Is This a Defining Moment for the Bond Market?

It seems every year we read commentary saying that the “great bond market bull run” is coming to an end. And you know what? It has yet to happen. With U.S. bond market yields rising to levels not seen since 2018–19, market participants appear to be debating whether rates have further room to rise from here or whether the increases now represent a renewed buying opportunity to go long duration. Hence the title of this blog post: Is This a Defining Moment for the Bond Market?

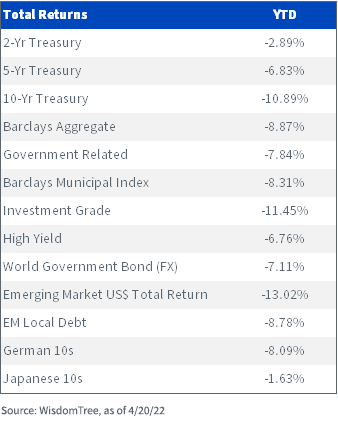

Ok, you maybe asking: am I being a little overdramatic here? Well, let’s take a look at the chart below to see where I’m coming from. As of this writing, there have been nothing but negative readings in just about every major area or sector of the broader global fixed income arena. It’s not like we haven’t seen red ink in the bond market in the past, but the magnitude of the negative returns year-to-date is quite staggering in some cases.

I’m a big proponent of not chasing yesterday’s trade, which is why we need to ask ourselves, where do we think the bond market is headed from here? Let’s use the U.S. Treasury (UST) market as our benchmark for the discussion. The rise in (UST) yields thus far in 2022 has been due to Fed rate hike expectations as well as the prospects for quantitative tightening (QT). A case can be made that UST yields have already factored in the hawkish pivot by the Fed, but I would argue that rates have not finished their ascent to higher ground yet.

First of all, the Fed has only raised rates once this year and hasn’t even begun to implement QT. The pairing of these two tightening strategies as outlined by Powell & Co. up to this point can be a powerful force, and arguably, has never been attempted before. In addition, the current pricing for Fed Funds Futures just gets us back to neutral, whereby persistent inflation would probably force the Fed to take monetary policy into restrictive territory.

What about support from the global investor? Don’t look now, but non-U.S. sovereign debt yields have been increasing as well. In fact, remember all those stories about widespread negative global bond yields? Let’s just say that is now history. Using the German 10-year bund as our proxy, the yield level has risen more than 100 basis points (bps) year-to-date, and the absolute level is just under the 1% threshold. As recently as December, the bund yield was around -0.40%.

Perhaps, the most noteworthy factor is real yields, a.k.a. TIPS yields. In my opinion, the recent surge in the UST 10-Year yield has been the direct result of the increase in real yields. Since March 8, the 10-Year TIPS yield has skyrocketed by more than 100 bps, and what was once a rate of -1.08% actually got down to zero last week. During the last rate hike cycle in 2018, the 10-Year TIPS yield reached a high watermark of 1.16%, or close to 120 bps above where it resides as I write.

Conclusion

Now, I’m not predicting that UST yields will increase by another 100 bps. However, the factors I outlined in this blog post would seem to point to the potential for a bond market yield like the UST 10-Year to not only revisit its recent peak of 3.25%, but also overshoot that reading to the upside.

For more on this topic, please listen to one of our latest Basis Points podcasts, where Kevin Flanagan speaks with George Goncalves, Head of U.S. Macro Strategy at MUFG Securities, about global interest rates, possible outcomes for the next Fed meeting, and the impact of Quantitative Tightening.