The WisdomTree Portfolio Review, Part Three: Collaboration Models

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these model portfolios.

We are now on the third and final part of our “mini-series” of blog posts reviewing the 2022 performances of our Model Portfolios. Part one, focused on our strategic models, part two focused on our outcome-focused models and in this final entry in the series we focus on our collaboration models.

First, let’s define terms. We use the term “collaboration” as it is defined—“the action of working with someone to produce or create something.” We recognize that other people and firms have good ideas and/or good products, and we actively seek to find partners willing to work with us to deliver outstanding solutions.

An active part of our models business is to collaborate with RIAs, wirehouses, IBDs and other platforms to construct and manage customized models that fit those firms’ specific investment mandates. As they are customized, we cannot show those models on our Model Adoption Center, but they represent at least 50% of the total AUM in models that we manage, and we welcome that business.

A growing part of that is our Portfolio and Growth Solutions platform. On this platform, we not only help build models with advisors, we then take on the implementation, trading and ongoing rebalancing (including tax management, if desired) of those portfolios on the advisor’s behalf, freeing them up to spend more time on revenue-generating activities.

But we do have three publicly available collaboration models we can discuss—the Select models, which we manage in collaboration with PIMCO, the U.S. Growth series, which we developed in coordination with a large RIA and, of course, our flagship collaboration with Professor Jeremy Siegel in the Siegel-WisdomTree Global Equity and Longevity models.

Let’s take a look.

Siegel-WisdomTree Model

We have written extensively about these models, most recently in December of last year as we celebrated the three-year anniversary of their launch. So here we just provide a quick reminder of what these models are all about and why we collaborate so closely with Professor Siegel on them.

The investment thesis was to challenge the ability of the traditional 60/40 portfolio to help deliver on what we believe are the four primary objectives of most investors:

- Maintain or enhance current lifestyle by optimizing current income

- Minimize “longevity risk,” or the risk of running out of money before you die

- Maximize the potential for leaving a legacy after you die

- Minimize fees and taxes along the way

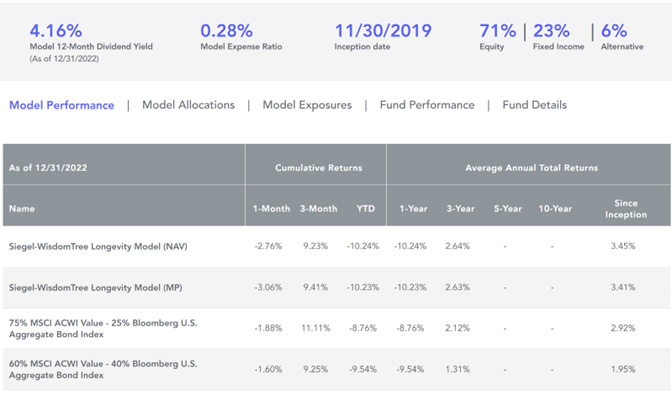

The Siegel-WisdomTree Longevity model attempts to solve for exactly these issues. Its anchor allocations are 75% stocks and 25% bonds (though we currently have ~6% allocated to commodities and managed futures for diversification purposes), with the equity allocation focused on value-oriented dividend-paying strategies.

The result is a portfolio that we believe, in comparison to a traditional 60/40: 1) generates enhanced current income; 2) has an improved longevity profile because of the heavier allocation to stocks; and 3) has only a slightly higher standard deviation (i.e., short-term volatility profile) than the traditional 60/40.

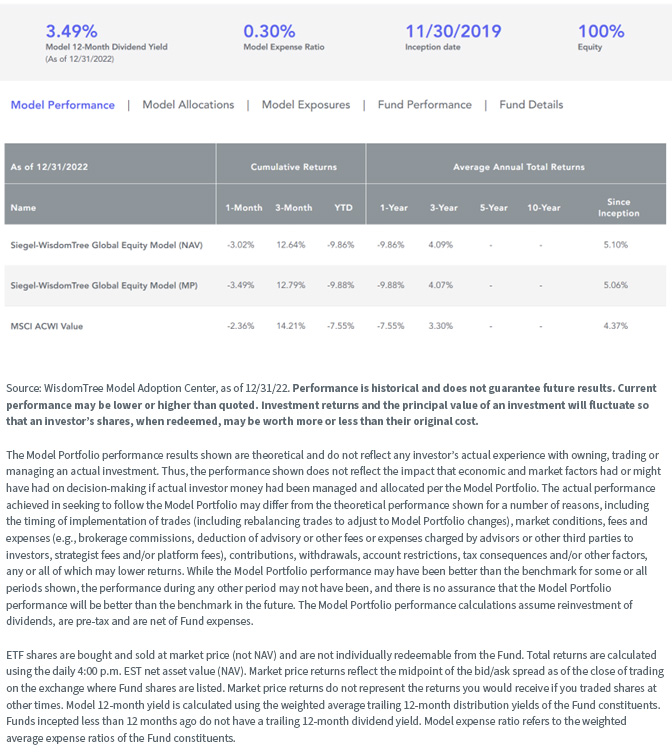

2022 saw this model underperform its benchmarks, where we use the MSCI ACWI Value Index as the equity benchmark. Value so dominated market performance in 2022 that any allocation away from that detracted from performance versus that benchmark

More specifically, in our case, although we definitely are value-tilted within these portfolios (in alignment with Professor Siegel’s philosophies and our own), we also overlay a distinct quality filter, and this did not help us. But, as we’ve said many times before, we will never apologize for having a quality tilt within our portfolios.

Since inception three years ago, however, these portfolios have comfortably outperformed their benchmarks. In the case of the Longevity model, this includes both a 75/25 benchmark and the more traditional 60/40 benchmark.

