Broad Commodities: An Often-Overlooked Source of Diversification

Commodities have outperformed every major asset class in the last two years by double-digit margins.1 This was particularly impressive in 2022, when every major asset class posted large losses but commodities posted substantial gains.2 2022 was a clear-cut case for diversifying a traditional portfolio of stocks and bonds with commodities. Beyond tactical opportunities, academic research has highlighted the advantages of using broad commodities as a staple component in long-term strategic asset allocations. However, close to half of the investors recently surveyed have no exposure to commodities.3 Recent impressive performance is changing the mood rapidly, with 45% of those not invested in commodities now considering investing.4 We believe, whether you look at recent or long-term data, the case for broad commodity inclusion in a portfolio is compelling. In this blog series, our objective is to lay out the many factual reasons why a broad commodity investment can be additive to a portfolio, starting with its diversification superpowers.

Quantitative analyses show that broad commodities are a very powerful source of diversification in a multi-asset portfolio:

- Broad commodities are positively skewed when equities are negatively skewed.

- They exhibit low correlations to most of the traditional asset classes.

- They remain uncorrelated in a crisis and can provide relief to a portfolio in geopolitical crises.

Positive Skew, Protection against Exceptional Events

Looking at the distribution of monthly returns of the Bloomberg Commodity Total Return Index and the S&P 500 Total Return Index since January 1960, we observe that:

- The returns of commodities and equities deviate from a normal distribution.

- The returns of equities are negatively skewed (-0.495 instead of zero for a normal distribution), meaning that there is more weight on the negative side of the distribution. On the contrary, commodities are positively skewed (+0.855), meaning that large positive returns tend to be more common for commodities than large negative returns when it is the contrary for equities.

Overall, this means that, historically, we can observe that commodities’ losses have been less deep and large gains more frequent than for equities.

In 2022, an energy crisis catalyzed by the Ukraine invasion sent the price of natural gas, oil, oil products and agricultural products higher. This directly benefited broad commodity indexes, which included these raw materials. Conversely, broad equity indexes suffered as profit margins were being squeezed by rapidly rising input costs. While Europe seems to have been lucky with a mild winter—which has allowed it to reduce energy consumption and build inventory—the Ukraine invasion is far from over, and further energy price shocks can’t be ruled out.

While performance distributions are important, the relative relationship between those two distributions is even more important for investors.

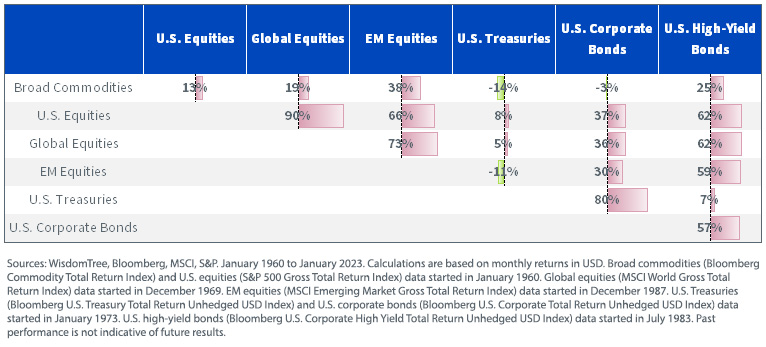

Commodities Offer Diversification from the Main Asset Classes

Broad commodity futures contracts indexes show very low correlations with most of the main asset classes. Commodities are negatively correlated to U.S. Treasuries and U.S. corporate bonds. They also offer a low correlation to equities and U.S. high-yield bonds.

It is worth noting that this very low correlation has been observed by academics as well. Low correlations have been observed by Bhardwaj, et al., 2005, Edwards & Liew, 1999 and Levine, et al., 2018, among others.

Figure 1: Correlation between Main Asset Classes

In the initial phases of the COVID-19 pandemic, correlations of many assets rose. Panic selling, followed by indiscriminate buying fueled by quantitative easing, drove those correlations higher. However, in the past year, the correlation between commodities and equities has fallen again to a normal level. Looking at daily correlations over the past year, the correlation between U.S. equities and broad commodities is back to 14%.6

The correlations between commodities and emerging market equities (19%6), U.S. Treasuries (5%6) and U.S. corporate bonds (9%6) have also remained extremely low. These low correlations once again make a compelling case for commodities as a diversification tool.

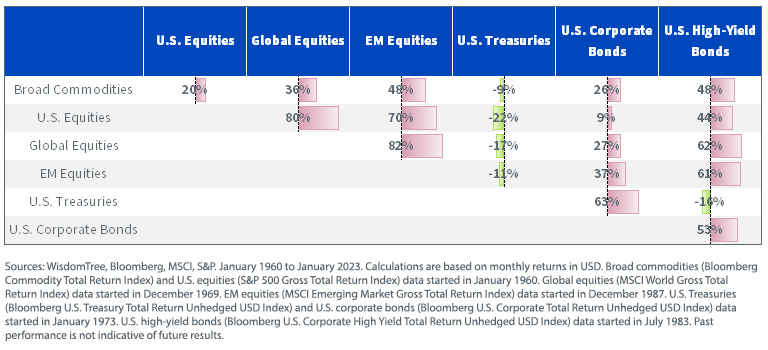

Increased Diversification in Crisis

While its low correlation with equities has always been a strong argument for proponents of commodity investments, critics have historically argued that this low correlation does not hold in periods of crisis. Figure 2 shows the correlations between different asset classes during the months when U.S. equities are down -5% or more to test this hypothesis. It is worth noting that the correlation matrix is not significantly different from figure 1. Commodities and U.S. Treasuries still offer the most diversification versus other asset classes. The correlation between commodities and the various asset classes remains very low, which should blunt most critics of that angle.

