Checking In on the Siegel-WisdomTree Model Portfolios

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We last wrote specifically about the Siegel-WisdomTree Model Portfolios back in August 2021. It is time for an update.

Before we dive in, let’s remind ourselves of the investment mandates we were solving for when we launched these models back in 2020.

First, most investors have four common investment objectives with respect to their investment portfolios (though each person’s “weighting” to an objective may differ):

1. Generate sufficient current income to maintain or improve their current lifestyle

2. Do not outlive their money (i.e., make sure the portfolio lasts at least as long as they do)

3. Ensure that family legacy or impact/philanthropic goals can be met

4. Minimize fees and taxes along the way

These common objectives face two primary challenges as we look out over the investment horizon.

1. Low interest rates: While interest rates are rising (a trend we believe will continue, with fits and starts), the absolute level of rates remains low by historical standards. It is true that the Fed has embarked on what most investors expect to be an aggressive “rate hike regime” as it belatedly acknowledges it is “behind the curve” on inflation, but given that it started from a baseline of zero, even an aggressive rate hike regime will result in modestly low absolute rates.

Not until late April/early May did Treasury real levels of interest rates move into slightly positive territory across most of the yield curve, suggesting investors still are locking in low real returns if they buy and hold those bonds until maturity.

U.S. Treasury Real Yields (%)

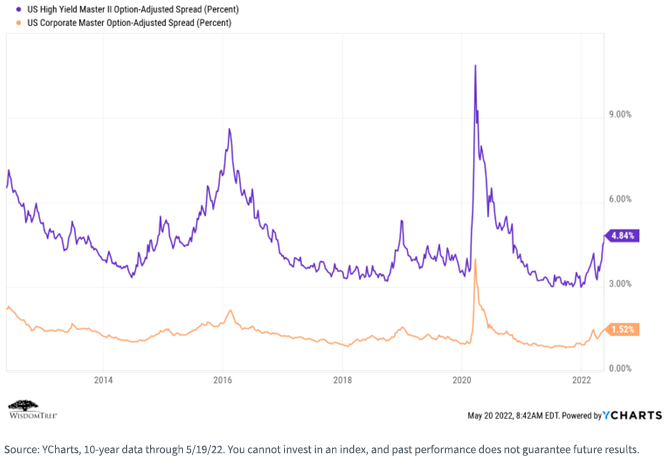

At the same time, while credit spreads have widened year-to-date (“YTD”), they remain well within historical levels.

The implication is that it will remain difficult to generate sufficient current income out of a fixed income portfolio to maintain or improve current lifestyles without taking unwanted additional risk (i.e., increased duration or credit risk).

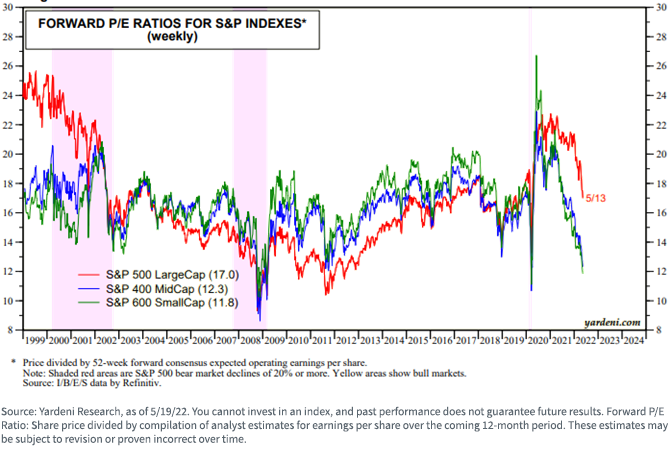

2. Lower forecasted equity returns: The potential return on any investment is at least partly a function of what you pay for it today. Despite the YTD market declines, equity market valuations do not represent “screaming buys” by historical standards (though they appear more attractive in small- and mid-cap stocks). Our own estimates are for roughly 5% real return versus a historical real return rate of 6.5%–6.7%.

The implication is that it may be more difficult to build portfolios that have a sufficient longevity profile to accommodate increased life expectancies without taking on additional equity risk.

