The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or Less

“I just dropped in to see what condition my condition was in”

(By Kenny Rogers & The First Edition, 1967)

When reviewing the current state of the global economy and investment markets, we recommend focusing on market signals and weeding out market noise. We believe the five primary economic and market signals that provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation and Central Bank policy.

GDP Growth

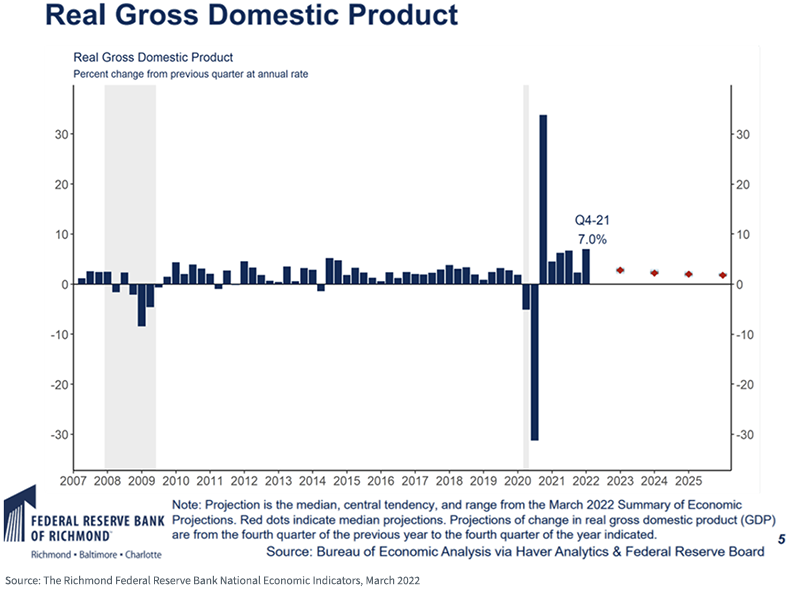

While decelerating from the pace of 2021, U.S. economic growth is expected to remain positive in 2022, pending further unexpected inflation and geopolitical news. The atrocities in Ukraine are unfathomable, and the continuation of the war plus further Western sanctions may result in significant inflationary and supply shortages as we move through the year. Consensus estimates for GDP growth in 2022 are roughly 3%–3.5%.

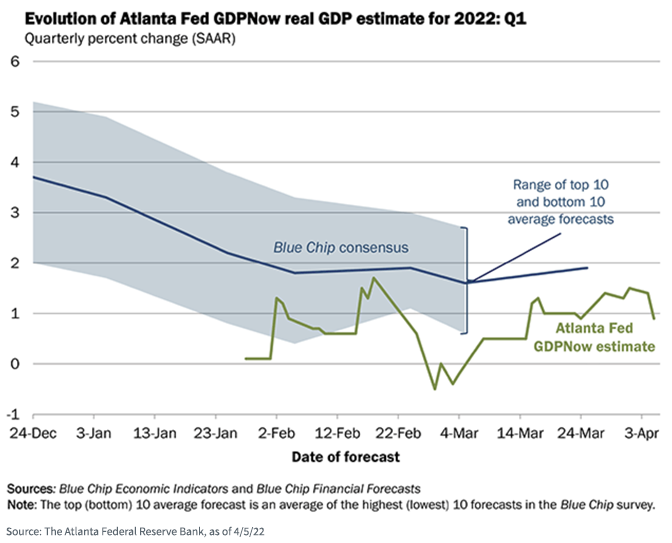

The Atlanta Fed “GDPNow” estimate pegs Q1 2022 GDP growth at a sluggish +0.9%, as COVID-19, rising inflation, ongoing supply chain issues and serious geopolitical tensions all weighed on economic activity. We maintain our outlook, however, that we may witness another “economic reopening” cycle as we move through the year.

