Red-Hot Inflation Kindles a Flame for Commodities and Gold

U.S. CPI inflation rose 6.2% in October 2021, marking the highest level of inflation since 1990. The print, released on November 10, 2021, outstripped the Bloomberg consensus survey of 5.9%. The fact that the market keeps being surprised by inflation indicates that something is missing from its expectations. We believe that supply-side shocks are both larger and more persistent than the market expects. Tell-tale signs of supply bottlenecks are littered through the details, including elevated energy and auto prices. Even services are showing broad-based price increases, indicating a shortage of labor.

Broad Commodities as an Inflation Hedge1

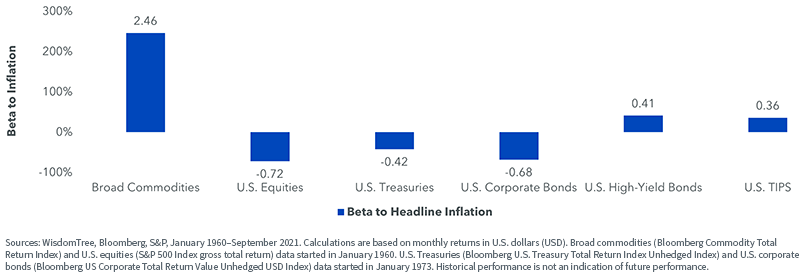

When it comes to assets that can hedge against inflation, commodities have historically stood out as winners. The asset class had the strongest inflation beta of all assets we have analyzed. It beat assets that are supposed to be structurally linked to inflation, such as U.S. Treasury Inflation-Protected Securities (TIPS).

Figure 1: Beta to U.S. Headline Inflation (CPI) of Different Assets

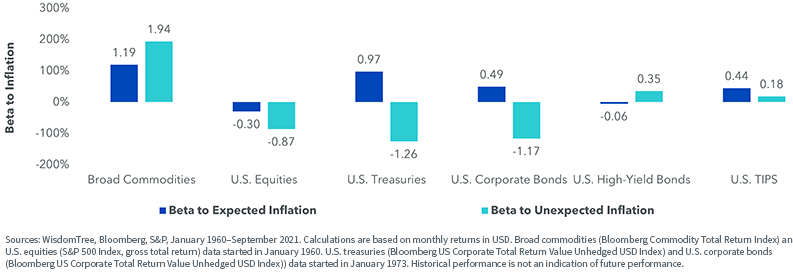

Commodities Have Historically Excelled at Hedging Against Unexpected Inflation

We believe commodities are an attractive hedging tool especially given today’s environment, given the nature of what is driving inflation. Commodities’ beta to unexpected inflation is even stronger than its beta to expected inflation.2 If the drivers of inflation today are unexpected, then based on our research, commodities are the place to turn to.

Figure 2: Beta to Expected and Unexpected Inflation of Main Asset Classes

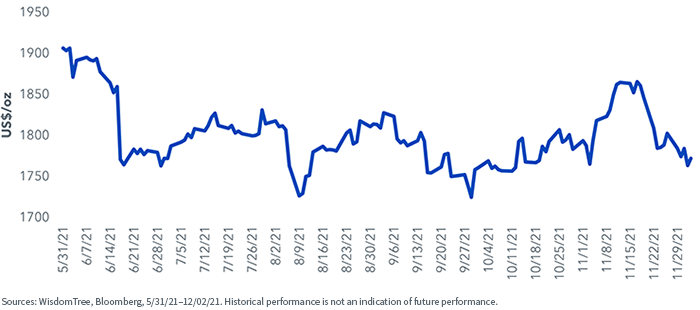

Has Gold Rediscovered its Mojo?

So far this year, gold has disappointed. It has historically been a good hedge for inflation, especially during periods of elevated inflation. Given that we have been in a period of elevated inflation for the past year, this really should have been the time for the metal to shine. Unfortunately, it has not lived up to its reputation, highlighting the fact that there are no guarantees. However, after the U.S. CPI inflation print of 6.2%, gold started to move strongly higher, breaking through US$1,862/oz on 11/11/21 for the first time since 06/14/21. Gold unfortunately did not hold onto those gains, falling to US$1763/oz by 12/02/21 i.e. retracing back to levels last seen at the at the beginning of November 2021.3 Gold has been under pressure from an appreciating US Dollar.4 The next CPI inflation data release will be on 12/10/21. We will have to see if that acts as a catalyst for gold prices when it is released.

Figure 3: Gold Price Hit a 5-Month High After Inflation Print, but Most Gains Have Dissipated

It is yet to be seen whether gold has shaken off its bad mood and returned to its normal behavior. Our models indicate that with this strength of inflation, gold she be trading higher than it’s currently valued. We think the potential strength in the US Dollar and rise in Treasury yields likely to result from the Federal Reserve’s tightening path (both in terms of tapering bond purchases and future signaling of rate increases), gives credence to this indication. We have argued that Q4 2021 is a critical time for gold to prove itself. We certainly hope that the next inflation reading acts as a defibrillator to bring the metal back to life on a more consistent basis.

1 For a detailed analysis of commodities and its relationship with inflation, please see The Case for Investing in Broad Commodities.

2 We use the short-term t-bill rate as a proxy for the market’s inflation expectations and unexpected inflation is measured as the actual CPI rate minus the nominal interest rate at the beginning of each period.

3 Gold was US$1765/oz on 11/03/21.

4 The DXY basket has risen from 93.96 on 11/9/21 to 96.15 on 12/02/21.

Important Risks Related to this Article

Investing involves risk including possible loss of principal.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company WisdomTree Investments, Inc.