Risk Factor Diversification—A Look Backward and Forward

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

If you are a regular reader of the WisdomTree blogs, you know how seriously we take factor diversification in the construction of our Model Portfolios. With 2021 now behind us, it is time to revisit this important topic.

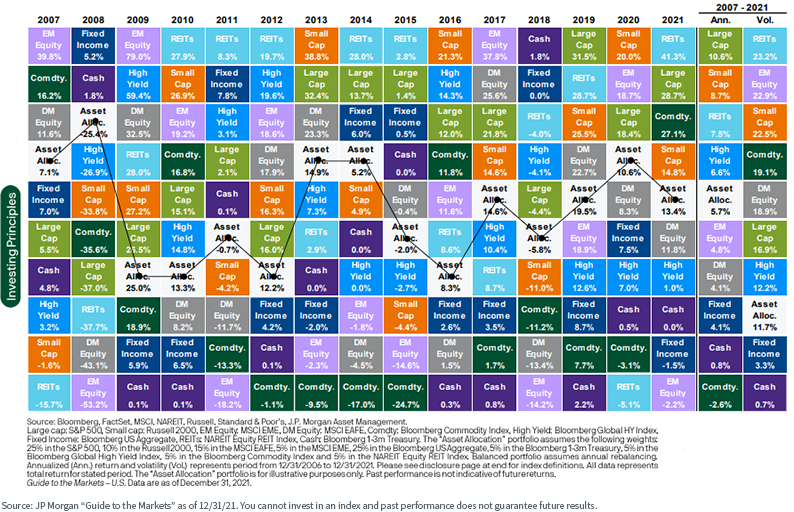

A quick reminder. Almost everyone understands and agrees on the importance of asset allocation—that is, diversifying a portfolio across multiple asset classes to improve its consistency and risk-adjusted performance potential. And many are very familiar with the “asset class quilt chart,” which illustrates just how difficult it can be to predict which asset classes will perform best and how diversifying may offer a more consistent performance, as illustrated in the example of the “Asset Allocation” portfolio below.

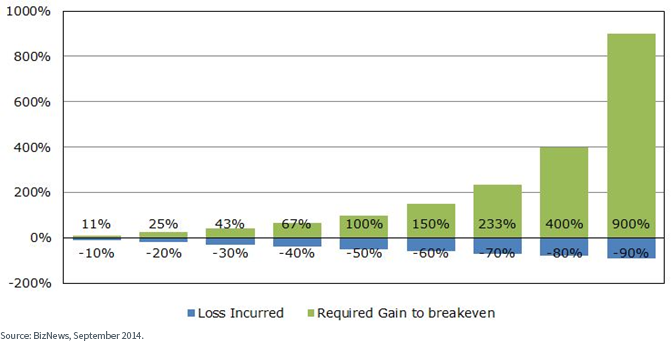

Why does consistency of performance matter? Let’s remind ourselves of the power of compounding—if you don’t lose as much in down markets, you don’t need to gain as much in up markets to still come out ahead.