The two biggest risks to that outlook are (1) an overly aggressive Fed that puts the brakes on economic growth in the name of taming inflation and (2) continued escalation of the war in Ukraine, resulting in still further sanctions that disrupt economic activity in Europe and create potential significant agricultural shortages worldwide.

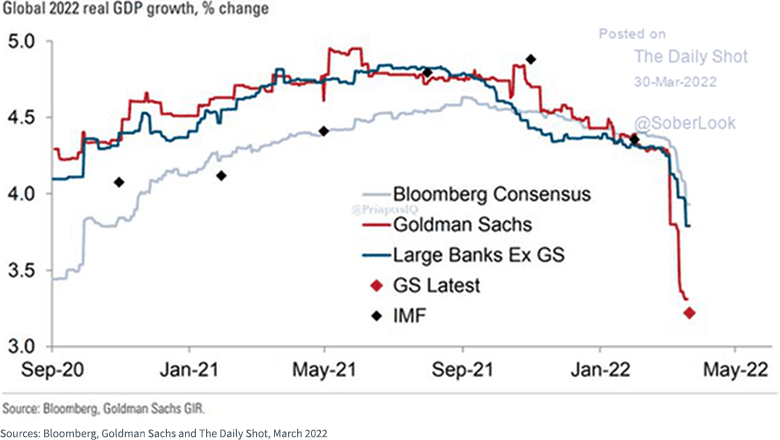

Those same supply chain and geopolitical concerns have also muted expected global GDP growth, though it is expected to remain positive. The consensus estimates are for 3%–4% growth for all of 2022.

Translation: A potentially volatile but mildly positive environment for “risk-on” assets. We are slightly out of consensus in that we do not believe we will head into recession in 2022, and perhaps not even until well into 2023. There simply is too much fiscal stimulus still in the system.

There are two primary “known unknowns” to this economic outlook, specifically:

- Spiraling inflation and the Fed’s corresponding response. The Fed has turned increasingly hawkish as it now fully realizes it is “behind the curve” in fighting inflation and has initiated what many believe will be an increasingly aggressive “rate hike cycle.

- The war in Ukraine, which seems to be escalating, resulting in further economic sanctions on Russia. The atrocities committed by the Russian army will not go unanswered, and potentially draconian sanctions may be imposed. We may have reached the point where the Western allies will accept increased shared economic pain in order to impose deeper sanctions on Russia.

This could have a significant impact on inflation, global commodities and economic growth. A bad-case scenario may also involve global food shortages later this summer, as Russia, Ukraine and Belarus provide a significant percentage of global wheat, barley and fertilizer.

