The World Has Seen a Massive Deployment of Robots

Few stories in 2022 get the amount of attention as anything that touches Elon Musk, CEO of Tesla and SpaceX, and the individual with the world’s highest net worth as of this writing. While news about Twitter tends to swamp the coverage of late, we were paying particular attention to Tesla’s “AI Day.”

A Humanoid Robot for under $20,0001

Tesla introduced Optimus to kick off the 2022 event. Importantly, even if a lot of progress has been made when measured on a year-over-year basis, this robot is not yet capable of acting anything like a regular person or performing job functions in full. Within robotics, it must be remembered that frequently the stuff that humans find the easiest—walking, balancing, picking up simple objects—is precisely the stuff that robots find the hardest. Having perfect recall of all the world’s information or the processing power to do nearly any reasonable calculation is much more easily within the robotic wheelhouse and similarly much harder for humans.

As is the case with many Tesla products, it will be important to continue to monitor the progress these technologies can make. We might think that robots like this could potentially lift heavy things, work in dangerous parts of factories or perform other higher-risk functions, but technological history has many examples of new use cases emerging once something is deployed at scale. Optimus and other similar products may lead in directions we haven’t yet imagined.

2021 Sees Robotic Installations Hitting Record Highs

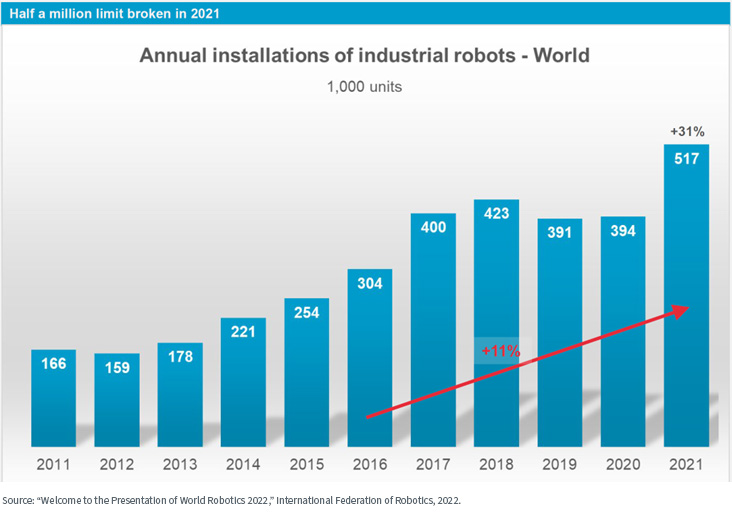

The International Federation of Robotics has an extensive array of information available for anyone seeking to learn more about different trends in the field of robotics. In figure 1, we can see2:

- 2021 saw 31% year-over-year growth in installations of industrial robots across the globe.

- 2021 was the first year where the annual installations of industrial robots surpassed 500,000 units.

- If one looks at the trend of growth for the period from 2016 to 2021, there was a clear trend of 11% annualized growth. This was by no means a straight line—after 2018’s figure of 423,000 installations, 2019 and 2020 both dropped back below 400,000. In a sense, it appears that the 2021 figure of 517,000 re-establishes the trend of growth.

Figure 1: Industrial Robot Installations Have Expanded Significantly from 2011 to 2021

China Has a Huge Robotic Workforce

China is at the forefront of many geopolitical discussions as we write these words. The 2022 Party Conference on its own is a historic event, and we are also dealing with the ramping up of semiconductor export restrictions from the U.S., the continuation of “Zero-Covid” lockdowns and even speculations about what might or might not be in store for the “Taiwan Question.”

