both large and mid-caps have consistently remained more than two standard deviations below their long-term averages since the second half of 2021 as well. This was primarily due to the economic uncertainty and impending rate hike cycle that markets were forced to confront after the rapid, post-pandemic recovery. Investors who bravely maintained their equity allocations preferred the perceived safety of larger companies at the expense of smaller ones, and the small-cap market suffered disproportionately.

Today, however, markets are becoming more optimistic that the Fed will both pause its tightening cycle in early 2023 and eventually begin to cut rates by the end of the year or in early 2024. Markets are eagerly anticipating this pivot, and once signaled, we may see an overdue rally in risk assets, especially if weakening economic data forces the Fed to hasten the pace of policy easing.

Russell 2000 Fwd. P/E (ex. Negative Earners) vs. Russell 1000

-vs,-d-,-russell-1000.jpg)

Russell 2000 Fwd. P/E (ex. Negative Earners) vs. Russell Midcap

-vs,-d-,-russell-midcap.jpg)

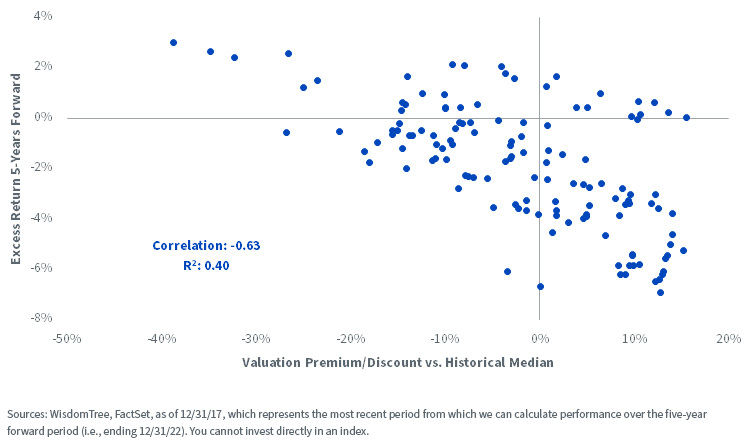

3. Current Valuations May Precede Outperformance

Small caps are a notoriously junky market, inundated with unprofitable companies that then skew broader valuations so dramatically that they become practically meaningless.

If you remove these non-earners, however, there’s a decent relationship between forward P/E ratios relative to their longer-term median and subsequent five-year excess returns versus large caps. Using monthly data back to the beginning of 2007, the greater that the valuation discount to large caps became, the more that small caps exhibited positive rolling excess returns versus large caps over a subsequent five-year period. This is evinced by the -0.63 correlation and R-squared multiple of 0.4, which imply that a sizable portion of five-year excess returns versus large caps can be explained by prevailing small-cap valuations relative to their own historical median.

As of January 24, the small-cap market was trading at a 22% discount to its longer-term median. Over our data history, a discount this steep at month-end has helped deliver outperformance over large caps six out of seven times.

Russell 2000 Fwd. P/E (ex. Negative Earners) Premium/Discount vs. Excess Returns against Russell 1000

Actionable Ideas for Small-Cap Investing

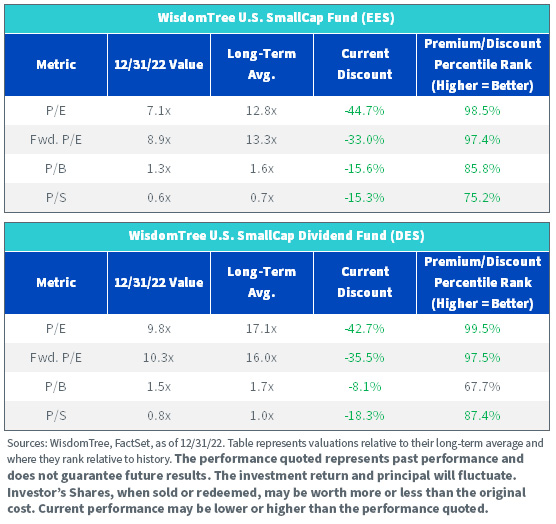

Much like the broader market, WisdomTree’s U.S. small-cap equity Funds also sport attractive multiples that are heavily discounted by historical standards.

Given recessionary fears and the attendant impact on corporate earnings, the WisdomTree U.S. SmallCap Fund (EES) may withstand market volatility due to its explicit focus on profitable companies while avoiding non-earners. If the historical relationship between multiples when excluding unprofitable companies and outperformance versus large caps is any indicator, EES could be well-positioned for small-cap allocations during an equity market recovery.

Likewise, we continue to prefer value investing over growth in 2023, building off the success of last year’s reversal of a decade-long market theme. The WisdomTree U.S. SmallCap Dividend Fund (DES) marries size exposure to dividend investing, a key tenet of the value investing ethos, to deliver an income tilt within small-cap allocations.

While we may not know when an equity market recovery will begin, we do know there are prevailing opportunities in small-cap markets to assess in advance.

For the most recent month end and SEC standardized performance, please select the respective ticker: EES, DES.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.