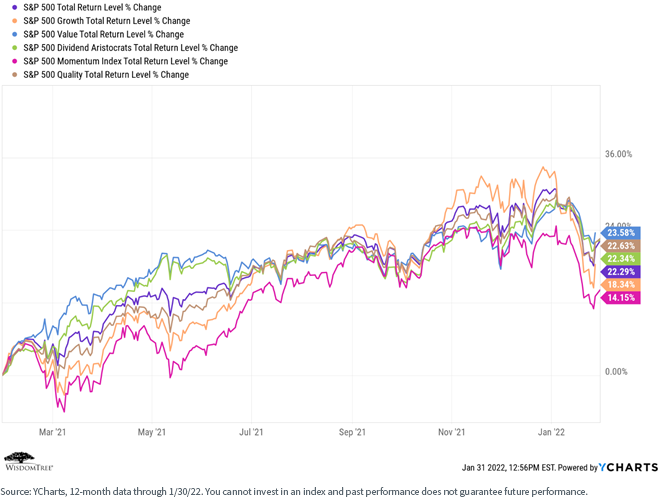

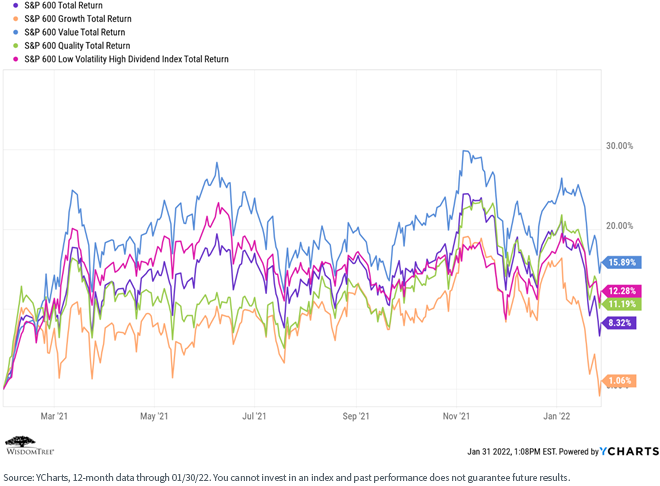

As our friends and readers know, we take diversification one level further and diversify across risk factors as well as across asset classes. Take a look at the performances of multiple risk factors within the S&P 500 Index over the past 12 months and note there is an almost 9.5% return dispersion between them.

For definitions of terms in the chart above please visit the glossary.

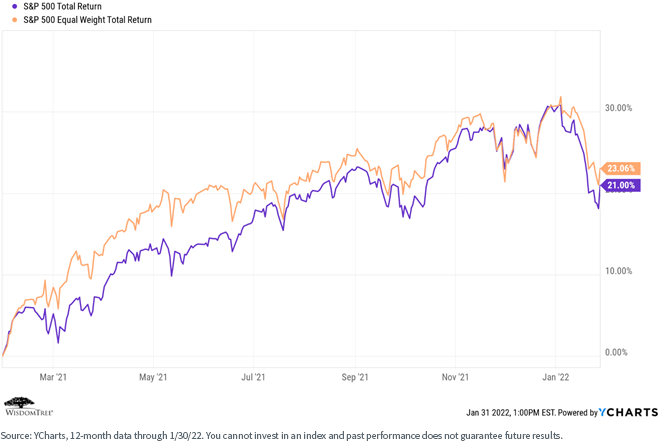

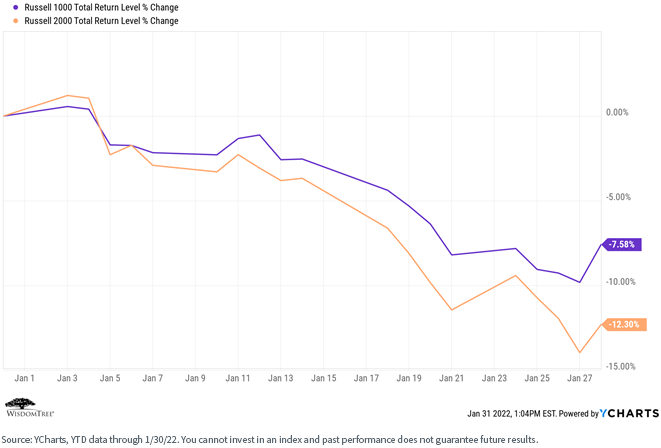

A factor that doesn’t show up in the above chart is the size factor, that is, the performance of small-cap stocks versus large-cap stocks. Using the S&P 500 equal-weighted index – a large cap index – as a proxy (since it gives equal weighting to the stocks in the S&P 500 index that have smaller market capitalizations, versus the strict market capitalization weightings used for the broad index), we can see the outperformance of “smaller-cap” stocks within the S&P 500 – a large cap index – over the course of the past 12 months (despite the fact that those stocks have been punished in the current YTD market downturn, as illustrated in the second chart by the performance of the Russell 1000 – a large cap index – versus the Russell 2000 – a small cap index).

For definitions of terms in the chart above please visit the glossary.