So, the question becomes—how can we build a “better mousetrap” to the traditional "60/40" portfolio that can potentially address most investors’ objectives in the face of current and expected future market environments? Fortunately, there are things we can do.

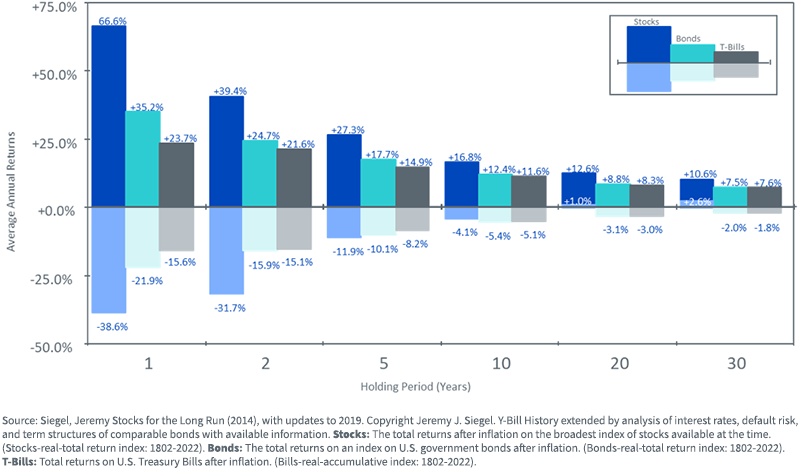

Drawing on the research of Dr. Jeremy Siegel of the Wharton School (a since-inception strategic investment advisor to WisdomTree), we know that, over a reasonable time horizon, stocks have done better than bonds, and even the worst historical periods for stocks have been better than that of either bonds or cash.

Maximum and Minimum Returns 1802 - 2020

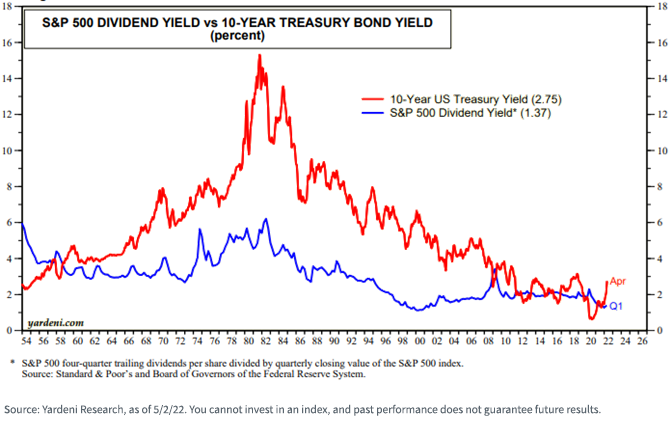

Additionally, current dividend yields from the equity markets remain comparable (though currently lower) to the nominal 10-Year Treasury yield. We argue, however, that equity dividend yields are more sustainable as they represent a return on real assets. In addition, equities hold the potential for upside total return, while bonds do not (if held to maturity).

The Siegel-WisdomTree Model Portfolios

It was with these “facts on the ground” that, in collaboration with Dr. Siegel, we constructed the Siegel-WisdomTree Model Portfolios—a Global Equity model and the “flagship” Longevity model. The Longevity model is explicitly our attempt to build a “better mousetrap” to the traditional 60/40 portfolio:

1. A targeted (but not fixed) 75% allocation to yield-focused equities to improve current income generation, the longevity profile and the legacy potential of the overall portfolio (Investor Objectives #s 1, 2 and 3). The yield-focused nature of the selected equity securities means they tend to have a lower equity beta profile.

2. A targeted (but not fixed) 25% fixed income allocation that is constructed for quality income generation in a risk-controlled manner and to function as an appropriate equity risk hedge (Investor Objective #1).

