The Highest-Yielding Treasury Security…Revisited

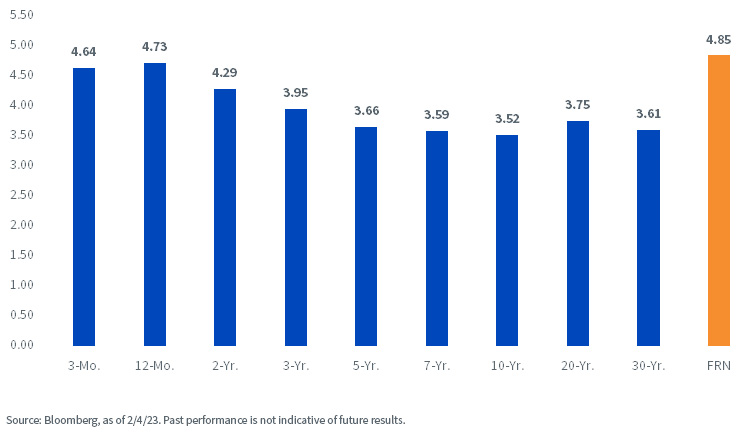

With 450 basis points (bps) worth of Fed rate hikes on the books since last March, the U.S. Treasury (UST) market has now arrived at another milestone. UST floating rate notes (FRN) are now the highest-yielding Treasury security, at 4.85% as of writing.

The natural question to ask is where does it go from here? Well, where we go from here just got a lot more interesting following the January jobs report. Total nonfarm payrolls surged by an entirely unexpected 517,000—the rest of the report was also solid, highlighted by a 3.4% unemployment rate, the lowest since 1969! In fact, it prompted San Francisco Fed President Daly to describe the jobs report as a “wow number.”

U.S. Treasury Yields

The UST market may have reacted positively to Chairman Powell’s post-FOMC meeting presser last week, but I never really thought the Fed outlook had changed all that much. Given bond market sentiment since the beginning of the year (if not even a little further back), absent Powell declaring a ‘you’ve got it all wrong’ approach, it seemed that lower UST fixed coupon yields were going to be the path of least resistance.

Well, now that the money and bond markets are faced with that unexpected labor market setting, perhaps some newfound monetary policy reflection will be in order. In other words, another rate hike certainly looks like it’s coming at the March FOMC meeting. And, if the jobs numbers don’t weaken significantly after that, another rate hike could be in the offing for May. Perhaps more importantly, the Fed could be on a longer period of ‘pause,’ and hence the timing for potential rate cuts gets pushed back accordingly.

That brings us back to the USR FRN yield. A scenario whereby the Fed raises rates at least once more and goes on hold for an extended period will more than likely keep this security among the highest yielders in the Treasury market. Even with the backup in UST fixed coupon yields post-jobs, the UST FRN yield is still close to 60 bps above the 2-Year level and an eye-opening 133 bps over the 10-Year yield, as of this writing.

Conclusion

As I blogged in late November, I keep going back to the shape of the Treasury yield curve and what investors are (perhaps ‘are not’ is a better way of looking at it) being compensated for. At current yield levels, UST fixed coupon securities remain vulnerable to economic data surprises such as the aforementioned jobs report, especially with the Fed apparently now in full data-dependent mode. You need to ask yourself the question: why should I expose myself to heightened volatility and speculative rate risk when I can use UST FRNs to avoid such outcomes AND receive a higher yield than from Treasury fixed coupons? The WisdomTree Floating Rate Treasury Fund (USFR) offers investors a means of investing in the UST FRN space.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.