No Attack of the Killer BBBs

An overarching theme when investing in U.S. corporate bonds the last few years has been the discussion surrounding the credit makeup of the investment grade (IG) universe. Specifically, the share of the BBB-rated sector within this universe has risen considerably since the end of the Great Recession in 2009. As a result, there have been numerous articles written on the topic, and of course the usual hype surrounding a “what if” scenario. In other words, what happens if the BBB sector stumbles? While we are certainly mindful of this new IG landscape and monitoring it carefully, we are not ready to ring any alarm bells at this time.

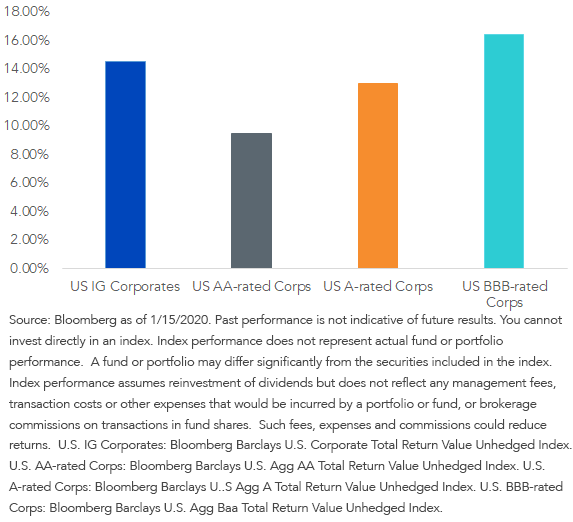

As we all know, past performance does not predict future results, but calendar year (CY) 2019 offered an interesting glimpse into the U.S. IG market. Total return for a variety of fixed income asset classes last year was a very positive experience, but for broader IG corps, it was a “double-digit” performance in plus territory. Guess which sector rose to the top? You guessed it, BBBs (+16.4%).

Figure 1: 2019 Total Returns

Admittedly, we do not expect the 2020 performance to be this robust, but some modest positive readings would be our base case. For IG corps, there are some potential warning signs to watch from a balance sheet perspective (interest coverage and cash/debt ratios). However, on the supportive side of the equation, the Federal Reserve (Fed) has definitely provided a friendlier glide path with monetary policy, and economic data, such as the recent jobs report, continues to suggest a +2% type of growth trajectory, with no recession on the immediate horizon. Last, but not least, on the short list, as the recent signing of the U.S./China Phase 1 trade deal underscores, trade tensions have been de-escalated (for now), as compared to last year.

We believe these key macro factors should be supportive for BBB-rated credits in general. In addition, BBB corporates typically have a stronger incentive toward balance sheet discipline in order to maintain their investment grade credit rating to avoid becoming a “fallen angel” (an issue that gets downgraded from IG to high yield).

Obviously, investors have been wondering about recent downgrade trends in the U.S. IG space. We thought it would be useful to provide some insights on this topic, as it relates to our own yield-enhanced core strategy as well, the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY), which overweights credit as compared to the Bloomberg Barclays U.S. Aggregate Index (Agg) but cannot deviate beyond 20% of the weights in the Agg.

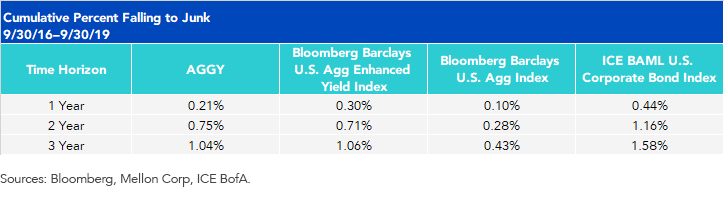

Figure 2

In figure 2, we measured the percent of AGGY falling to junk over the past three years and compared it to the Agg, the Enhanced Yield Index, and a broad-based corporate index. Our analysis suggests that AGGY’s credit overweight has not resulted in a significant increase in downgrades to junk and was visibly less than that of broad U.S. corporates.

- Marginal Increase in Downgrades to Junk: Over the three-year period stretching from 9/30/2016 to 9/30/2019, AGGY had only 0.61% more downgrades to junk compared to the U.S. Agg (1.04% in AGGY vs. 0.43% in the U.S. Agg; both figures are cumulative). The one-year horizon only saw a 0.11% difference vs. the Agg (0.21% vs. 0.10%).

- U.S. Corporates Had More Than 1.5x More Downgrades to Junk: Over the same three-year time, an investor broadly buying U.S. corporate bonds would have had 1.58% of their portfolio falling to junk (more than 1.5x vs. AGGY).

Conclusion

To reiterate, we are very mindful of the current U.S. IG corporates landscape, but playing to investors’ anxieties is normally what makes headlines. However, sometimes facts get in the way.

Unless otherwise stated, all data sourced is Bloomberg as of January 17, 2020.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Credit ratings apply to the underlying holdings of the Fund, not to the Fund itself. Standard & Poor’s, Moody’s and Fitch study the financial condition of an entity to ascertain its creditworthiness. The credit ratings reflect the rating agency’s opinion of the holdings’ financial condition and histories. The ratings displayed are based on the highest of each portfolio constituent as currently rated by Standard & Poor’s, Moody’s or Fitch. Long-term ratings are generally measured on a scale ranging from AAA (highest) to D (lowest), while short-term ratings are generally measured on a scale ranging from A-1 to C.