Earnings

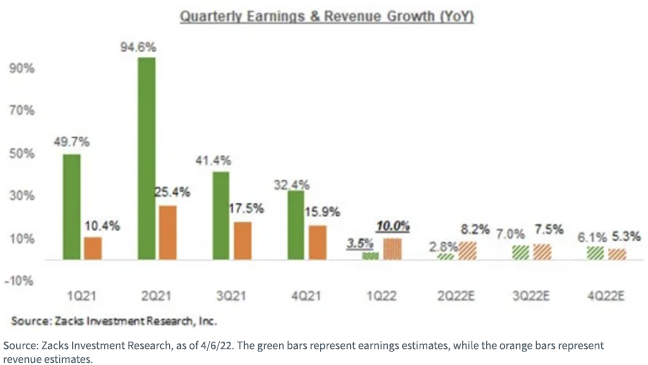

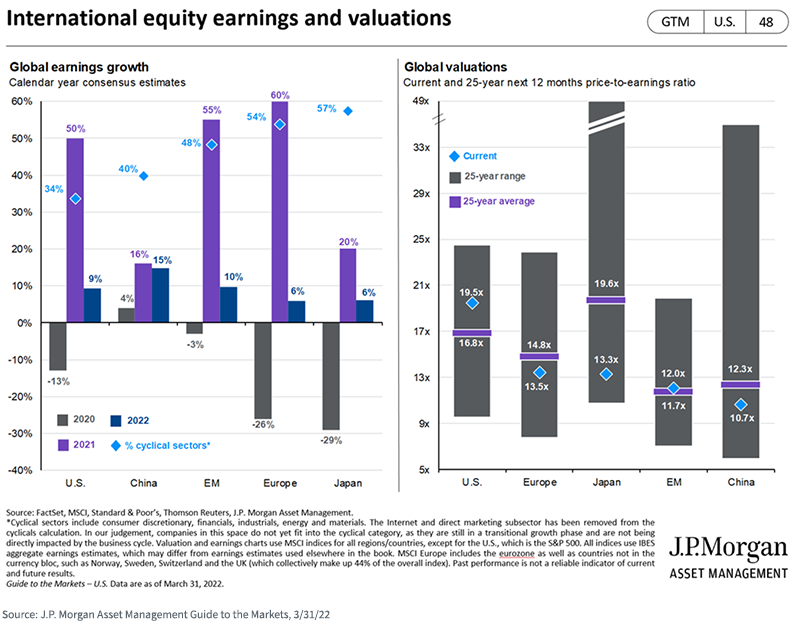

The U.S. Q1 2022 earnings season will soon begin, and the outlook is for lower but still positive revenue and earnings growth. S&P 500 Index earnings are expected to grow 3.5% over Q1 2021 earnings, on a 10% increase in revenues.

Non-U.S. earnings are also expected to be solid in 2022. Valuations outside the U.S. continue to look relatively attractive compared to the U.S., especially in Japan.

Translation: A continued positive environment for global risk assets. We believe there will continue to be a valuation “tug of war” between positive earnings and rising interest rates. So far, rising rates are winning, as the market tumbled in Q1.

We saw a full-blown “factor rotation” away from growth and toward value and dividend stocks in Q1. We believe that trend will continue, and our portfolios are positioned accordingly. We also believe “quality” (i.e., companies with strong balance sheets, earnings and cash flows) may become increasingly important as we sail into the potentially volatile seas of 2022.

Interest Rates and Spreads

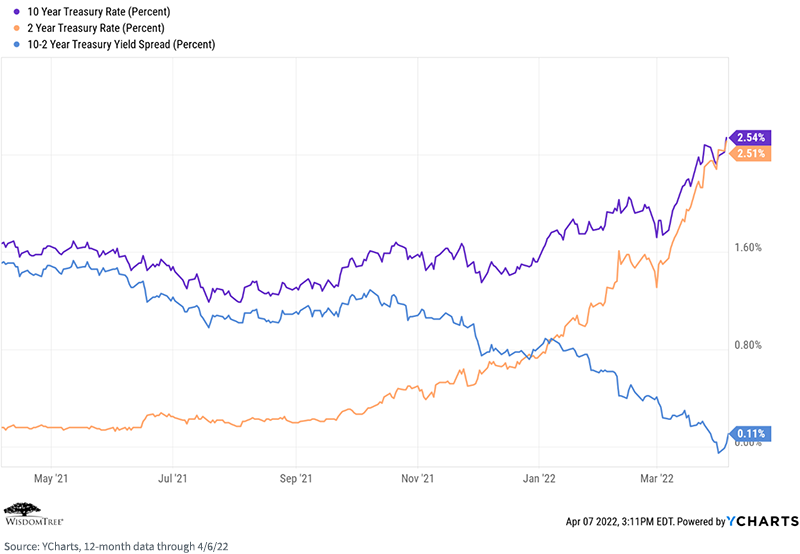

While rates have risen across the yield curve (a trend we expect to continue), the real action has been in the short end of the curve (orange line), as the market reacts to higher inflation and a more aggressively hawkish Fed. The market grew increasingly concerned about a yield curve “inversion” as a signal of future recession, but we don’t believe that is the case this time—at least not yet.

