Conversations with Clients in Turbulent Times

“These are the times that try (peoples’) souls. The summer soldier and the sunshine patriot will, in this crisis, shrink from the service of their country; but (they) that stand by it now, deserve the love and thanks of man and woman. Tyranny, like hell, is not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph. What we obtain too cheap, we esteem too lightly: it is dearness only that gives everything its value.”

(Thomas Paine, American patriot, in his seminal Revolutionary War pamphlet, “The Crisis,” written in December 1776. It proved to be a turning-point publication in maintaining the American independence effort at a time when things looked very bleak.)

The last time we wrote about talking to clients in turbulent market environments was in March 2020—the beginning of the COVID-19 pandemic. We don’t suggest we have re-entered that kind of dark period, but the markets certainly have been volatile and disconcerting in 2022. So, once again, we present potential opportunities for valuable introspection and client conversations.

When discussing current conditions, there are broad observations and several specific ideas that can benefit your clients.

Broad Market Observations

- This is not 2008 or early 2020. Yes, market performance in 2022 has been terrible across most asset classes. It has been a long time since most U.S. investors have experienced this combination of high inflation, slowing economic growth, uncomfortable correlation between stock and bond performance, and correspondingly persistently negative market performance. But we have been around long enough to know we are not witnessing a fundamental collapse of the economy or global capital markets. What we are seeing is what used to be considered “normal,” which includes periodic economic recessions and market downturns. It may get worse before it gets better, but we do believe it will get better.

- Our expected outcome? The economy is slowing but we have a “mixed message” environment in which inflation is high and sticky, the Fed is hawkish and the economy is slowing. At the same time, the labor market remains tight and corporate earnings projections are muted but not apocalyptic. Bond market credit spreads—which we think rarely “lie” —suggest Corporate America is in reasonable shape from a balance sheet perspective. We are not sure we believe in the notion of a “soft landing,” and the Fed appears to be fixated on taming inflation, which will not be friendly to economic growth. We believe we are headed for recession, and markets will remain volatile, but it may not be as doomsday-like as some suggest.

Recommended Courses of Action:

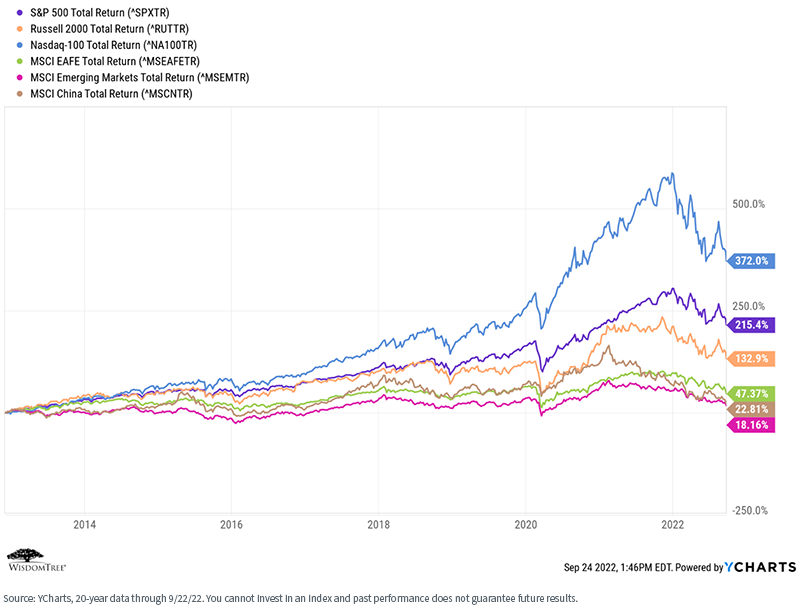

- Be aware, be attentive, but do not be afraid. Well-diversified investment portfolios are built with full market cycles in mind, in the expectation that periods like this will occur. Many investors became complacent over the course of a 12 to 13-year bull run, and though the most recent 12-month market decline is decidedly uncomfortable, market declines are normal. Market timing is notoriously difficult, and generally we do not recommend moving to cash, thereby locking in recent losses that we believe may recover over the course of the next 24 to 36 months. Our stance: stay diversified, stay liquid, but stay invested. Here is a chart of global market performance over the past 20 years. The market is not required to always go up, but that does seem to be the trend.

For definitions of indexes in the chart above, please visit the glossary.

