No Powell Pivot

Prior to the release of the recent jobs and CPI reports, it seemed all the rage that another “Powell Pivot” could be coming yet again. For those who might not be familiar, the phrase refers to the changing policy stance of the Fed Chair regarding inflation. First up was the shift from inflation is transitory to we need to fight inflation at, essentially, all costs. The current reference was the expectation that the Fed could dial back its aggressive rate hike path due to economic and market-related concerns. Well, the “hotter” than expected September CPI report has basically eliminated the premise of another Powell Pivot any time soon.

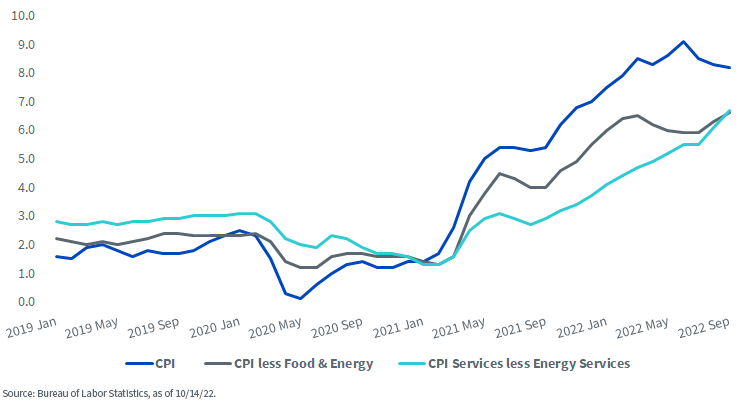

Let’s take a bit of a deeper dive into the latest inflation release. While headline CPI has come down from its annualized peak rate of +9.1% in June, it still resides at the historically high reading of +8.2%. In addition, this very modest deceleration has really been more of a function of lower energy prices than any underlying improvement in price pressures. To provide perspective, energy costs have fallen in a visible fashion over the last three months (-4.6%, -5.0%, -2.1%), reflecting declines in both gasoline and fuel oil.

CPI Data 12-Month % Changes

In fact, goods inflation, overall, has moderated as the emphasis shifted to services in a post-COVID-19 lockdown economy. This is where things get “sticky.” Indeed, core CPI (less food and energy) has actually been rising while the headline inflation reading was coming off its aforementioned peak. Since June, the year-over-year reading for core CPI has risen from +5.9% to +6.6%. This is not a development Powell & Co. were hoping for. In fact, quite the opposite…it’s moving in the “wrong” direction for the policy makers.

Service-related inflation is now the problem for the Fed. Since rate hikes began in March, the “services less energy services” component has seen its annual rate of increase jump from +4.7% to +6.7%, a full two percentage point increase. In addition, the increase has occurred in all three of the major sub-groupings: shelter, transportation services and medical care services.

If service-related inflation adds the “sticky” component to the dilemma, what happens if energy prices reverse course and begin to rise in the months ahead? The widely publicized announcement of oil output cuts from OPEC+ appears to raise the specter of this possibility, another headache for Chair Powell.

Conclusion

When analyzing the inflation numbers, it is important to remember that it is akin to looking backward. The Fed’s hope is that future CPI reports will begin to show that the “Volcker-esque” pace of rate hikes since May will eventually start to tamp down price pressures. However, in the meantime, the persistently “hot” inflation readings will offer Powell no comfort whatsoever and continue to point the policy makers toward another 75 basis point rate hike in November.

I’ve blogged in the past about the track record for Fed Funds Futures as not being all that good, but nonetheless, for those who are counting, the terminal rate for Fed Funds has now moved up into the 4.75%–5% range.