What’s Yield Got to Do, Got to Do with It?

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“There is income back in fixed income.”

We first began writing this periodic series of blog posts on “generating yield in an evolving market” back in March 2021 and, most recently, last September. It’s time to revisit.

When we began this series, we were encountering the somewhat anomalous situation of equity dividend yields being higher than bond yields. It was a bleak time for bond investors—rates were near zero, and credit spreads were trading near historical lows.

Well, as Bob Dylan might sing, “The times they are a-changin’.” Let’s take a look.

Let’s start by surveying the current market environment. All eyes are on the Fed—will it continue to tighten in the face of continued strong employment and loose financial conditions? Will it “pivot” and begin easing back off in the face of a slowing economy and signs that inflation is trending downward?

Given recent economic, inflation, and labor reports, the Fed is signaling it will maintain its hawkish position and has recently provided guidance that two, perhaps three more rate hikes of 25 basis points (bps) each in March, May, and June remain a possibility. Even our since-inception strategic advisor, Professor Jeremy Siegel, who earlier in the year believed the Fed had gone too far and needed to pivot back toward easing has acknowledged that recent data is “testing his hypothesis of a quicker “pivot”.

What we do know is the Fed has now shifted into full “data-dependent” mode and will, more than likely, act accordingly. We also hold an experienced belief that the bond market will, ultimately, tell us the answer. But the result, for now, is continued bond market volatility.

Here is the current Atlanta Fed “Market Probability Tracker,” which charts the market-traded course of the Fed Funds Rate (the short-term rate controlled by the Fed). While Fed Funds Futures have not proven to be more accurate than anything else in predicting future rate movements, this chart does provide a snapshot of what the market is currently thinking—a “terminal rate” peaking above 5.25% by June and then declining over the remainder of the year.

The Expected Future Path of the Three-Month Average Fed Funds Rate

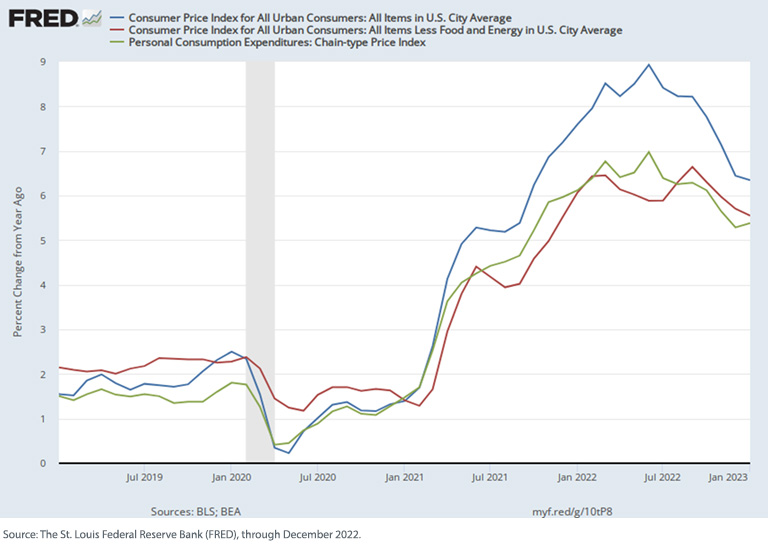

At the same time, and despite the Fed’s ongoing anxiety, inflation seems to have peaked and is moving downward, though it remains well above the Fed’s 2% “target rate” and recent reports have come in higher than expected

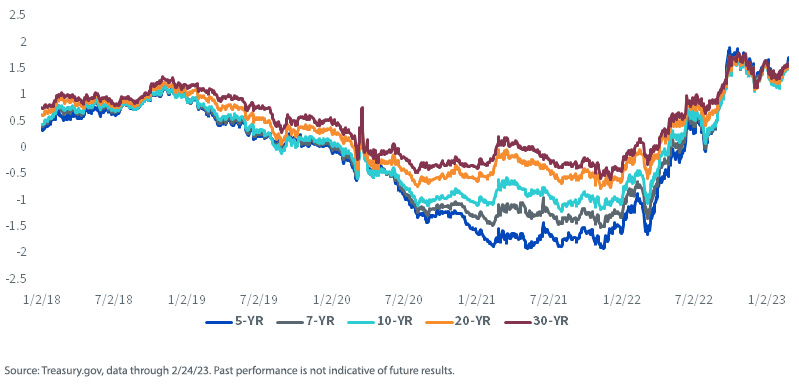

Treasury real yield rates have been solidly in positive territory across the maturity spectrum since last June. While they may be stabilizing, we see no reason why they should reverse themselves and head back toward zero again.

U.S. Treasury Real Yields (%)

Nominal Treasury rates have also moved higher, with the short end rising sharply in the face of the Fed’s aggressive pace of rate hikes. The yield curve has been inverted for months (as measured by the 10-Year minus 2-Year yield and the 10-Year minus 3-Month spreads), resulting in calls of recession by many economists and advisors. Perhaps, maybe even probably, but the market continues to send “mixed messages” regarding slowing economic activity versus a still-robust labor environment.

