The WisdomTree Q2 2022 Asset Class and Risk Factor Review and Outlook

This article may be relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We recently shared with you our Q2 Economic and Market outlook. In this blog post, we share our asset class and risk factor outlook.

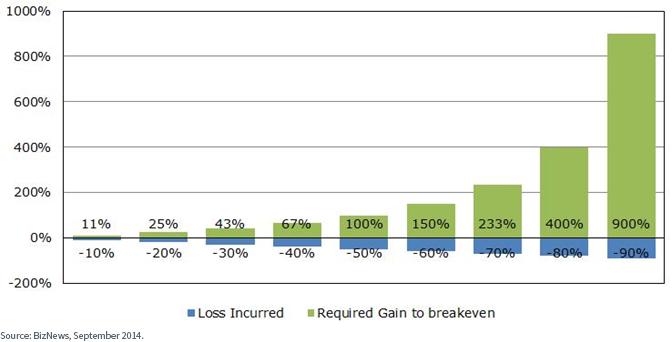

Regular readers of WisdomTree blogs know that we are firm believers in both asset class and risk factor diversification when building our Model Portfolios. We believe this increases the potential for more consistent performance over full market cycles. This goes together with our belief in the power of compounding—if you don’t lose as much in down markets, you don’t have to win as much in up markets to still come out ahead in the long run.

Equity Asset Class Review and Outlook

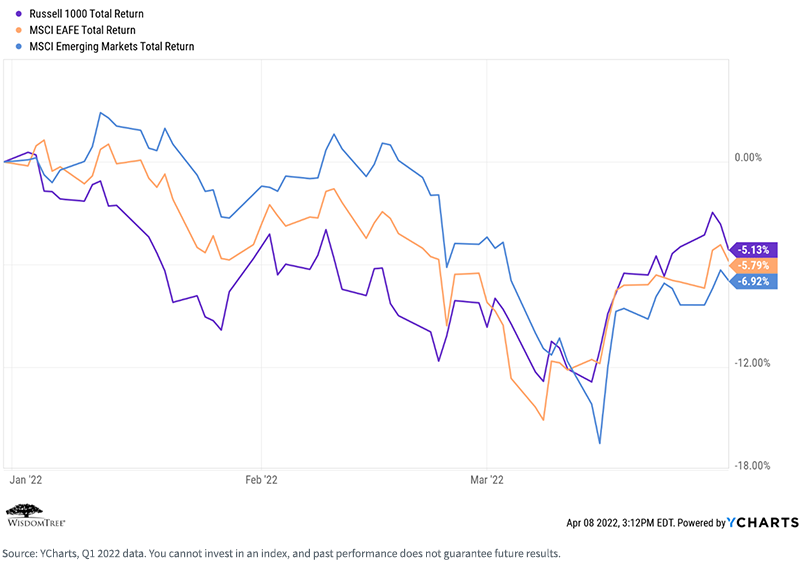

Let’s begin with a quick Q1 review of asset class performances. Geographically, the U.S. outperformed the EAFE and emerging markets (“EM”) regions, at least partially due to a consistent strengthening of the dollar, but with respect to the EM, mostly due to the ongoing economic and market slump in China.

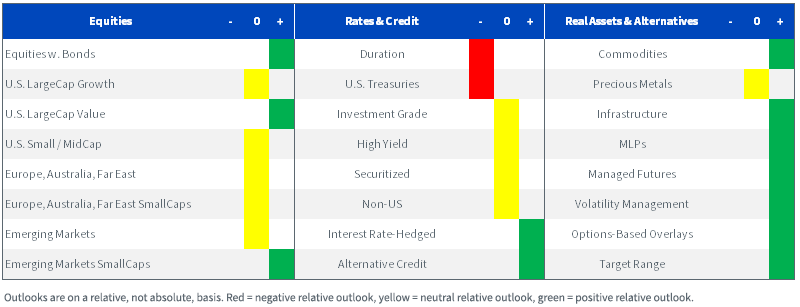

For definitions of the terms in the chart above, please visit the glossary.

