Weathering a Potential Recession Blow in High-Yield Corporates

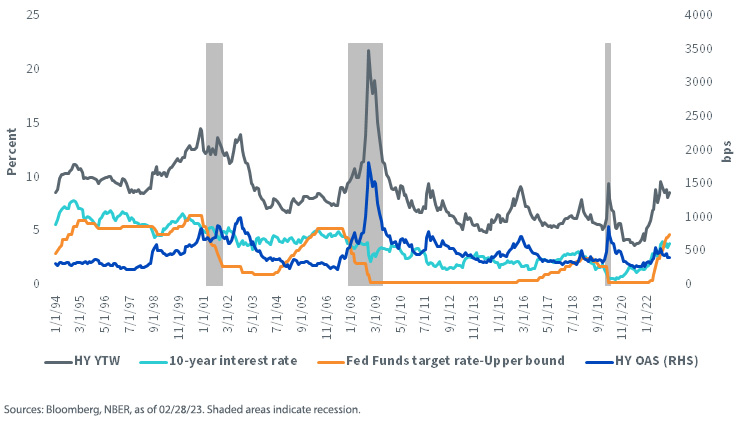

Market participants have faced a lot of challenges in recent years, but none has been more impactful than the Federal Reserve's decision to raise interest rates by 450 basis points (bps) in the last year to combat persistent high inflation. In its quest to lower the pace of economic activity and bring down the generational-high inflation, the Fed has increased the prospect of a recession and potential distress in corporate bond markets, particularly for lower-quality borrowers. The tightening of monetary policy by other central banks around the globe has also fed this concern. However, with the increase in risk-free interest rates and widening in corporate spreads, investors would be remiss not to notice the attractive yield and spread levels in the high-yield (HY) market, which have not been seen since the 2007-2009 global financial crisis.

Depending on one’s view about whether Fed tightening can deliver a soft versus hard economic landing, different assumptions could be made about the future path of spreads and interest rates. In this piece, we look past the favorable scenario of a soft landing to focus on what risks high-yield investors might face if a harder landing emerges, given current valuation levels and using past recessionary periods as a guide.

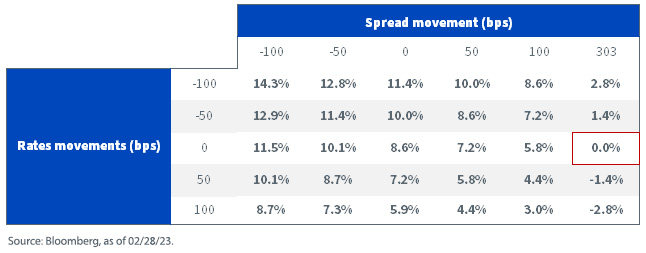

Over the past 30 years, there have been three recessionary periods during which high-yield spreads rose by an average of 630 bps. As of February 28, 2023, high-yield spreads and the yield to worst (YTW) were 412 bps and 8.63%, respectively. If the market settles on the notion of a hard landing in the near future, and assuming the aforementioned average spread widening during a recession, high-yield spreads could widen by 478 bps more from current levels (spreads have already widened by 152 bps from the trough of 268 bps on 6/30/21). By keeping risk-free interest rates unchanged, this would result in an annualized 5% loss. However, with an average drop of 118 bps in the 10-year interest rate during these recessionary periods, the average loss would come down to 1.7%.

It is worth mentioning these results are skewed by the massive 1,264 bps spread widening between 2007 and 2009. By removing this period from our analysis, HY OAS and the 10-year interest rate have on average widened by 313 bps and narrowed by 84 bps, respectively, during the other two recessions. This means 161 bps of extra widening from current levels. Assuming these moves, the HY market could provide a solid positive return of 6.4% for the year.

Lofty yield levels in the HY market have provided investors with a cushion to absorb potential losses from deteriorating corporate fundamentals and increases in spread levels. As a matter of fact, in order to lose all this protection and break even in their investment, an investors’ base case would center around a 303 bps or more increase in spreads in the upcoming year, with no change in risk-free interest rates. However, with the average fall in interest rates during recessions, investors could potentially expect a positive return for the year.

High-Yield Corporate

In conclusion, investors will likely navigate choppy waters in the next couple of years when it comes to markets and the Fed. However, the HY market is well-positioned to absorb potential spread widening and produce a positive return for the year. This provides an excellent opportunity for long-term investors.

Related Content

Fixed Income Is Back

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.