Finally, after rising for several months, credit spreads have once again slipped toward levels that are neither “wide” nor “tight” by historical standards.

For definitions of terms in the charts, please visit the glossary.

What Is a Yield-Seeking Investor to Do?

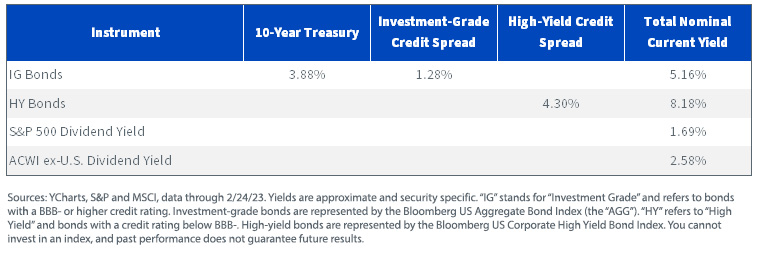

One of our primary investment themes for 2023 is “There is income back in fixed income.” Let’s compare current nominal yields in the fixed income versus equity markets.

For definitions of terms in the charts, please visit the glossary.

Certainly, in comparison to the equity markets, there is income back in fixed income. In addition, most corporate balance sheets are in solid shape. Given this, generating and 8+% on high-yield bonds may seem very interesting for advisors seeking yield.

Product/Strategy Ideas

On the fixed income front, we see three “high conviction” ideas. First up, U.S. Treasury floating rate notes (FRNs). These securities are reset to the weekly UST 3-Month T-bill auction, with a spread, and contain no corporate credit risk. With the Fed still in “rate hike” mode, this strategy provides investors with a means of income without the aforementioned bond market volatility. The WisdomTree Floating Rate Treasury Fund (USFR) gives investors a means to implement this strategy.

As we just discussed, the U.S. high-yield market offers compelling income as well. However, with recession concerns remaining a key part of the investment landscape, a solution that focuses on quality will be of paramount importance. The WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) uses a quality screen while tilting for income.

Finally, with a rally in rates expected for the second half of this year, investors may wish to move their bond allocation toward benchmark duration. The WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) is an investment-grade solution that offers investors a way of achieving this duration target while also focusing on augmenting income needs.

Model Portfolio Ideas

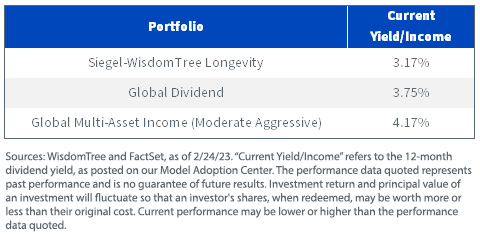

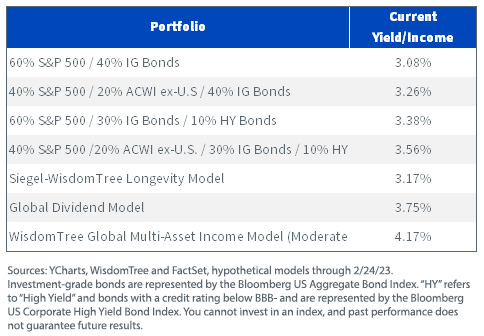

In addition to our product lineup, WisdomTree also manages three Model Portfolios we think fit nicely into today’s yield environment, depending on investor objectives: an all-equity Global Dividend model, Multi-Asset Income models of different risk bands and the Siegel-WisdomTree Longevity model, which we manage in collaboration with our strategic advisor, Professor Jeremy Siegel.

All these models focus on generating all or much of the current yield out of the equity allocations while using the fixed income allocation to generate additional, risk-controlled yield.

Let’s look at the current yield of these portfolios (as of February 24, 2023). “Current Yield/Income” refers to the most recent 12-month dividend yield.

For the most recent standardized and month-end performance, click here. All yield and total return information for these model portfolios and all of the underlying securities within those models can be found in our Model Adoption Center.

Now let’s examine some hypothetical “typical” client portfolios.

Conclusion

For investors seeking yield, we believe there are multiple ways to achieve this goal without taking on excessive risk, including incorporating quality-screened high-yield and dividend-focused equities within the portfolio. For investors wishing not to take on duration risk while benefitting from the Fed rate hiking regime, our floating rate U.S. Treasury product may fit the bill.

Additionally, our yield-focused Model Portfolios are all delivering on their mandates of generating enhanced yield in a risk-controlled manner.

The bottom line is that we have rotated almost 180% from our first blog post on this topic—there is, indeed, income back in fixed income. And that’s what yield’s got to do, got to do with it.

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the account; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from the information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.