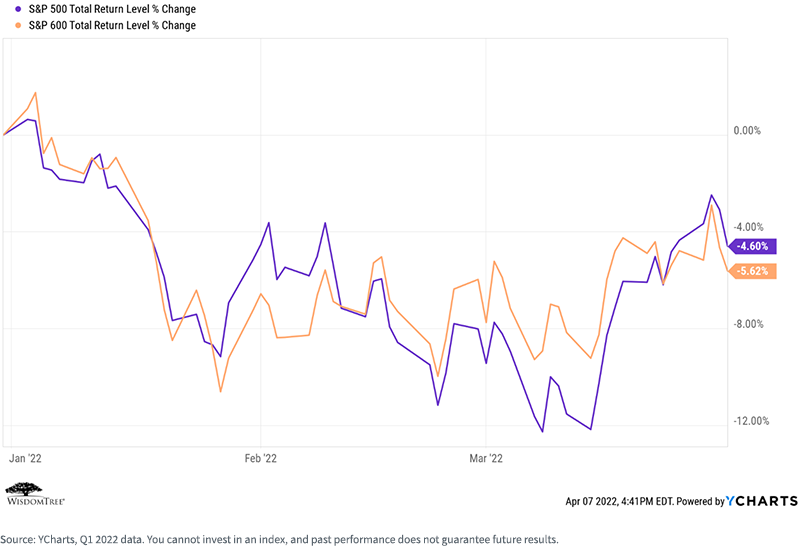

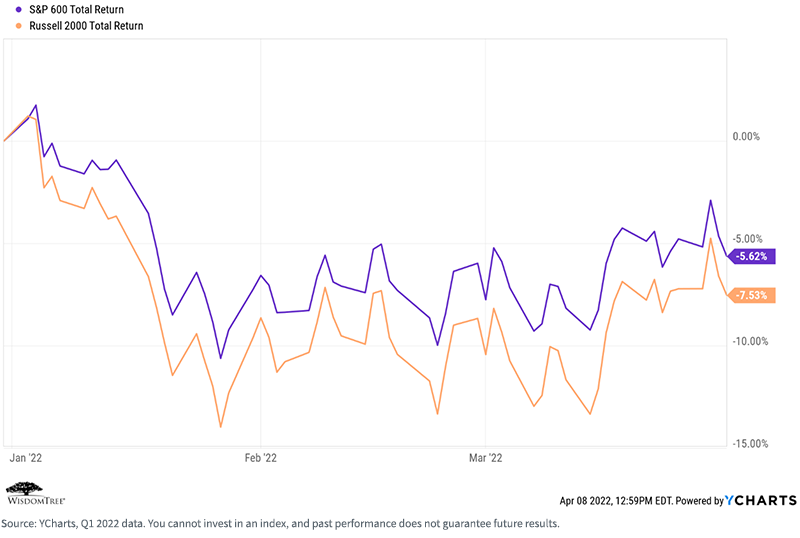

Within the U.S., large caps continued to outperform small caps. We believe this may change as we move through the year.

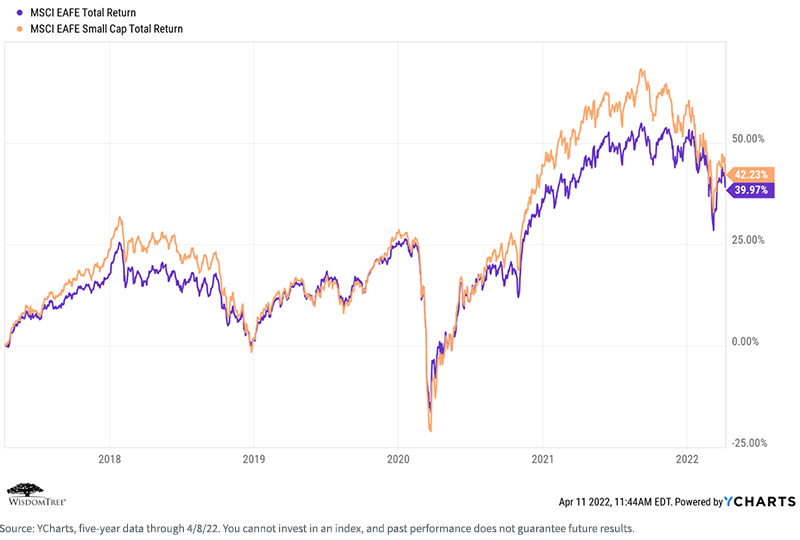

EAFE small caps underperformed EAFE large caps for the quarter, but a longer time horizon “lens” illustrates why we like that asset class as a strategic holding in our Model Portfolios.