3. The portfolio is constructed entirely with ETFs to potentially optimize fees and taxes (Investor Objective #4).

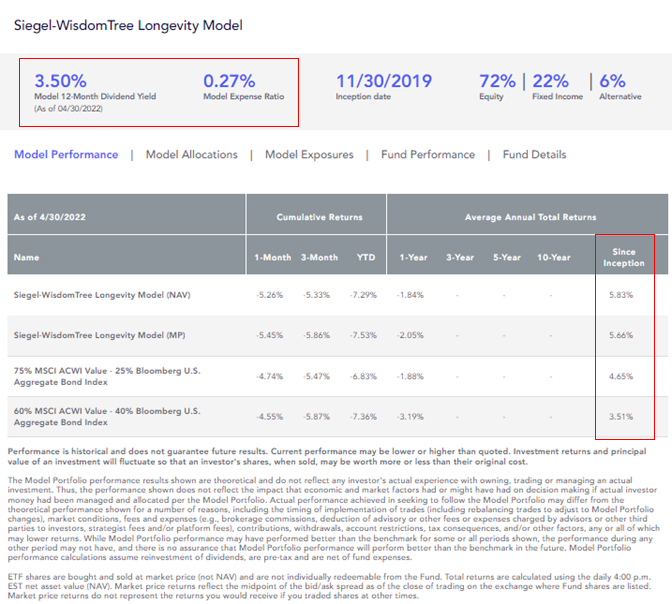

When we say “targeted but not fixed” allocations, it simply means that we have the ability to deviate on a marginal basis as market conditions change. Currently, the portfolio is 72/22/6, with a 6% “alternatives” allocation to managed futures and commodities (funded equally from equities and fixed income).

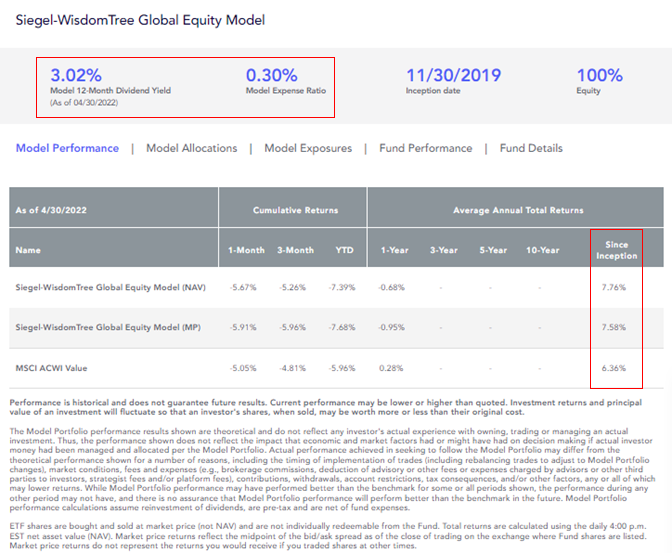

We built the Global Equity model on the same principles but in recognition that many advisors prefer to manage their own fixed income portfolios and/or want to create different risk profile portfolios than our suggested 75/25.

The potential results of our asset allocation, portfolio construction and security selection decisions are:

1. Improved current income generation

2. A better longevity profile (i.e., reduced short-fall risk)

3. Better potential for funding legacy objectives

4. An expected slightly higher standard deviation than a traditional 60/40 portfolio. That is, the investor and advisor are accepting slightly higher short-term volatility in exchange for increased current income and a better longevity profile.

We launched these models in late 2019, so they now have more than two years of live performance under fairly extreme market conditions (in both directions), and so far, they have performed as expected from both a total return and a yield perspective. The current 6% allocation to “alternatives” reflects the fact that we hold positions in managed futures and broad-basket commodities to mitigate the perceived risks of rising inflation.

For individual Fund standardized performance, Fund-specific links for yield, most recent month-end performance and a prospectus, please click here.

Conclusion

We launched the Siegel-WisdomTree Model Portfolios in an attempt to address what we believe are some of the primary issues and conditions that investors will face into the foreseeable future. Our view is, simply, that the traditional “60/40” portfolio will face significant headwinds in meeting investor objectives as we move through this decade and the next. We believe we have succeeded in constructing a “better mousetrap.”

Financial advisors can learn more about these models and how to successfully position them with end clients at our newly launched Model Adoption Center.

Important Risks Related to this Article

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.