The WisdomTree Q2 2022 Fixed Income Positioning

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We recently reviewed the fundamental construction and ongoing management of our “strategic building block” fixed income Model Portfolio. As a quick reminder:

1. Investment Objective: Deliver superior risk-adjusted total return and yield relative to its benchmark, the Bloomberg U.S. Aggregate Index (the “Agg”), which broadly tracks the performance of the U.S. investment-grade bond market and is composed of both government and investment-grade corporate bonds (including U.S. Treasuries and the debt of major industries including real estate, industrial companies, financial institutions and utilities).

2. Investment Strategic Framework: Establish defined risk parameters for key fixed income attributes—interest rate risk, credit risk, volatility risk, currency risk—to frame the investment approach in meeting the objective.

3. Investment Approach: The portfolio is actively managed with respect to duration, credit quality and security selection to achieve the desired objective through prudent investment management.

In our March Model Portfolio Investment Committee (MPIC) meeting, we voted to implement a small handful of changes to our fixed income Model Portfolios as we head into the second quarter of 2022. This blog post summarizes those changes and why we made them.

The WisdomTree Economic and Market Outlook for Q2 2022

Before we summarize our recent Model Portfolio changes, let’s put them in the context of our broad market outlook. We recently published our Economic and Market Outlook for Q2 2022. We expressed our opinion that interest rates, with periodic retracements, will move higher as we move through the year, prompted in part by a now-hawkish Fed that, recognizing it is “behind the curve” with respect to inflation, has embarked on what we believe will be an aggressive “rate hike cycle” regime.

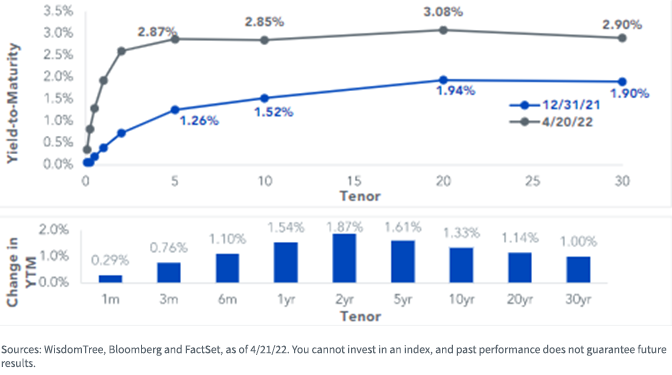

A quick illustration of recent yield curve movement captures this point nicely.

Treasury Yield Curve

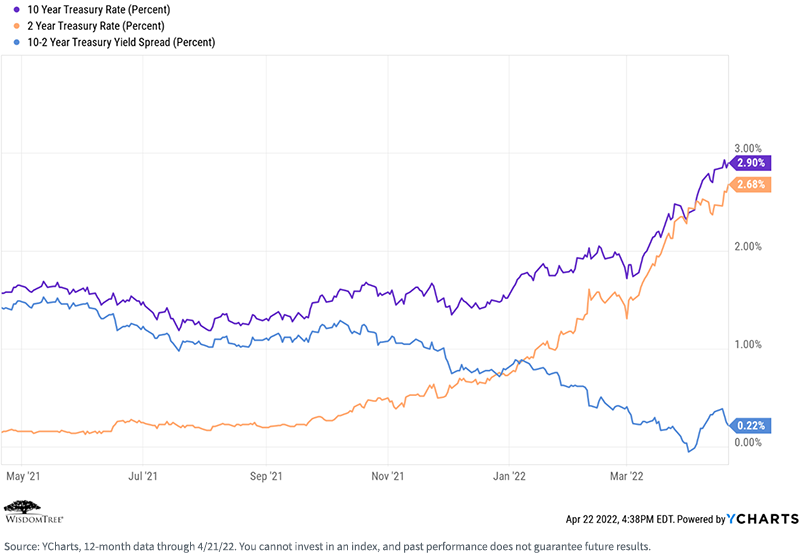

Another way of illustrating recent yield curve movement is by measuring the spread between short-term and long-term rates (i.e., measure the “shape” of the curve, not just its absolute levels). We will use the widely followed “10-Year minus 2-Year” spread. After briefly inverting for one day on March 29 (which always raises market concerns about an impending recession), this spread has since widened. This may be in response to Fed Vice Chair nominee Lael Brainerd’s recent comments about the commencement of reducing the Fed’s balance sheet (i.e., “quantitative tightening”), which may have the effect of pressuring longer-term rates upward.

