Don’t Pay Large for Small Caps

Black Friday is long behind us, but the importance of finding a bang-for-your-buck is a year-round endeavor. While it’s human nature to want to pay as little as possible for the best products, that’s often easier said than done, and the best deals can be elusive.

When investing, valuation ratios can serve as your “bargain hunter,” as they indicate how much you’re paying to access the fundamental health of the underlying investment. At WisdomTree, we pay special attention to valuations, since many of our strategies are implicitly designed to keep them in check.

How Can Earnings Help?

WisdomTree’s core family of funds manages valuations by weighting their underlying companies by earnings per share. Those with greater earnings over the previous 12 months receive greater weight than those with less, rewarding businesses with impressive financial health and efficient operations.

An important byproduct of this method is that the Funds’ valuations remain subdued, especially after rebalancing each December.

The benefit has been especially apparent in U.S. small caps, which is traditionally one of the more speculative asset classes due to investors’ desire for small companies with exciting business prospects. As a result, small caps typically have expensive price-to-earnings (P/E) valuations.

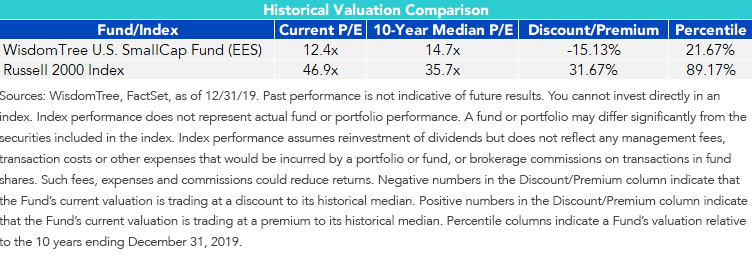

Look no further than the Russell 2000 Index for proof. As of 2019, its 10-year median P/E ratio is 35, and it’s currently trading even higher at 46. By comparison, the earnings-weighted WisdomTree U.S. SmallCap Fund (EES) has a median P/E of only 14, and it’s currently trading at a 15% discount to its median after rebalancing in December.

Figure 1: U.S. Small Cap Valuation Performance Comparison

For standardized performance of EES, please click here.

But if both EES and the Russell 2000 Index provide exposure to the same market, what’s causing the valuation gap?

There are two answers.

First, we must remember that small caps are often the subject of immense speculation.

With a market cap-weighted index like the Russell 2000, investors bid up the share price of small companies they believe have potential.

Meanwhile, valuations climb higher without any guarantee that these companies will ever be able to back it up. In fact, about 20% of the Russell 2000 Index is currently comprised of companies with negative earnings, adding unprofitability into the valuation recipe as well.

Second, WisdomTree’s approach reduces the speculative element of small-cap investing by its earnings-weighted methodology. By emphasizing profitability, the Fund targets companies that already have a track record of financial health, which provides less-expensive access to an otherwise often expensive asset class.

Quality Can Reward with Lower Valuations

An earnings methodology is not the only way to keep valuations under control. A focus on quality and income can help as well, and the WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) illustrates this example.

By screening for companies with the best three-year averages for return on equity (ROE) and return on assets (ROA), while prioritizing long-term earnings growth expectations, we implicitly filter out much of the unprofitable junk in the small-cap space.

The fund is then weighted by dividends, which means each company receives a new weight each December commensurate with the dividends they contribute to the total amount of dividends paid in the starting universe.

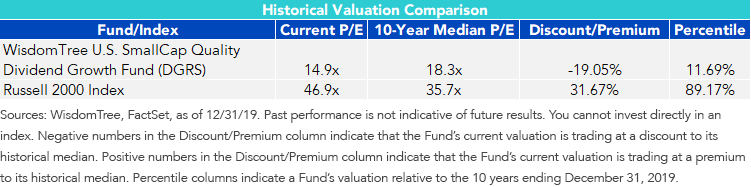

When all is said and done, the emphasis on operational health is illustrated with healthy earnings and rewarded via lowered valuations. After the rebalance this past December, the Fund is trading at a 19% discount to its 10-year median P/E.

Meanwhile, broader U.S. small caps, represented below by the Russell 2000 Index, are trading at a 32% premium and about 10% off their 10-year high, while DGRS finds itself in the opposite position, offering access to the small-cap market without breaking the bank.

Figure 2: Quality Filters Can Also Reduce Valuations

For standardized performance of DGRS, please click here.

Pay Small for Small Caps

While most U.S. investors are wondering whether equities will continue to climb higher in 2020, we feel they’re only doing themselves a disservice by piling into the small-cap market when it’s most expensive.

We agree that small caps have impressive potential, but that potential is best realized when you’re only paying for those companies that already have something to show for themselves.

Both the EES and DGRS target these companies and are currently trading at considerable valuation discounts after their recent rebalance, which could provide a favorable opportunity for small-cap market access.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.