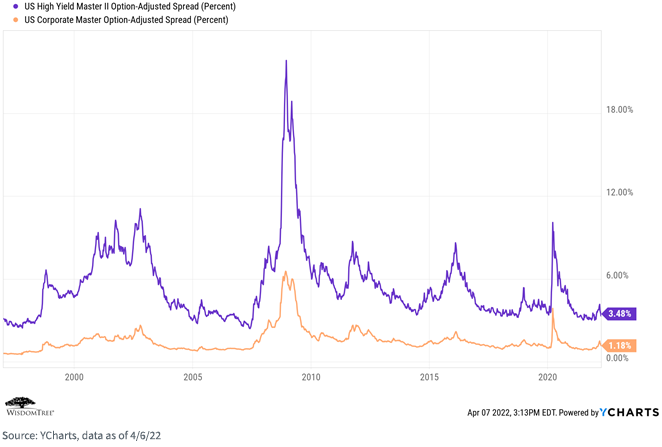

Credit spreads widened in Q1 but generally remain tight and in line with historical levels (suggesting investor comfort with potential default rates). Quality security selection, however, remains critical. There is not a lot to love about the total return potential for bonds in 2022, but we believe there is relative value in floating rate Treasuries (as both an interest rate and duration hedge) and interest rate-hedged corporate and high-yield bonds.

Translation: In Q1, we moved to further shorten our duration, and we maintained our position of being over-weight in credit relative to the Bloomberg Aggregate Bond Index, with a focus on quality security selection, especially in high yield. Corporate balance sheets are solid, so coupons should be relatively safe. We see potential pockets of opportunity in interest rate-hedged bonds, floating rate Treasuries and alternative credit, but now is not the time to take excessive risk in your fixed income portfolio.

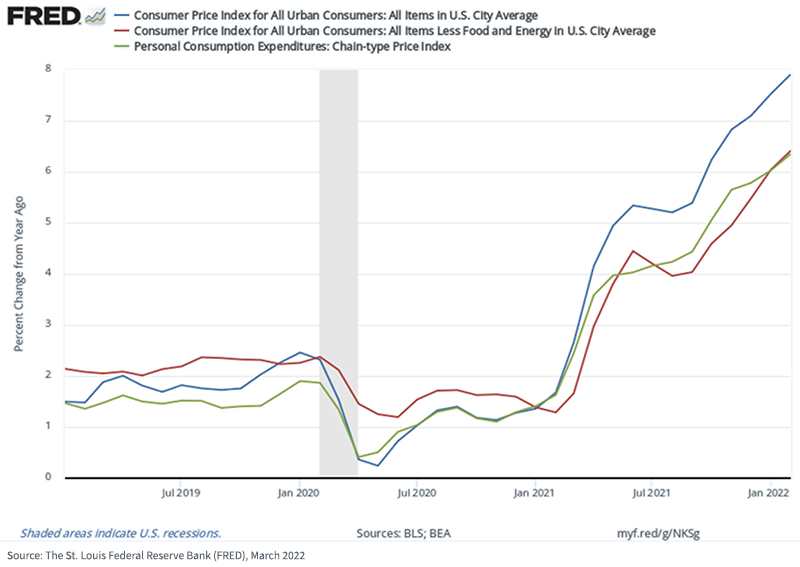

Inflation

Inflation is the economic issue of the year—the Fed has turned more “hawkish” but remains behind the curve. All eyes will be on Fed behavior and actions as we move through 2022.

