Investing in a Post-60/40 Market Regime

This article is relevant to financial professionals interested in model portfolios. WisdomTree ETF model portfolios are directly accessible only by financial professionals, through the WisdomTree website and various model portfolio platforms.

WisdomTree has collaborated with Wharton finance professor Jeremy Siegel for almost 20 years.

Professor Siegel is known for his long-term view on equities as the preferred way to grow assets.

But his recent research looks at the bond market, and challenges created by the income available from traditional fixed income assets.

Professor Siegel increasingly is convinced that interest rates may stay low for much longer than he had anticipated. Quite frankly, he does not see any particular catalyst for a rapid or unexpected rise in interest rates—for many years to come.

The investment implications may be profound.

In this new market environment, moderate risk investors—the typical 60/40 investors—will likely struggle to generate sufficient yield from their income portfolios to maintain their desired lifestyles.

To put it more bluntly, WisdomTree believes a 60/40 portfolio is not going to get the job done for many investors. This asset-class world view is complicated by long-term aging trends.

Longevity Is the New Black

Research from the MIT Age Lab1 illustrates that we are living longer, and that longevity will increase as health science and technology continue to advance. Our wealth and financial plans need to evolve as well.

The income-focused retirement portfolios many investors have traditionally relied on may not be appropriate for the new retiree demographic characteristics.

This requires us to redefine risk in long-term investment portfolios.

We have trained ourselves (and our clients) to define risk as the standard deviation of portfolio returns—a fancy way of saying short-term volatility risk.

But as investors live longer, we need to re-introduce another definition of risk: the risk of outliving your money.

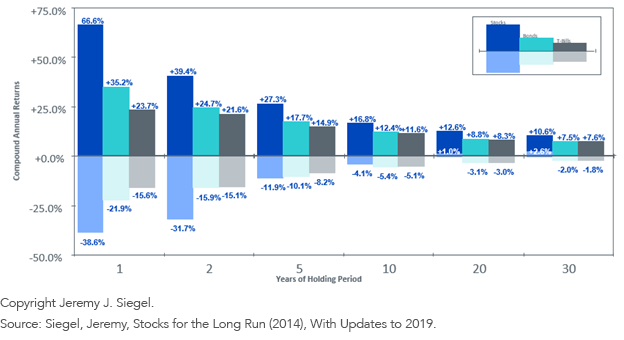

This aligns with the main message from Professor Siegel’s first book. The premise in Stocks for the Long Run is easy to understand—stocks may be volatile in the short term, but, as shown in figure 1, equities have outperformed all other major asset classes over full market cycles and through time. They have done so with more stable, consistent, and less volatile returns than bonds at 20-30 year time horizons.

Maximum and Minimum Returns 1802–2019

But let’s examine the typical investor.

Three Objectives Investors Care About

Almost all investors are concerned with three primary investment objectives (with differing levels of importance):

1. Generating sufficient income to maintain or improve their current lifestyle;

2. Not outliving their money and/or having enough money at their death to fulfill their legacy objectives (be it inheritance, philanthropy or some combination); and

3. Minimizing taxes paid along the way.

In a post-60/40 investment landscape, how should we be rethinking long-term portfolio construction to meet these investor objectives?

Working in collaboration with Professor Siegel, WisdomTree developed two “Siegel-WisdomTree” model portfolios.

These are constructed to address all the above-mentioned industry trends and the three identified primary investor objectives. Both portfolios are:

1. Heavily allocated to equities (“stocks for the long run”), to mitigate the longevity shortfall risk.

2. Within equities, allocated to more dividend/income/yield-oriented equities. This accomplishes two goals:

a. Currently equities can potentially deliver higher yields than most bonds, so a yield-focused equity portfolio has better potential to deliver the income required to meet current lifestyle maintenance needs.

b. The characteristics of the equities selected tend to be more defensive or lower-beta in nature. Despite the higher allocation to equities versus the traditional 60/40 portfolio, the Siegel-WisdomTree models have only modestly higher short-term volatility risk, and we believe the overall model portfolios have the potential to deliver improved risk-adjusted returns.

3. The all-ETF portfolio structure helps to optimize the tax-efficiency of the portfolio.2

Relative to traditional 60/40 portfolios, we believe the Siegel-WisdomTree models have the potential to provide:

1. Competitive risk-adjusted returns.

2. Higher current income/yield for lifestyle maintenance.

3. Increased long-term probability of not outliving your money and/or being able to fund your legacy objectives.

4. Slightly higher short-term volatility (standard deviation) risk.

We never subscribe to the phrase, “It’s different this time.” But we do believe in paying attention and responding to both investor objectives and current market conditions.

In the Siegel-WisdomTree models, we believe we’ve done both, while also enabling financial advisors to “outsource for growth.”

Advisors increasingly leverage third-party model portfolios as they seek to increase scale and efficiency in their practice. This allows them to focus on their core competencies while they still deliver institutional-quality investment solutions.3

This new collaboration with Professor Siegel on model portfolios is the latest advisor solution WisdomTree is excited to bring to the market.

1See, for example, The Longevity Economy: Unlocking the World's Fastest-Growing, Most Misunderstood Market, by Joseph F. Coughlin, PublicAffairs Publishing, November 2017.

2ETFs generally can be more tax efficient than actively managed mutual funds, for a variety of structural reasons, including but not limited to (a) fewer taxable events during portfolio rebalancing and reallocation; (b) no annual payment of accrued but unrealized capital gains; and (c) more tax-favorable redemption and settlement procedures. This may not be true for all ETFs at all times, but the ETF structure generally is viewed to be more tax efficient than the mutual fund structure.

3See, for example, “https://www.deltadata.com/model-portfolios-are-the-future-of-investment-management/”

Important Risks Related to this Article

Please note, WisdomTree is not in business with Delta Data and we have not received any compensation for including a link to their article in this piece.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus for WisdomTree Funds containing this and other important information, please call 866.909.9473 or visit WisdomTree.com to view or download a prospectus. Investors should read the prospectus carefully before investing.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country or sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Diversification does not eliminate the risk of experiencing investment losses. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see each Fund’s prospectus for a discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

© 2020 WisdomTree Investments, Inc.

This content is for information only and is not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should it be considered or relied upon as a recommendation by WisdomTree regarding the use or suitability of any model portfolio or any particular security.

This content has been prepared without regard to the individual financial circumstances and objectives of any investor, and the appropriateness of a particular investment or

strategy will depend on an investor’s individual circumstances and objectives. Investors and their advisors should consider the investor’s individual financial circumstances, investment time frame, risk tolerance level and investment goals. Investors should consult with their own advisors before engaging in any transaction. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a model portfolio’s allocations will provide positive performance over any period. The model portfolios are provided “as is,” without any warranty of any kind, express or implied. Information and other marketing materials provided to you by WisdomTree or any third party concerning a WisdomTree model portfolio, including allocations, performance and other characteristics, may not be indicative of an investor’s actual experience from an account managed in accordance with a model portfolio’s strategy.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.