For definitions of the terms in the chart above, please visit the glossary.

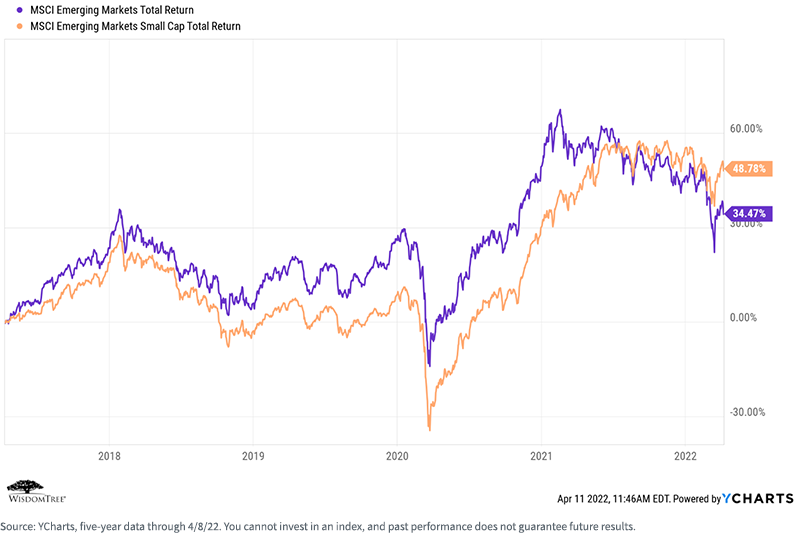

The comparative outperformance of EM small versus large caps is more dramatic—which is why we also maintain a strategic allocation to EM small caps within our Model Portfolios.

Outlook

Heading into this year, we were optimistic on EAFE and EM allocations relative to the U.S. The ongoing economic slump in China, the invasion of Ukraine and the fairly relentless strengthening of the dollar now give us pause; therefore, we remain in line with the MSCI ACWI Index with respect to our geographic allocations. We added to our U.S. small-cap allocation at the beginning of the year, funding it with a reduction to large-cap growth stocks.

On a relative basis, that trade has worked well for us (i.e., large-cap growth stocks fell more than small-cap stocks), but small caps continue to underperform on an absolute basis relative to large caps. We believe that may change over the course of the year because we believe we may see another “economic reopening” cycle at some point in 2022.

Equity Risk Factor Review and Outlook

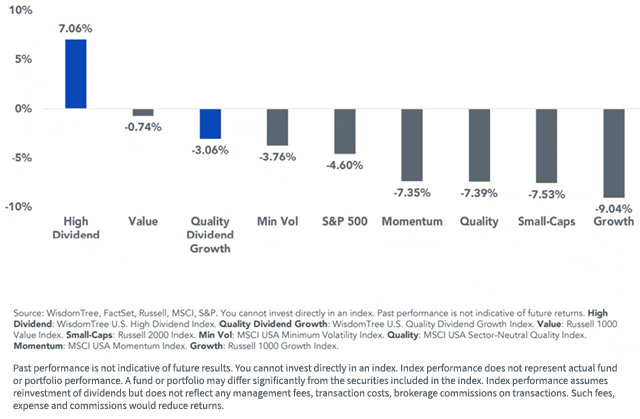

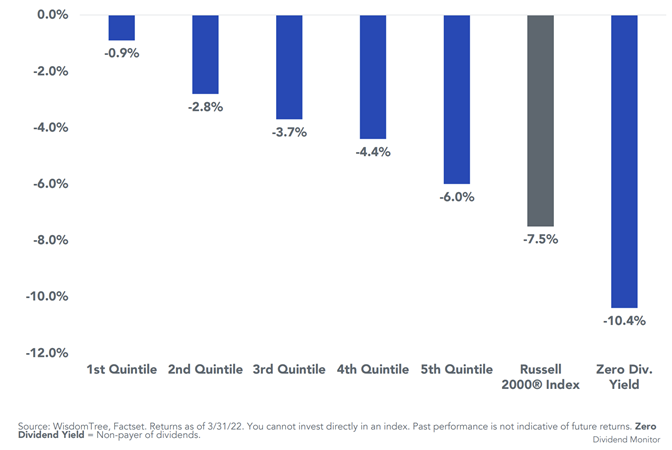

The first quarter saw a dramatic “factor rotation” in the U.S. away from large-cap growth and toward value and dividends. The dispersion between the performance of value and growth stocks is now as wide as it has ever been. Interestingly, because the fixed income market also suffered during the quarter, value and dividend stocks provided the better “hedge” to the equity market downturn.

