Recession May Be a Red Herring for a Market Fueled by a Supercycle

While broad commodities have outperformed most major asset classes year-to-date,1 the pressure of rising interest rates, a strong U.S. dollar and fears of several large economies tipping into recession have led to a pullback since the summer of 2022. We believe that the current negative business cycle pressures on commodities are likely to be temporary and give way to the larger forces pushing the demand for commodities higher and constraining the supply of those commodities.

Historically, commodities have been a cyclical asset class, generally declining when the business cycle turns negative. But even history illustrates that commodity prices can continue to rise long after a business cycle has turned if fundamentals are supportive. Oil price shocks in the 1970s and 1980s are a case in point. Admittedly, they are unusual cycles, but today, we are likely to be living in another energy price shock.

Energy Price Shocks Continue

Since we published our Market Outlook, the Organization of the Petroleum Exporting Countries and partner countries (OPEC+) has announced a large cut to oil production from November 2022, amounting to two million barrels per day. As we expected in our Outlook, OPEC+ reacted to the price weakness in oil after the summer and sought to raise the price of Brent oil to more than $90/barrel (prices had fallen to $84/barrel on September 26, 2022, just over a week before the OPEC decision). It has been successful in keeping prices above $90/barrel since that decision but has laid the groundwork for further cuts by painting a pessimistic picture on demand forecasts (giving the group an excuse to intervene in the market again).

Meanwhile, the war in Ukraine shows no sign of improving, and natural gas supplies into Europe from Russia have fallen to a trickle. The European Union has taken various measures to try to soften the shock. However, we view several of the proposals with skepticism. For example, introducing price caps on natural gas imports could simply divert natural gas to other countries and worsen the energy shortage for the EU. Interfering with price benchmarks, such as the Title Transfer Facility (TTF), could send incorrect pricing signals and lead to overconsumption of energy, resulting in additional shortages.2

Supply Shortages of Commodities Extend Beyond Energy

A combination of rising energy prices and interest rates has driven many metal smelters to shutter production. High fertilizer prices (petrochemical product) are also constraining crop yields.

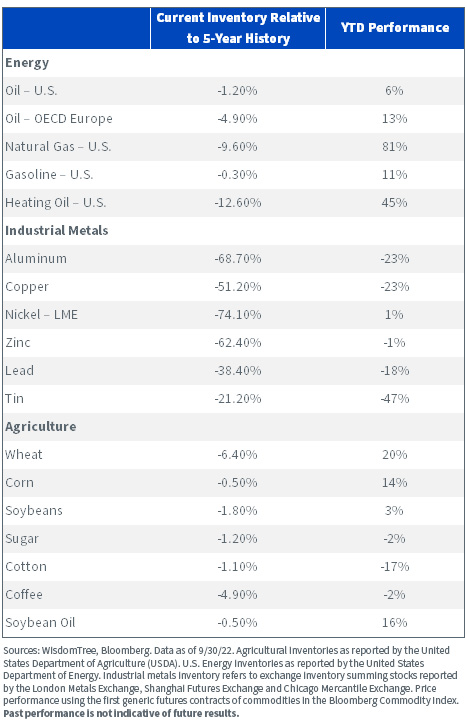

Looking across the commodity spectrum, all commodities have lower-than-normal levels of inventory

Base Metal Supply Is Especially Low

Looking at the table above, the inventory of base metals is considerably lower than their respective five-year averages, yet base metals have seen the largest price declines of all the commodity sub-sectors. The markets are pricing in demand weakness from an economic deceleration. However, demand has not weakened yet. On the other hand, supply is declining fast.

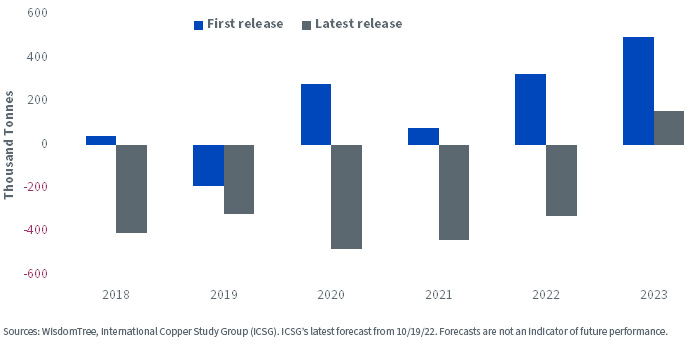

Let’s take the example of copper. The International Copper Study Group (ICSG)’s first forecast for 2022 copper balances (demand less supply), cast in October 2021, was for a sizeable surplus of 328,000 tons. Its latest forecast (cast on October 19, 2022) is for a deficit of 328,000 tons in 2022. Judging by historical revisions, their 2023 forecast of a surplus is likely to be revised down. Their initial forecasts tended to assume no production disruptions. Yet, as we have observed this year, production disruptions can be very large.

Copper Forecasts Revised to a Supply Deficit Again in 2022

China’s Economic Deceleration Is Countered by Policy Support

China’s “zero-COVID” polices have slowed economic growth and thus, its demand for commodities. Despite a lot of speculation that China will ease on zero-COVID policies at the beginning of November 2022, on November 5th 2022, a spokesperson from the National Health Commission’s disease prevention and control bureau said China will stay the course on coronavirus restrictions. That matters because China is the largest commodity consumer in the world.

However, its central bank has been loosening policy and President Xi has called for an ‘all-out effort’ to increase infrastructure sending (and given local governments free rein to raise debts financing to fund these projects). At China's 20th Communist Party Congress which completed last month, Xi Jinping clinched his third five-year term in charge of the nation. His speech pointed to national security taking a greater role in policy priority than the economy.

Commodity Supercycle

An energy transition and a revitalized global infrastructure spend are likely to drive the demand for commodities significantly higher over the coming years. However, today we are living in the down-phase of a business cycle. Even though many commodity markets are visibly tight, commodities are not sufficiently pricing in the tightness. In the U.S., the Inflation Reduction Act and the Infrastructure Bill are both strong tailwinds for commodity demand. In Europe, the sharp focus on weaning off Russian energy dependency is adding new urgency to the energy transition, and we expect to see accelerated energy infrastructure plans take place.

Conclusion

As a headline, economies going into recession doesn’t inspire huge confidence in a commodity rebound. However, history does suggest that an economic slowdown combined with high inflation has been associated with positive commodity and gold performance. The energy price shock has set off a vicious circle of supply contraction from metals, fertilizers and other energy-intensive commodities. The energy transition- and infrastructure-led supercycle remains in play even if short-term business cycle phenomena dictate headlines today. As we emerge from this phase of the business cycle, we may find commodity markets extraordinarily tight.

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

1 Year-to-date (12/31/21 to 10/21/22) performance of Bloomberg Commodity Index, 13.75%; S&P 500, -22.10%; Bloomberg Global Agg Sovereign, -27.99%; FTSE EPRA NAREIT, -31.04%. Source: Bloomberg data in total return terms. For definitions of indices please visit the glossary.

2 “Commission makes additional proposals to fight high energy prices and ensure security of supply,” 10/18/22.