Siegel-WisdomTree Longevity Model

Siegel-WisdomTree Global Equity Model

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

Select Models (with PIMCO)

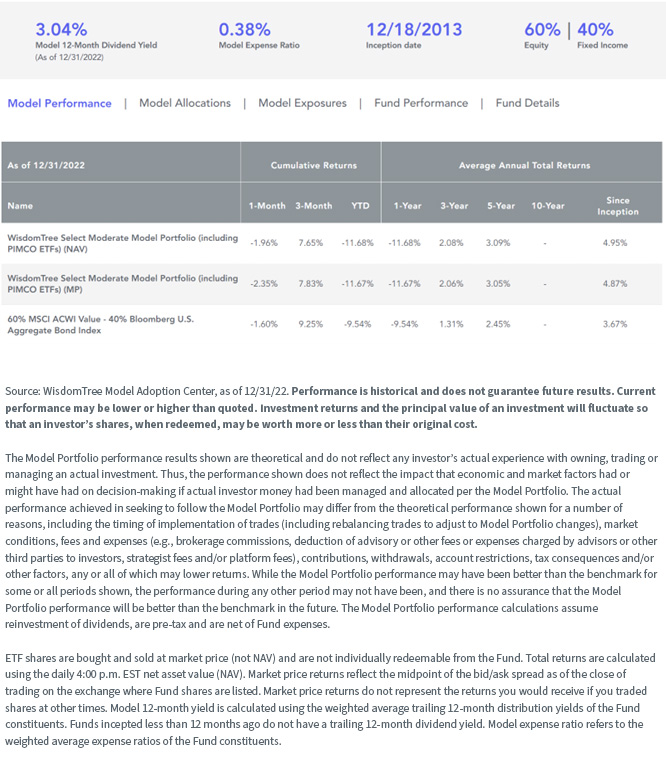

These are multi-asset portfolios that we manage in coordination with PIMCO. All the equity allocations are WisdomTree products, while all the fixed income products are from PIMCO, a market leader in fixed income asset management.

WisdomTree is the “lead” portfolio manager, but our CIO of Fixed Income works closely with PIMCO to ensure that our outlooks and allocations remain aligned.

2022 saw these portfolios underperform their benchmarks due primarily to our allocations to emerging markets, international small caps and long-duration zero-coupon Treasuries. Since inception in December 2013, however, these models have consistently outperformed. Here we use the “moderate” (60/40) model as an example.

WisdomTree Select Moderate Portfolio (including PIMCO ETFs)

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

U.S. Growth Model

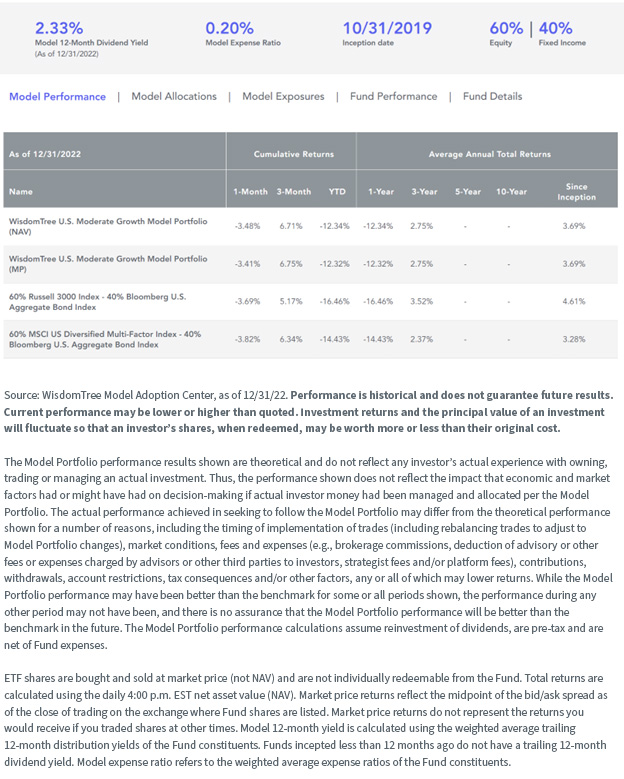

These models were developed in coordination with a large RIA that liked our approach to asset allocation and risk factor diversification but wanted a U.S.-only model to deploy with their client base. We were happy to help.

Although this is a customized model, it is available to other advisors on different platforms, so we are able to show performance and portfolio specifics.

The thesis behind these models, on the equity side, is similar to that of our U.S. multifactor model, which is then combined with a variation of our fixed income model and offered at different risk bands (conservative, moderate, aggressive, etc.).

As we discussed in the two previous blog posts, both our fixed income model and our U.S. multifactor model enjoyed outstanding performances in 2022 relative to their underlying benchmarks. Intuitively, then, you would think that these growth models performed equally as well—and you would be correct.

Using the “moderate” (60/40) model as an example, we see significant outperformance versus its underlying benchmarks. We enjoyed similar outperformance levels in the other risk bands.

WisdomTree U.S. Moderate Growth Model Portfolio

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here. Month-end performance can be found at wisdomtree.com/etfs.

Conclusion

As we saw in our strategic and outcome-focused models, our collaboration models performed as expected in 2022 and delivered on their mandates. If we are correct that we are in the “early innings” of a value, dividend, quality and size rotation in the global markets, we have an excellent foundation to build from as we move through 2023.

This brings us to the end of our portfolio review “mini-series.” Financial advisors can learn more about these models and how to position them successfully with end clients at our Model Adoption Center.

Important Risks Related to this Article

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.