U.S. Factor Return YTD as of 3/31/2022

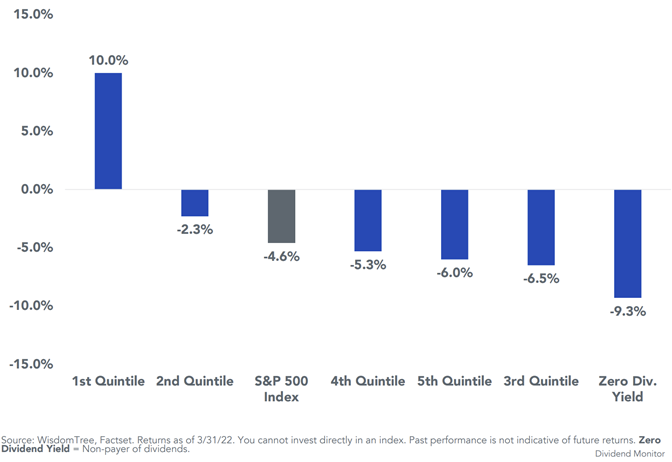

The performance dispersion between high-dividend stocks and non-dividend-paying stocks was dramatic.

Year-to-Date S&P 500 Dividend Yield Quintiles Performance

For the most recent standardized and month-end performance, click on the respective ticker: WTHYE, WTDGI

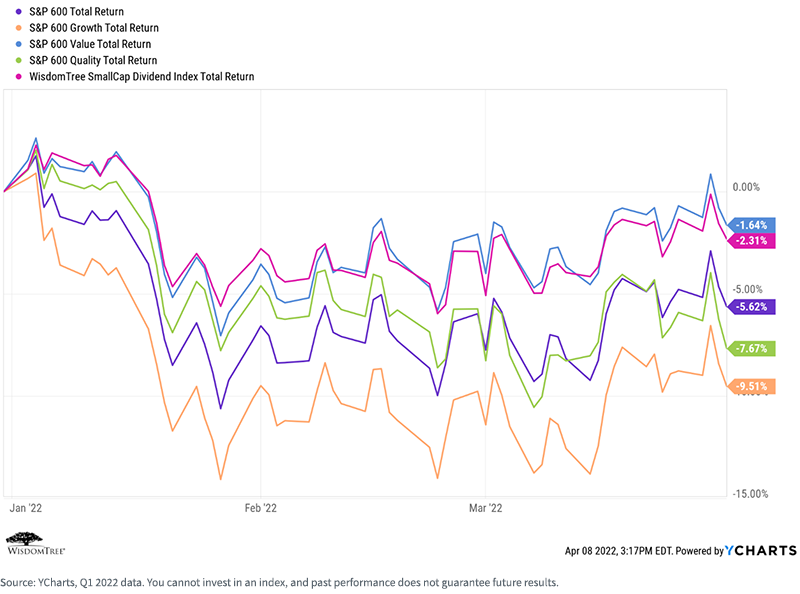

We also witnessed the outperformance of value and dividend stocks in small caps.

The performance dispersion between high-dividend stocks and zero-dividend-paying stocks in small caps was almost as dramatic in large caps.