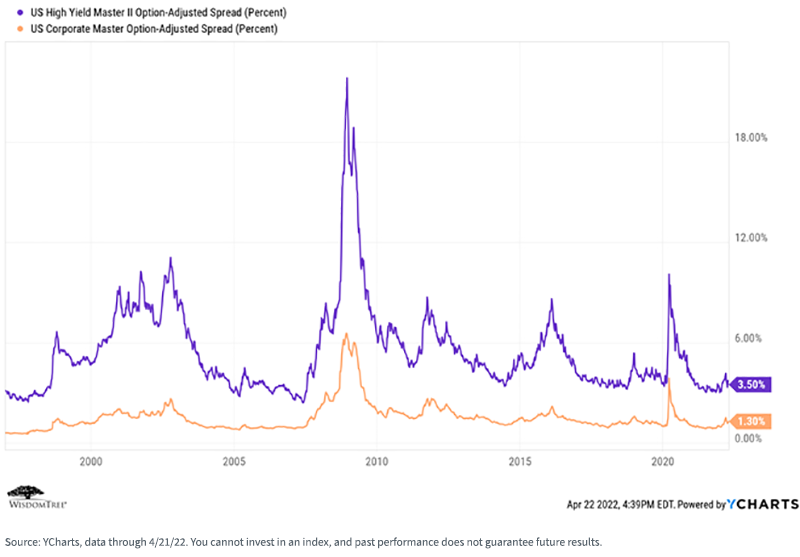

After widening earlier in Q1, credit spreads have since retreated to levels we’ve experienced for most of the past several years, suggesting that investors remain comfortable with the default risk on their fixed income holdings—a view we agree with.

Model Portfolio Positioning

As mentioned above, in our March Model Portfolio Investment Committee (MPIC) meeting, we voted to make a small handful of changes to our fixed income portfolios and allocations.

Specifically, even though our portfolios were already shorter in duration compared to the Agg, we voted to further reduce that duration by reducing our allocations to our core bond strategy and intermediate-maturity Treasuries and using those funds to increase our allocation to our Floating Rate Treasury Fund (USFR), which offers rates that reset weekly based on the three-month Treasury Bill auction rate.

The net result is that we are short duration and over-weight in quality credit relative to the Agg. Typically, as mortgage rates rise, prepayments fall, thereby extending the inherent duration of mortgage-backed securities. We also maintain an under-weight allocation in that space.

Let’s dive a little deeper into why we made these changes in the wake of the bond market rout in the first quarter.

1. History suggests “we have only just begun”: Rates rose into past rate hike regimes. We examined the evolution of Treasury yields and core bond performance in each of the five previous “rate hike regimes” (beginning in 1988,1994, 1999, 2004 and 2015, respectively). In each case, yields on 10-Year Treasuries only peaked after the Federal Reserve had delivered a significant amount of tightening. For example, the 1988 and 1994 cycles each saw the Fed hike rates 175 bps before the 10-Year Treasury yield peaked. The extended 2004 and 2015 cycles saw even more tightening before the Treasury yield plateaued. With only 25 bps of hikes to date, we believe we may still be in the “early innings” of the current ultimate interest rate rise. To us, there does not seem to be any justification for taking excessive duration risk.

