Portfolio Pilates: Building a Strong Core, Part II

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

In the first of this two-part blog “mini-series,” we focused on our Core Equity Model Portfolio. In this one, we focus on our Fixed Income Model Portfolio.

As a reminder, these two Model Portfolios serve as the base for almost every other Model Portfolio we manage, including our Strategic Multi-Asset Model Portfolios, Endowment Model Portfolios, Multi-Asset Income Model Portfolios and Siegel-WisdomTree Longevity Model Portfolio.

As with all WisdomTree Model Portfolios, our Core Equity and Fixed Income Model Portfolios share certain common characteristics, with some differences for the Fixed Income Model Portfolio, given it is a fundamentally different asset class:

1. They are global in nature. WisdomTree is a global asset management firm, and we believe in global diversification.

2. They are ETF-centric, which we believe helps optimize fees and taxes.

3. They are “open architecture” and allocate to both WisdomTree and third-party strategies. This (a) is just the right thing to do for advisors and end clients, (b) allows us the freedom to deploy other firms’ “best ideas” and (c) helps us build both asset class and risk factor diversified portfolios.

4. The factor characteristics (quality, duration, yield, etc.) embedded into most WisdomTree fixed income ETFs allow us to construct “core/satellite” portfolios in a more cost- and tax-effective manner than the traditional approach of using mostly active managers when running a fixed income portfolio. Fixed income mutual funds, in particular, tend to be more expensive and less tax-efficient than ETFs.

5. WisdomTree charges no strategist fee on any of its Model Portfolios—our revenue is generated only by the expense ratios of the WisdomTree products that are included in any given Model Portfolio.

As one of our “strategic building blocks,” our Fixed Income Model Portfolio is used as a stand-alone Model Portfolio and serves as a foundation for our fixed income exposures within multi-asset models. Adjustments to this core are often made to enhance diversification as the targeted asset class mix changes across balanced models, but the Fixed Income Model Portfolio lies at the core of our relative thinking.

The Fixed Income Model Portfolio

Let’s now dive into the Model Portfolio itself. The investment mandate of the overall Model Portfolio is as follows:

1. Investment Objective: Deliver superior risk-adjusted total return and yield to its benchmark, the Bloomberg Aggregate Bond Index (the “Agg”), which broadly tracks the performance of the U.S. investment-grade bond market and is composed of both government and investment-grade corporate bonds (including U.S. Treasuries and the debt of major industries such as real estate, industrial companies, financial institutions and utilities).

2. Investment Strategic Framework: Establish defined risk parameters for key fixed income attributes—interest rate risk, credit risk, volatility risk, currency risk—to frame the investment approach in meeting the objective.

3. Investment Approach: The portfolio is actively managed with respect to duration, credit quality and security selection to achieve the desired objective through prudent investment management.

The portfolio contains eight individual line items of globally diversified fixed income ETFs. It is primarily a U.S.-focused portfolio, with only a small allocation (4%) devoted to emerging market local debt via our own ELD. Of the eight line-item allocations, the Model Portfolio holds six WisdomTree products (84% of the dollar allocation) and two third-party strategies (16% of the dollar allocation).

The “core” of the Model Portfolio is a 35% allocation to our own core-plus bond strategy, AGGY—the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund. This Fund is designed and managed to track the Agg but generate superior risk-controlled yield and total return.

We then surround that core position with individual sector allocations, including mortgages and other securitized credit (via our own MTGP), high yield (via WFHY, our primary high-yield strategy that screens for quality by eliminating negative earners from inclusion in the underlying Index), longer-duration Treasuries that may serve as a hedge to the broader portfolio equity allocations and shorter-duration/floating rate strategies that we use as duration management tools.

The overall Model Portfolio is short duration and slightly over-weight in quality credit relative to the Agg, and we remain comfortable with that positioning.

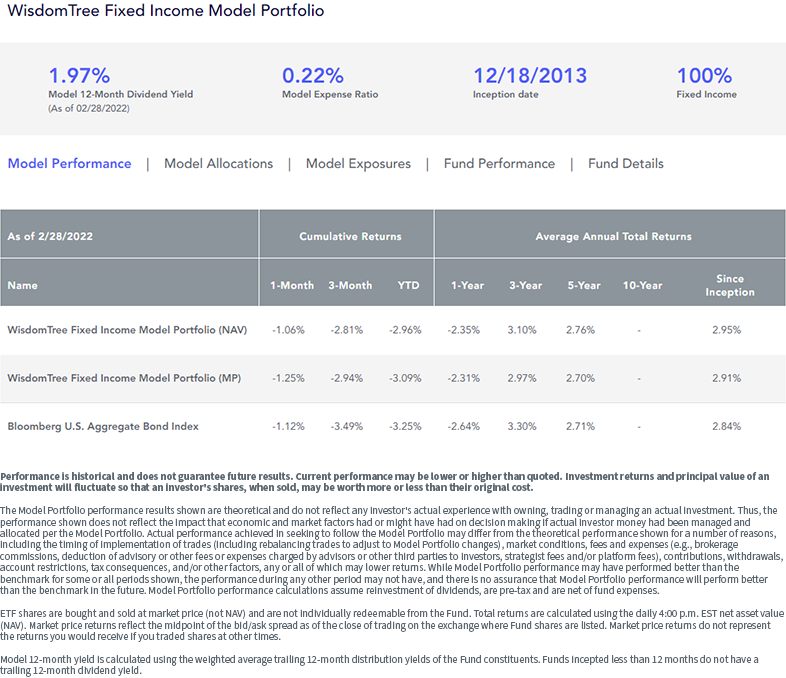

As you see in the performance summary below, depending on whether you look at net asset value (NAV) or market price (MP) returns for a given time frame, the Fixed Income Model Portfolio has outperformed the Agg over almost every period since its inception in 2013—not an easy thing to do in an actively managed fixed income portfolio.

For individual Fund standardized performance, Fund-specific links for yield, most recent month-end performance and a prospectus, please click here.

Three final observations:

1. The current expense ratio for our Fixed Income Model Portfolio is 0.22% (22 basis points), which we believe is attractive for an actively managed global fixed income portfolio.

2. Through February 28, 2022, the underlying funds within the Model Portfolio had an aggregate yield of 2.97% versus 2.33% for the Agg Index.

3. Our active management of this Model Portfolio has allowed us to generally outperform the Agg on both a total return and a yield basis without taking excessive risk relative to that Index. We attribute this to both smart asset allocation and smart security decisions.

Conclusion

The WisdomTree Fixed Income Model Portfolio is a foundational base for almost every other Model Portfolio we manage. It is constructed to deliver better risk-adjusted performance relative to its benchmark, and it has consistently done so since its inception in 2013.

Given our views on the current and future evolution of both interest rates and credit spreads, we are optimistic we can continue this consistent performance well into the future.

Financial advisors can register with WisdomTree to access fully transparent information (performance, fees, yield, allocations, etc.) via our Model Adoption Center.

We hope you take a look.

Important Risks Related to this Article

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses. You cannot invest directly in an index.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.