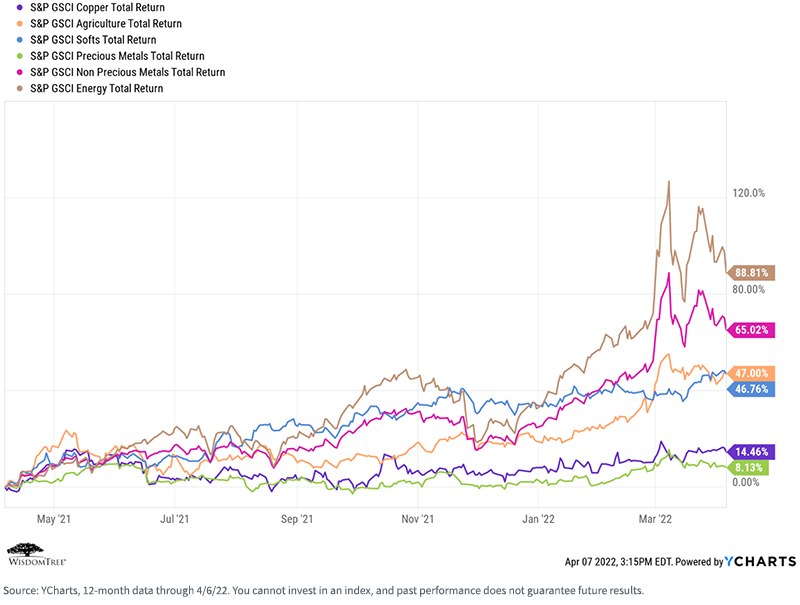

Global commodities are rising on expectations for global shortages in the face of what may be an “economic reopening” regime at some point in 2022. After a generally poor 2021, even precious metals have rallied recently as inflation fears grow and as a “store of value” trade amid the war in Ukraine. The longer that war continues, the greater the risk of serious commodity shortages going forward, as Russia and Ukraine are significant producers of wheat, barley and both precious and industrial metals.

Translation: Inflation is the story of 2022. The Fed has turned hawkish and initiated what most people believe will be an aggressive “rate hike cycle”—perhaps even at the expense of economic growth. Historically, stocks have provided a reasonable hedge to moderate inflation because they represent real assets, and we also maintain our position in broad-basket commodities within several of our Model Portfolios.

We note that rising inflation is not just a U.S. phenomenon—it is global. We may have entered a new inflation environment in which we witness “The Great Rate Normalization Regime".

Central Bank Policy

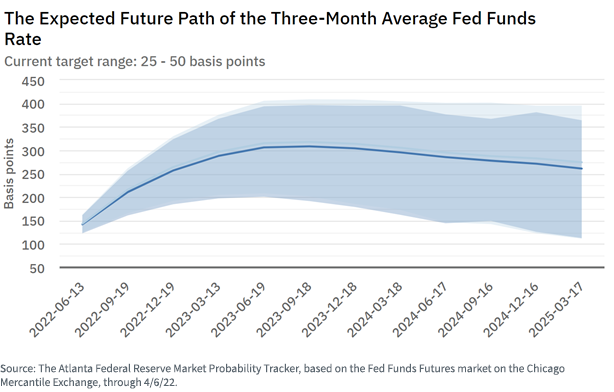

After perhaps waiting too long, the Fed has begun to increase rates, and expectations are that it will become increasingly aggressive as we move through the year. The Fed Funds Futures market is now pricing in a Fed Funds Rate of roughly 2.50% by year-end. That implies expectations for the possibility of more than one 50-basis-point (0.50%) hike over the course of the six remaining FOMC (Federal Open Market Committee) meetings this year.

Summary

When focusing on what we believe are the primary market signals, the “condition our condition is in” is somewhat of a mixed bag, with some large outstanding uncertainties. Economic growth and earnings are expected to be positive, COVID-19 and its variants should move to the rearview mirror, and the “mid-term elections season” in Washington, D.C., often means gridlock in Congress, which is usually positive for equity markets. But inflation and the Russia/Ukraine conflict are significant uncertainties and could dramatically affect global economic and market conditions.

We believe that “fundamentals” will matter again and that we may enjoy another “economic reopening” market regime sometime in 2022, which may favor value, small-cap, quality and dividend-focused stocks. We’ve already witnessed a significant “factor rotation” toward value and dividend stocks, both of which at least partially mitigated the broad market downturn in Q1. We think that trend will continue.

But inflation, interest rates, Fed behavior and the war in Ukraine all weigh on market sentiment. So, while we are modestly optimistic in our outlook for 2022, we believe we are in for increased volatility. We continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.