How to Find Higher Yield

Things have been quite challenging for the bond market thus far in 2022—this is perhaps the biggest understatement of the year. Although money and bond market yields have increased appreciably through the first five months of 2022, there is one dynamic that has still not changed all that much: interest rates in general remain historically low.

Unfortunately, this is what happens when rates fall toward the ‘zero’ threshold from a monetary policy perspective. In other words, rates have a rather large hole to climb out of. Thus, even with the U.S. Treasury 10-Year (UST) yield rising 130 basis points (bps) since December 31, the yield is only at 2.81% as of this writing.

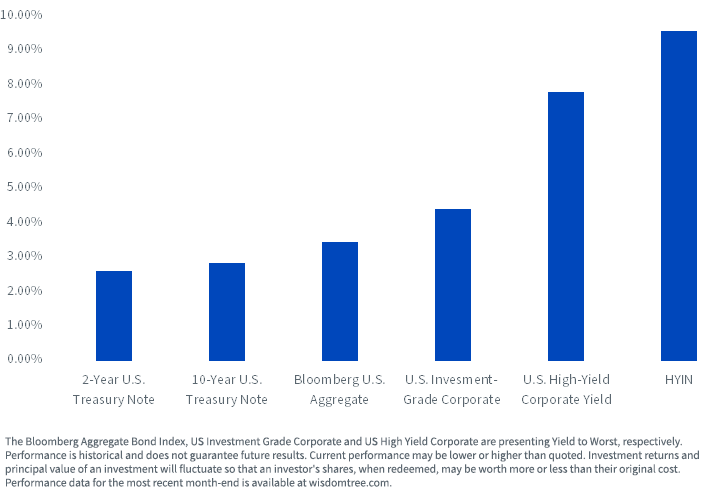

Fixed Income Yields

For the most recent standardized performance click here.

As a result, investors are still left with the quandary of where to find yield. The enclosed chart provides some perspective of what investors are facing in the U.S. fixed income arena in terms of available yields. Due to a rather flat yield curve, UST fixed coupon yields are all essentially below 3%. Even with one of the worst performances on record year-to-date, the benchmark Bloomberg U.S. Agg’s yield is not much higher at under 3.46%. Typically, fixed income investors have turned to the U.S. credit markets to try and generate incremental yield, and this premise still holds as U.S. investment-grade and high-yield rates do offer some upside at 4.40% and 7.82%, respectively.

A Yield Solution

However, what if an investor could find a higher yield? The alternative credit space is garnering increasing attention of late, as investors are becoming more aware of the yield opportunities in this asset class. Alternative credit investments are debt-based products whose yield and/or expected return is higher than investment-grade fixed income securities. The category includes a broad universe of borrower segments, such as households, corporations and commercial real estate sponsors. Three main segments of alternative credit are business development companies (BDCs), credit-centric closed-end funds (CEFs) and mortgage real estate investment trusts (REITs).

Accessing the alternative credit space has been difficult for some investors in the past. Rather than gaining broad-based exposure to a diversified set of managers, options have often been limited to just one of the aforementioned segments of alternative credit. WisdomTree has collaborated with Gapstow Capital Partners to create access to a more diversified approach to this asset class. The WisdomTree Alternative Income Fund (HYIN) seeks to track the price and yield performance, before fees and expenses, of the Gapstow Liquid Alternative Credit Index (GLACI).

Due to the underlying nature of alternative credit, the fund can potentially carry elevated volatility, but it also has potential for a higher yield profile. As of this writing, the SEC 30-day yield for HYIN came in at 9.57%, which is 175 bps above the rate for high yield (the next closest option) and more than 600 bps higher than the Agg. In addition, a portion of the fund's alternative credit is concentrated to exposures in floating rate notes, which can help to keep the correlation to the Agg to a minimum.

Important Risks Related to this Article

For a prospectus click here.

There are risks associated with investing, including the possible loss of principal. The Fund invests in alternative credit sectors through investments in underlying closed-end investment companies (“CEFs”), including those that have elected to be regulated as business development companies (“BDCs”) and real estate investment trusts (“REITs”). The value of a CEF can decrease due to movements in the overall financial markets. BDCs generally invest in less mature private companies, which involve greater risk than well-established, publicly traded companies and are subject to high failure rates among the companies in which they invest. By investing in REITs, the Fund is exposed to the risks of owning real estate, such as decreases in real estate values, overbuilding, increased competition and other risks related to local or general economic conditions. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.