Powering Your Portfolio with WBAT

We believe battery solutions are the core of our world’s energy transformation.

We believe developments in battery technology represent an emerging megatrend, fueled by massive attention to climate change and rapidly evolving technologies.

Over the last decade, lithium-ion battery costs have declined by 80%,1 driving battery adoption and growth beyond portable electronic (e.g., mobile phones) into larger applications, like electric vehicles and stationary storage solutions.

Within the transportation market, electric vehicles need a portable electricity source, and batteries are the solution. Looking ahead, electric vehicle adoption is likely to be the main catalyst for battery demand. As battery costs continue to fall, we approach cost parity between electric vehicles and internal combustion engines, which marks a significant catalyst for higher battery demand.

Within power production, batteries are becoming a key source of renewable energy. Other renewable sources, like wind and solar, are intermittent, making it difficult to match electricity demand with the instability of natural elements. In contrast, batteries can store excess production and release it at times of higher demand. As a stationary storage solution, batteries can be employed at the utility level or at the consumer level with residential battery storage.

Introducing the WisdomTree Battery Value Chain and Innovation Fund

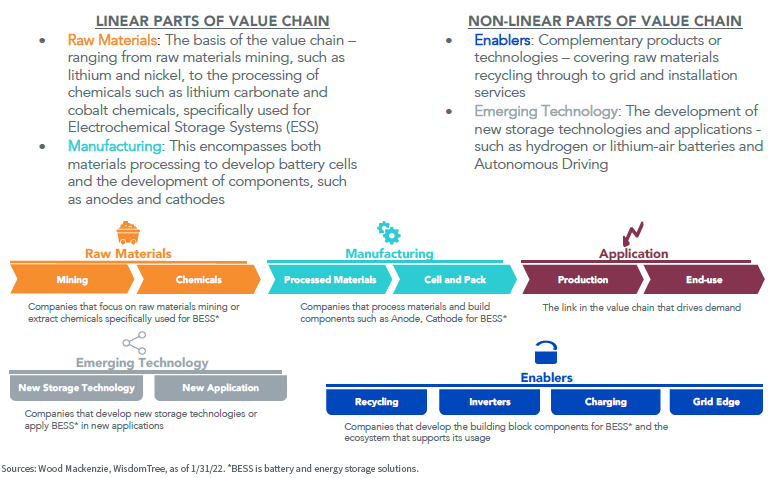

The battery value chain is made up of a myriad of industries across the globe. WisdomTree believes that the multisector utilization of battery components and technologies creates an opportunity for investors to gain diversified exposure to the companies that are enabling the inevitable energy transition.

The mining and chemical industries each provide raw materials to manufacture battery cell components. Cells are then packed for different applications—such as increasingly popular electric vehicles. At the end of life, batteries may be recycled or used for secondary applications, such as electrochemical storage systems.

In addition, a series of industries has evolved symbiotically with this value chain. Charging infrastructure and smart grid software providers can both benefit from, and support, the growth of the electric vehicle industry.

The WisdomTree Battery Value Chain and Innovation Fund (WBAT) aims to provide exposure to companies across the battery value chain:

WBAT seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Battery Chain & Innovation Index, which is comprised of companies primarily involved in battery and energy storage solutions and innovation.

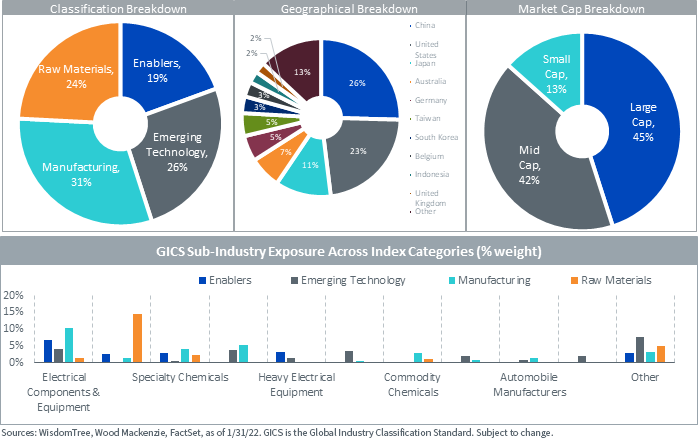

Our process starts with identifying companies that operate across the battery value chain and scoring each one based on its exposure to battery and energy storage solutions and innovation. The methodology is designed to tilt toward companies with higher exposure to competitively positioned segments of the battery value chain. We also use a number of other screening techniques to mitigate the risk of exposure to illiquid or extremely high-risk companies in positions of high weight.

WBAT is both geographically and industrially diverse, and it was designed with the capability to continually evolve with rapidly developing technology.

Powering Your Portfolio with WBAT

Battery solutions are expected to experience enduring growth as technological advancement creates demand from new applications in the coming decades. With WBAT, investors now have access to a financial product that is tilted toward parts of the value chain we view as having the highest future growth potential.

1 WisdomTree, Wood Mackenzie, as of 2/8/22.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in equity securities of exchange-listed companies globally involved in the investment themes of Battery and Energy Storage Solutions (“BESS”) and Innovation. The value chain of BESS companies is divided into four categories: Raw Materials, Manufacturing, Enablers and Emerging Technologies. Innovation companies are those that introduce a new, creative or different technologically enabled product or service in seeking to potentially change an industry landscape, as well as companies that service those innovative technologies. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund may invest in a company that does not currently derive any revenue from innovation or developing technologies, and there is no assurance that a company will derive any revenue from innovation or developing technologies in the future. Battery value chain company stocks have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. Battery value chain companies may be susceptible to fluctuations in the underlying commodities market. Additionally, energy storage solutions companies may be subject to the risks associated with the production, handling and disposal of hazardous components, and litigation arising out of environmental contamination. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.