Figure 2: Correlations between the Main Asset Classes When U.S. Equities Are Down More Than -5% in a Month

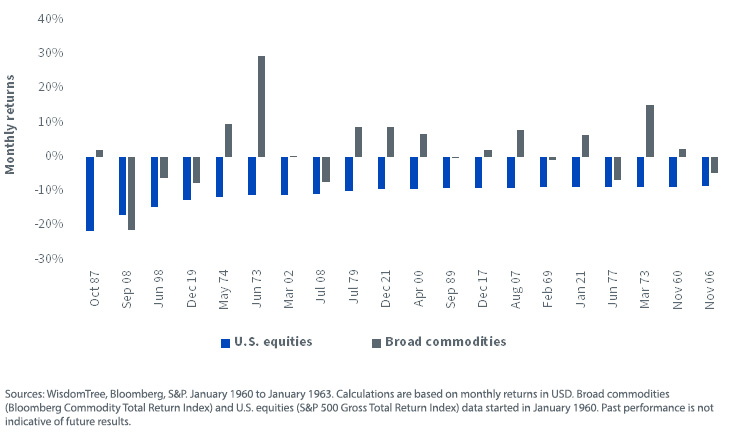

Digging further into the relative behavior of commodities in periods of equity crisis, figure 3 illustrates the performance of the Bloomberg Commodity Total Return Index in the worst 20 months for the S&P 500 since 1960. We observe that commodities have offered very strong differentiation to an investor. Taking the example of the worst month for equities in the last 60 years or so, U.S. equities lost -21.5% in October 1987, following “Black Monday.” During that same month, the BCOM Index gained 2.1%. This would have provided incredible help to any investor during that month. In fact, commodities have outperformed equities in 19 out of those 20 months. In 12 months, commodities have even performed as positively as they did in October 1987.

Figure 3: Broad Commodities Performance in the Worst 20 Months for the S&P 500 since 1960

Diversification with the WisdomTree Enhanced Commodity Strategy Fund

Investing in broad commodity strategies in the U.S. has gotten easier. A revamped WisdomTree Enhanced Commodity Strategy Fund (GCC) attempts to dynamically select maturities in an effort to maximize carry , potentially enhance return and reduce volatility compared to first-generation broad commodity strategies, which invest only on the front-end of futures curves. Cumulative performance since inception has been 33.34% (to January 31, 2023), compared to 13.92% on the S&P 500 Index or 6.71% on the MSCI ACWI Index or -17.16% on the Bloomberg Global Aggregate Bond Index over the same timeframe. Returns on the Fund appear to corroborate the case for diversification through broad commodities.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Click here for the most recent month-end performance.

1 Between 2/10/2021 and 2/10/2023, the Bloomberg Commodity Index has outperformed the Bloomberg Global Aggregate Bond Index by 38%, MSCI ACWI (global equities) by 35%, S&P 500 (U.S. equities) by 19%, FTSE EPRA NAREIT Developed (Real Estate) by 24% and Bitcoin by 63%. Source: Bloomberg.

2 Between 12/31/2021 and 12/31/2022, all the assets in footnote 1 fell by more than 12%, while the Bloomberg Commodity Index rose close to 12%. Source: Bloomberg.

3 Forty-six percent of investors surveyed in September 2022 said they did not invest in commodities. The survey, conducted by CoreData Research, an independent research agency, polled 600 professional investors across Europe, ranging from wholesale financial advisory firms to wealth managers and family offices. The investors surveyed are responsible for approximately €710bn in assets under management.

4 Twenty-one percent of all survey respondents replied “No, but are considering,” while 25% responded with a hard “No.”

5 Sources: WisdomTree, Bloomberg, S&P. January 1960 to January 2023. Calculations are based on monthly returns in USD. U.S. Equities stands for S&P 500 Gross TR Index. Broad Commodities stands for Bloomberg Commodity TR Index. Historical performance is not an indication of future performance, and any investments may go down in value.

6 Sources: WisdomTree, Bloomberg, MSCI, S&P. December 2021 to December 2022. Calculations are based on daily returns in USD. Past performance is not indicative of future results.

7 Carry (commodity): yield that can be expected on a trade over the investment period, assuming no change in spot prices, valuation or shape of futures curves.

8 The front-end of futures curves refers to futures contracts that have shorter maturities.

Additional Sources

Bhardwaj, G., Gorton, G. B. & Rouwenhorst, K. G., 2015. Facts and Fantasies About Commodity Futures Ten Years Later. Yale ICF Working Paper No. 15–18.

Edwards, F. R. & Liew, J., 1999. Managed Commodity Futures. Journal of Futures Markets, vol. 19, no. 4 (June), pp. 377–411.

Levine, A., Ooi, Y. H., Richardson, M. & Sasseville, C., 2018. Commodities for the Long Run. Financial Analysts Journal, Volume 74, pp. 55–68.

Important Risks and Disclosures Related to this Article

There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include the use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks and, historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relates directly to the value of the futures contracts and other assets held by the Fund, and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the price of futures contracts further from expiration may be higher (a condition known as “contango”) or lower (a condition known as “backwardation”), and the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.For definitions of terms in the charts above, please visit the glossary.

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.