Year-to-Date Russell 2000 Dividend Yield Quintiles Performance

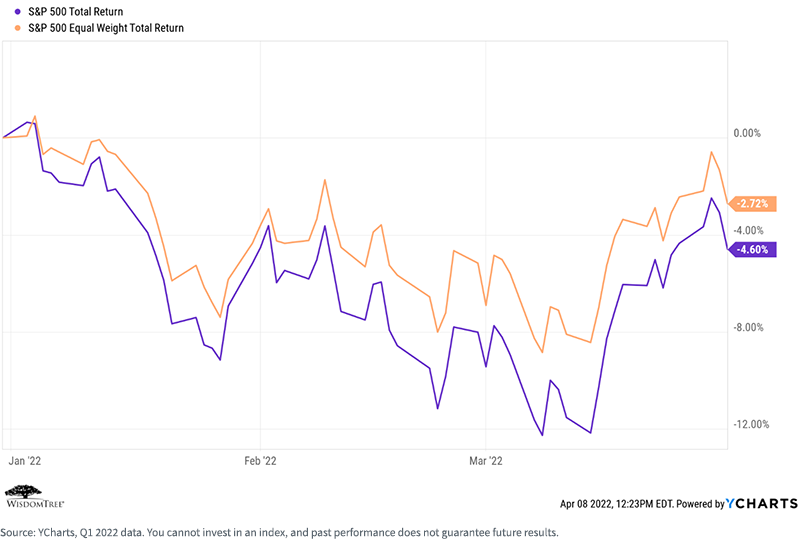

Although large-cap stocks outperformed small-cap stocks at the asset class level, we saw outperformance of smaller-cap stocks within the large-cap Index due primarily to the dramatic decline of large-cap growth stocks over most of the quarter. (We use the S&P 500 Equal Weight Index as a proxy for smaller-cap stocks within the S&P 500 Index.)

Another interesting dispersion between large caps and small caps is the performance of the quality factor. Within small caps, quality shined. (We define quality as firms that have strong earnings, balance sheets and cash flows.) Here, we compare the S&P 600 Index to the Russell 2000 Index—the S&P 600 is considered the higher-quality Index because it eliminates more negative earning companies than the Russell 2000 Index.

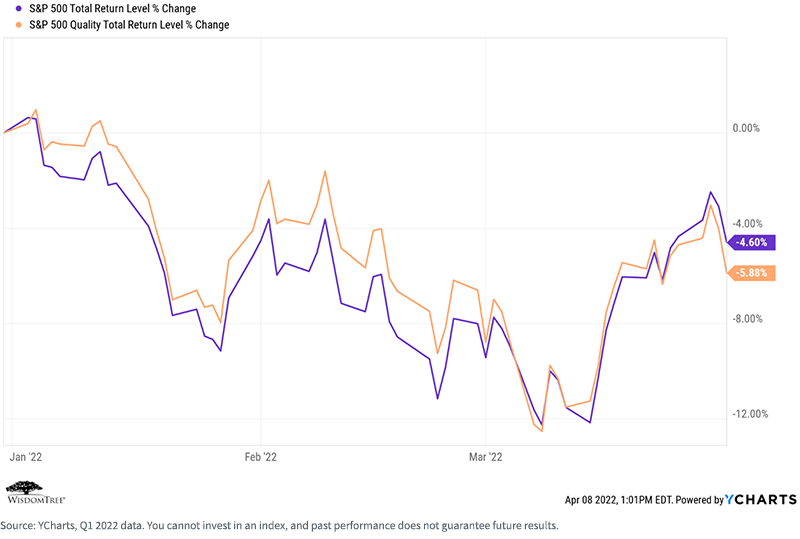

But this quality trade has yet to show up in large-cap stocks. We believe it will as we move through what we believe will be an increasingly volatile 2022.

Outlook

Most of the WisdomTree products and Model Portfolios have inherent factor tilts toward value, dividends and quality. This served us very well in the first quarter, especially the tilts toward value and dividends. We believe this trend will continue as investors increasingly focus on fundamentals and the “sooner rather than later” benefits of sustainable dividends and share buybacks.

We believe both the size and quality factors will become increasingly important as we move through 2022—a year we believe will be marked by increased volatility, rising rates and increasing geopolitical tensions but also by an “economic reopening regime” at some point during the year. This phase of the economic cycle historically benefitted the size, value, dividend and quality risk factors.

Conclusions

2022 has been an interesting year so far. We continue to believe there will be a valuation “tug of war” between generally solid earnings and rising interest rates.

Something we find interesting is that, for the past six months or so, the market “narrative” was that because growth and tech stocks are “longer duration” assets (because their earnings and cash flows are expected further out in the future), they were more highly sensitive to the rise in rates, hence their downturn over much of the quarter.

But growth stocks “caught a bid” in the past few weeks, despite the continued rise in rates, somewhat breaking that narrative. Our hypothesis is that this happened because valuations had fallen sufficiently to reattract investors.

How this “correlation” plays out over the remainder of the year remains to be seen. This is why we are adamant about being both asset class and risk factor diversified in our Model Portfolios—the market is smarter than we are, so we need to "spread our bets."

Our Model Portfolios and most of our products have inherent factor tilts toward dividends, value, quality and size. Given our economic and market outlook for the remainder of this year, we think that is a rather good place to be.

Important Risks Related to this Article

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.