WisdomTree U.S. Value Fund: High Value Buybacks

Buybacks are a viral topic because they reached near peak levels in 2021. Many argue that these repurchases were done at the market’s peak, implying that companies bought back their own shares at overvalued multiples—an inefficient use of capital that is likely to earn a poor return on investment for their shareholders.

It’s true that buybacks were historically elevated in 2021. And it may be true that some companies could have better allocated capital into less expensive investments, but it’s certainly not true for all.

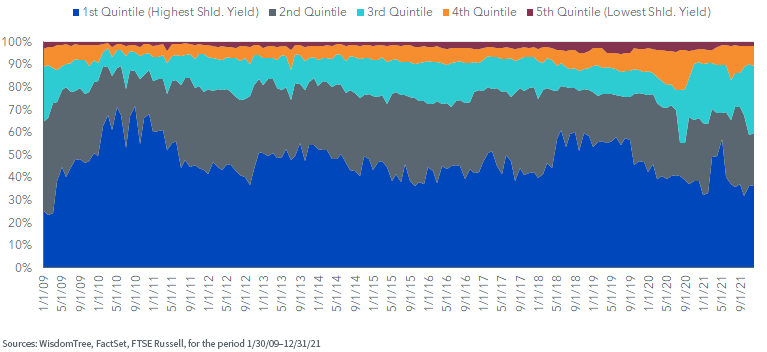

Not all buybacks are created equal. In fact, our analysis of repurchases within the Russell 1000 Index indicates that most net repurchases were executed by companies categorized with the highest shareholder yield—in other words, by companies that are repurchasing shares at more attractive levels relative to their market capitalizations.

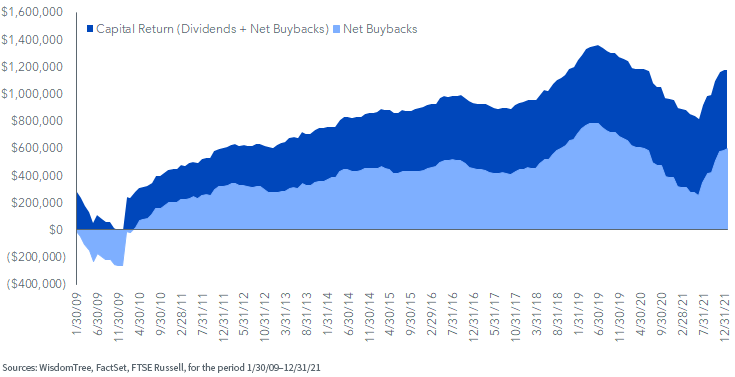

Russell 1000 Index—Trailing 12-Month Net Buybacks ($m)

Russell 1000 Index—% of Net Buybacks by Shareholder Yield Quintile

Ideally, share repurchase programs are opportunistic and antidilutive, meaning that buybacks are done at discounted valuations and result in a significant reduction to the number of shares outstanding. In this scenario, buybacks have the potential to create value for shareholders by increasing their share in a company that, ideally, increases in value over time.

The WisdomTree U.S. Value Fund (WTV) aims to identify companies that fit within these preferred buyback guardrails and that are also exhibiting superior quality metrics.

WTV ranks and selects companies based on a composite score of their shareholder yield and quality metrics. In this dual framework, shareholder yield identifies companies that are repurchasing stock at attractive levels relative to their market capitalization, while the quality component identifies companies with higher relative efficiency, profitability and cash flow.

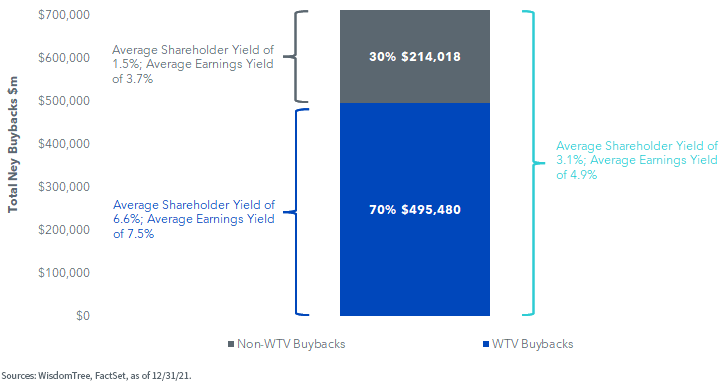

WTV held 146 stocks as of its most recent rebalance, capturing 70% of the buybacks executed by the 800 largest U.S. stocks in the trailing 12 months.

Importantly, the average shareholder (6.6%) and earnings (7.5%) yields of WTV constituents are significantly higher than those of the non-WTV constituents (1.5% and 3.7%). In short, this indicates that the companies in WTV are buying back their shares at more attractive relative valuations than those that do not make the cut into the basket.

The companies in WTV are also meaningfully reducing their share counts. On average, companies in WTV reduced their shares outstanding by 2.8% in the trailing 12 months while the remainder of the 800 large-cap U.S. stock universe increased share counts by 1.1% on average, which dilutes shareholder ownership.

800 Largest U.S. Stocks—Trailing 12-Month Buybacks ($m)

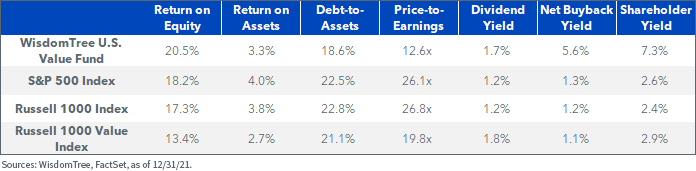

As discussed, quality is an equally important ingredient to the WTV recipe. The strategy targets companies that are generating more profit and cash flow per dollar invested in the business, which is why WTV’s return on equity and assets are at the higher end relative to benchmarks for broad and value-focused U.S. equities.

One valid concern with buybacks is whether they are financed with debt or equity. An added benefit to WTV’s quality screen is that the constituents of the Fund have lower debt-to-asset ratios than the broader benchmarks.

For definitions of terms in the chart above, please visit the glossary.

In the current volatile, rising rate environment we believe WTV companies, with strong balance sheets and profitability metrics, are well positioned for potential outperformance.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WTV was formerly the WisdomTree U.S. Quality Shareholder Yield Fund (QSY).