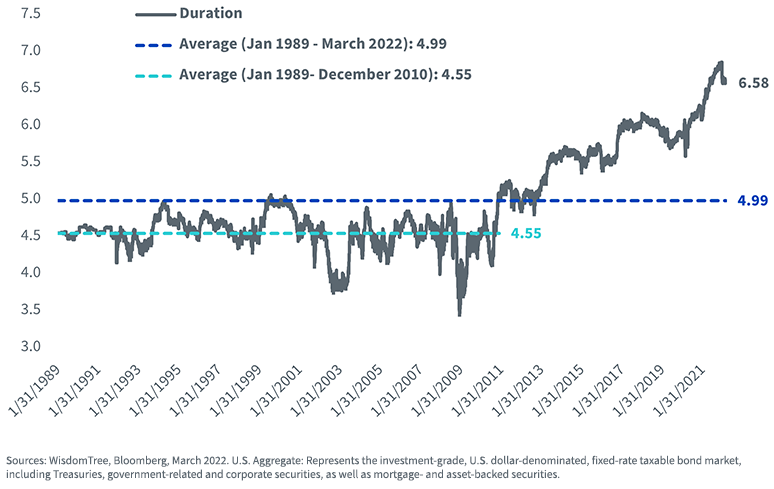

2. Extended interest rate risk within core benchmarks: The potential interest rate risk in the Bloomberg U.S. Aggregate has grown exponentially in recent years. For the formative years of our careers, the duration of the “Agg” generally fluctuated between four and five years, feeding common investor perceptions about core bond risks. Zero interest rate policy changed all that. Since 2013, the Agg’s duration has marched steadily higher. Its current level of 6.58 years ranks in the 97th percentile of durations since 1989 and seems disconnected from our past perception of the core bond risk profile.

U.S. Aggregate Duration Characteristics

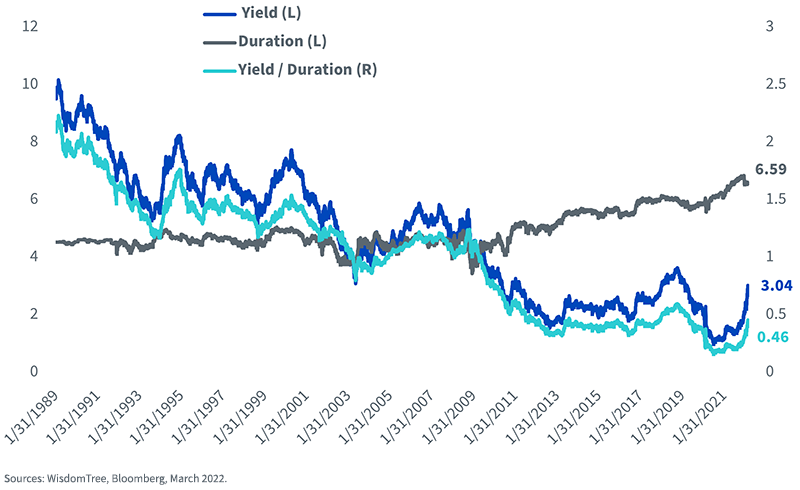

3. More risk, less compensation: Elevated interest rate risk levels are further complicated by the steady fall in compensation or income to offset this risk. Yields have fallen, and durations have risen, triggering a long-term decline in the “unit of return for unit of duration risk” ratio. You simply are not being as compensated for taking duration risk as you used to be.

U.S. Aggregate Yield and Duration Characteristics

The combination of aggressive Fed tightening cycle, heightened interest rate risk and limited coupon protection suggests caution is still warranted.

At the same time, one positive aspect of the recent low interest rate environment is that corporations were able to restructure their balance sheets and issue lower-cost debt. Regardless of economic uncertainty, most corporate balance sheets are in decent shape, and we view the overall default risk as low by historical standards. This is why we remain comfortable being over-weight in quality credit.

Conclusions

We tend to be strategic investors at WisdomTree and build and manage our Model Portfolios to seek to perform consistently and as expected over full market cycles. That said, we will make dynamic changes as market conditions change—something that certainly happened in Q1 2022.

Our fixed income Model Portfolios have performed well and have beaten their benchmark (the Bloomberg Agg) on a total return basis over almost every period since inception in 2013.

With our recent reallocations to further shorten duration and remain over-weight in quality credit, we believe we are well-positioned for the market conditions we expect to see over the remainder of 2022 and beyond.

You can learn more about all our Model Portfolios, including full transparency into allocations, individual securities, fees, yield and performance, at our Model Adoption Center.

We invite you to take a look.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.