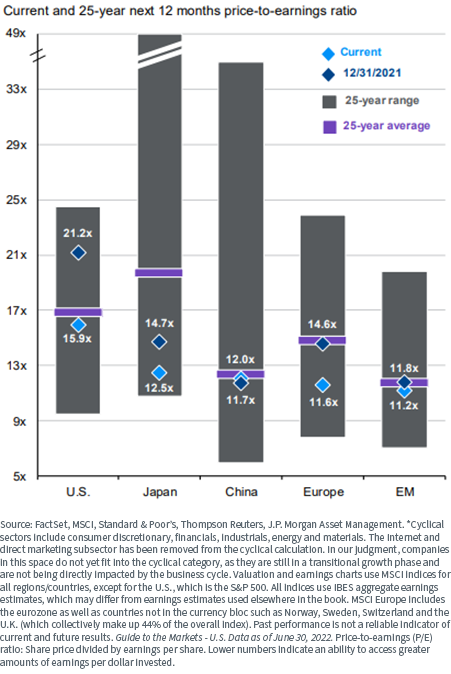

- Actively seek to avoid common behavioral investment mistakes. In times of stress, many investors default to behaviors that can harm long-term performance. One example of this is home country bias or reallocating to what seems to be a more known and comfortable market: your own. In this recent market environment, however, the EAFE and EM markets offer attractive valuation potential for the patient investor.

Global Valuations

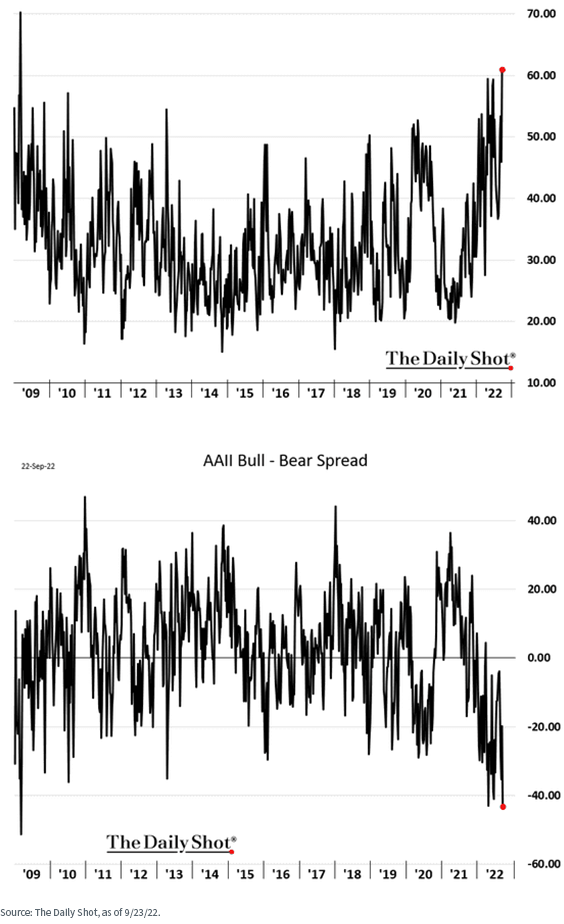

A second example is the gambler’s fallacy, in which investors believe they will “know” when to get into and out of the market. This is almost universally false. Market timing is extremely difficult, and the empirical evidence suggests that individual investors are particularly bad at it. The better approach is to remain disciplined and stick with a long-term portfolio that was constructed to ride the waves of volatile markets.

- If you are sitting on cash, pay attention for reentry points. It is difficult to invest when there is fear or even panic in the air. But, as the market adage goes, “be fearful when others are greedy, and greedy when others are fearful.”

AAII U.S. Investor Sentiment Bearish Readings

- Engage in active tax-loss harvesting. Many investment positions may currently be “underwater.” Rather than wait it out or panic and move to cash, actively seek to tax-loss harvest by swapping out of existing losing positions and into similar ETF positions. The losses are pocketed to offset future gains in the portfolio, and the investor remains fully invested. After the 30-day wash rule period has passed, investors can swap back into the original position or, if they prefer, stay with the new position and maintain both their desired allocation and exposure objectives. There has rarely been a time over the past 10 to 12 years when active tax-loss harvesting has had more potential to add value, in both the equity and bond market. Remember, the two things an advisor has the most control over are fees and taxes. Smartly managing both can help advisors “pay for themselves.” Take advantage of it.

Conclusion

These are the times when clients need their advisors the most. Keep them informed, keep them calm, keep them invested and identify opportunities for turning market turmoil into proactive and potentially positive results.

As Thomas Paine concluded in “The Crisis,” “This is our situation, and who will may know it. By perseverance and fortitude, we have the prospect of a glorious issue.”