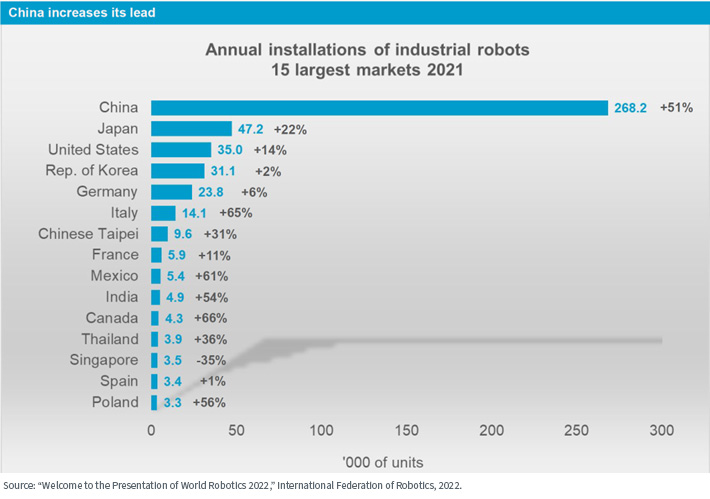

But figure 2’s image comes across as rather stark. It’s not certain that many people would know or predict prior to looking at the data that China has the most industrial robotic installations—Japan or South Korea tend to be cited often. Yet:3

- China had 268,200 industrial robotic installations in 2021—more than half of the total number of global installations of 517,000 cited in figure 1.

- Japan is certainly a major market and was in the number two ranked position—but the drop from 268,200 to 47,200 is SIGNIFICANT.

- China had 97,000 installations in 2016, whereas the rest of the world had 207,000. 2021 marked the shift where China had more installations than the rest of the world after significant growth in the past five years.

- One of the more exciting growth industries was Automotive, where in 2020, China had 31,000 installations, and in 2021, 62,000 installations. We know that electric vehicles and smart cities are a major focus in China, and it’s clear that this can be part of that investment effort.

Figure 2: China Is a Market Leader in Industrial Robotics

Service Robots Could Be the Bigger Market

Industrial robots are certainly important and should continue to grow, but there is a broad range of possibilities for “service robots.” One can think of service robots as any robot that is not bolted to a factory floor. In 2022, when it is difficult to fill certain types of jobs, service robots could be the ones that are more useful in this context.

Figure 3 shows one concrete example of a robot that is being deployed presently to help in cleaning floors. Floor cleaning is not the most glamorous of jobs, and in a tight labor market, it is still necessary even if finding the people willing to do it is much more difficult. The Tennant Co. T7AMR Robotic Floor Scrubber is sold with a specific eye toward appealing to an array of current concerns. The sales website indicates the robot helps to address:

- Labor Challenges—we know it is difficult to hire these types of workers in the fourth quarter of 2022.

- Safety—it is noted that the machine can be deployed safely in an environment alongside people.

- Environment—it is noted that the machine can use less detergent and less water, possibly appealing to the more environmentally conscious.

You might see this machine (or something similar) the next time you visit a local supermarket.

Figure 3: Tennant Co. T7AMR Robotic Floor Scrubber

Conclusion: Robots Represent Potential Opportunities for Artificial Intelligence and Machine Learning

We frequently write about artificial intelligence and machine learning, and we are always trying to present them not as black-box algorithms but tools that seek to provide real, tangible solutions. The floor-scrubbing robot above is one such example, and it is noted that it is powered by BrainOS, an artificial intelligence software platform that powers the world’s largest fleet of autonomous mobile robots. While cleaning the floor might seem simple enough, we have to remember that the robot is also navigating, avoiding obstacles, adapting to changing environments (think—people moving around it) and more.

Even in a difficult economic environment and one that has seen challenging equity performance, we believe it is an interesting time to be thinking about these megatrends and companies like BrainOS seeking to deploy these technologies at scale. The WisdomTree Artificial Intelligence and Innovation Fund (WTAI) is focused on finding companies providing interesting solutions that use artificial intelligence to help solve some of the day’s problems.

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

As of October 26, 2022, WTAI held 0%, 1.66%, 0% and 0% in Twitter, Tesla, Tennant Co. and Brain OS. Click here for a full list of Fund holdings. Holdings are subject to change.

1 James Morris, “Tesla AI Day 2022: Musk Demonstrates Optimus Humanoid Robot for Under $20,000,” Forbes, 10/1/22.

2 Source: “Welcome to the Presentation of World Robotics 2022,” International Federation of Robotics, 2022.

3 Source: “Welcome to the Presentation of World Robotics 2022,” International Federation of Robotics, 2022.

4 Source: Christopher Mims, “Meet the Army of Robots Coming to Fill In for Scarce Workers,” The Wall Street Journal, 10/15/22.

5 Source: braincorp.com

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.