It is worth noting that factor performance is not consistent across asset styles. Compare the factor performances in the above S&P 500 index-based graph to that same graph using S&P 600 (small- and mid-cap) performances.

For definitions of terms in the chart above please visit the glossary.

If you look closely, you will notice that quality is the most consistent factor, with dividends close behind (focus on the turquoise and olive-green lines below, respectively). It is rarely the best but also rarely the worst.

The implication, therefore, is that a factor-diversified portfolio should be anchored on quality and dividends—which is what we do.1,2

As we enter what we believe will be a much more volatile year for the equity markets, and long duration assets feel the pinch of rising rates, higher inflation and increasing investor pessimism, we believe historical fundamentals such as quality, dividends and value will matter again. Our Model Portfolios are positioned accordingly.

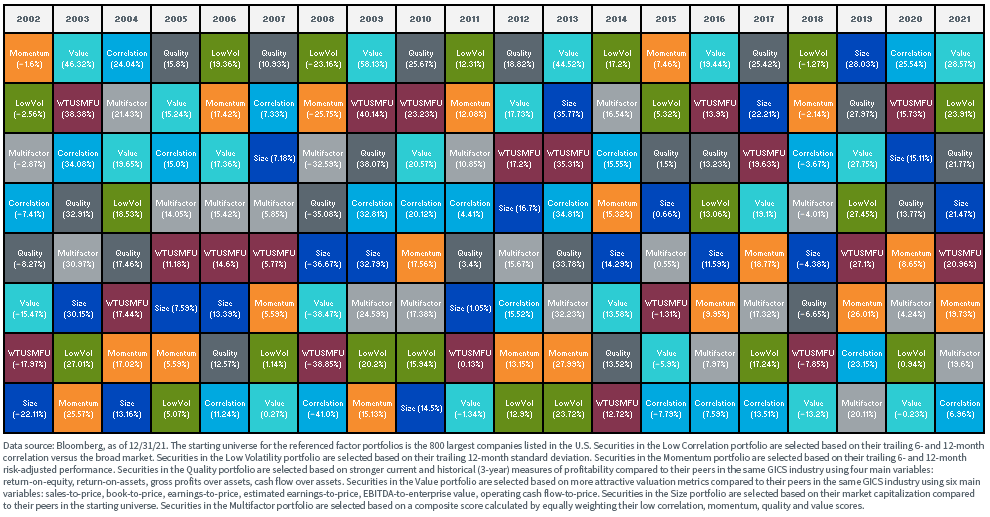

As a final point, it is almost impossible to out-guess the market with respect to which risk factors will outperform, or for how long when they do. We prepare a risk factor performance quilt every month to highlight this point.

Conclusions and Model Portfolio Implications

While each WisdomTree Model Portfolio has a different mandate, they all have certain common characteristics at the asset allocation and portfolio construction levels:

- Global in nature—we are a global shop, and we believe in global diversification

- ETF-centric, to improve the potential for optimizing fees and taxes

- Open architecture—they include both WisdomTree and third-party products, which is not only the right thing to do from the end client perspective, but also ensures that we can access any and all risk factor exposures we want to include in a given Model Portfolio

- The ETF structure and embedded risk factor tilts inherent in the WisdomTree product set allow us to build “core/satellite” Model Portfolios, increasing the potential to deliver both cost and tax efficiency and outperformance versus cap-weighted beta portfolios over full market cycles

- We charge no strategist fee—our revenue is derived solely from the expense ratios associated with the WisdomTree products we choose to include

We believe in diversification and the power of compounding—delivering consistent performance regardless of market regime. We believe that diversifying at both the asset class and risk factor levels optimizes our potential for meeting that objective.

We also believe that our quality, dividend and value tilt positions us well for the market conditions we expect in 2022.

You can learn more about our Model Portfolios at our Model Adoption Center.

1 We define “quality” to mean companies with stronger earnings, cash flow, balance sheets and dividends.

2 For a summary description of investment “risk factors” and the “Fama French Model”, see: https://www.investopedia.com/terms/f/factor-investing.asp.

Important Risks Related to this Article

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.