An “Un-Conditional” Guarantee?

The money and bond markets are already knee-deep in Fed policy conjecture only a couple of weeks into the new year. While the latest jobs data revealed a continued solid labor market setting to end 2022, other economic indicators, such as for manufacturing and services, pointed to real activity entering contractionary territory. Throw on top of that another report showing inflation has not only peaked but is continuing to “cool off,” and you get a full-fledged rally in the Treasury (UST) market.

While the dual mantras of “don’t fight the Fed” and “don’t fight the tape” battle it out (and will more than likely continue to do so for the foreseeable future), there is one aspect of monetary policy decision-making that is getting short shrift: financial conditions. Financial conditions have been an integral part of the Fed’s policy decisions, and the December 2022 FOMC minutes reinforced that this remains an important consideration in determining future assessments.

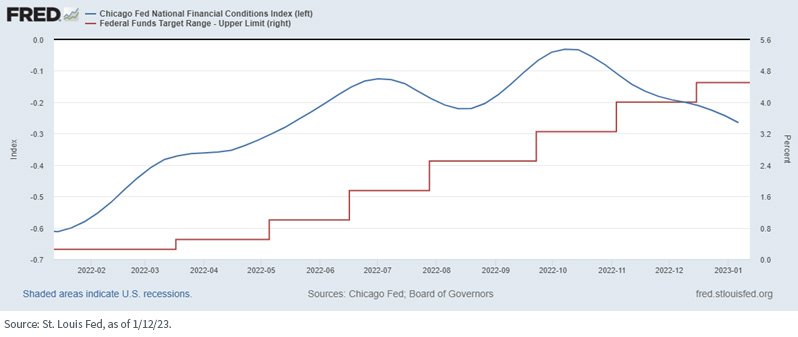

Against this backdrop, I thought it would be useful to provide some insights on the matter. I’m going to go out on a limb here and say that most market participants would probably think that, on the surface, given the “Volcker-esque” pace of rate hikes last year, financial conditions would have visibly tightened. Well, you would be partially correct. As measured by the Chicago Fed’s National Financial Conditions Index, things have tightened up from where they were prior to the Fed’s first rate hike last year, but after peaking in early October, a distinct loosening has since transpired. In fact, financial conditions in early January now stand at the same levels that existed back in May.

That brings us back to the Fed. In my opinion, there is little doubt that Powell & Co. are completely frustrated by this latest turn of events on the financial conditions front. To put it into perspective, even though the Fed raised the Fed Funds target range by an eye-opening 350 basis points (bps) since May, financial conditions are now unchanged from where they were seven months ago.

This frustration was on display in the aforementioned FOMC minutes. The minutes cited that “an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s efforts to restore price stability.”

Conclusion

Presently, the money and bond markets are debating whether the Fed will go with a 25-bp or 50-bp rate hike at the February 1 FOMC meeting but seem to be leaning toward the possibility that this next increase could potentially be the final move, and rate cuts will be forthcoming sooner than the policy makers have been saying. This is where the “real” disconnect lies; i.e., how long will the pause be? Based upon recent “Fed-speak,” Powell & Co. appear to be resolute in their stance that history has shown that “prematurely loosening policy” would be a mistake.

Buckle up—the volatility quotient is going to remain elevated!