In the Eye of the Beholder

Ever since the introduction of the omicron variant into the news stream, the money and bond markets have been vacillating between focusing on the latest headlines on this front and the more typical fundamental factors, such as the Fed, economy, inflation, etc. For now, this dynamic will more than likely remain in place, resulting in heightened market volatility. The most recent macro-related headline grabber was the November jobs report. While the numbers did not live up to expectations, the results still revealed an improving labor market.

Without a doubt, new job creation was softer than expected last month when total nonfarm payrolls rose by ‘only’ 210,000. In pre-pandemic times, a gain of this magnitude would have been characterized as ‘solid,’ but when consensus forecasts are calling for an increase of over 500,000, this result is met with disappointment. However, for all of you statisticians out there, before the seasonal adjustment process was utilized, the actual gain was 778,000.

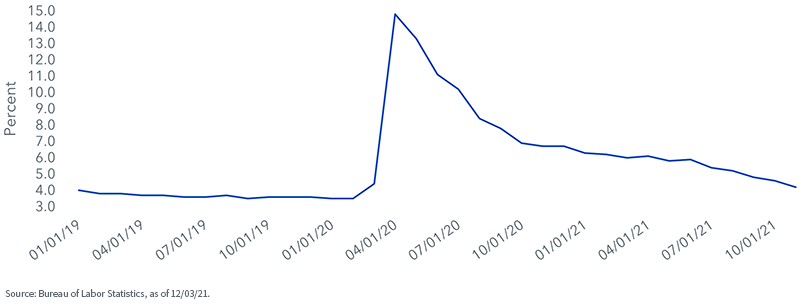

Unemployment Rate

For the record, there are two parts to the employment report: the establishment survey, which includes payrolls, earnings and hours worked, and the household survey, which contains the jobless rate data. This latter survey was, in fact, anything but disappointing. Indeed, the unemployment rate fell 0.4 percentage points to 4.2%, the lowest level since pre-pandemic February 2020. In addition, the alternate civilian employment measure surged by over 1.1 million while the number of unemployed plummeted by 542,000.

Let’s turn to the inflation part of the data, namely wages. Average hourly earnings rose at an annual rate of 4.8%, which was a bit below consensus forecasts. However, this gain tied last month’s tally for the highest non-pandemic reading in this data series going back to 2006.

Conclusion

The big question: did the November jobs data alter the recent narrative that Fed policy is about to become more hawkish? In my opinion, the answer is negative. Chairman Powell & Co. seem to have shifted their focus more toward inflation, at least based on recent public commentary. On that front, the data remains crystal clear: inflation is not going away any time soon. While longer-dated Treasury yields have been falling of late, the money and bond markets are still leaning toward a quicker end to the Fed’s taper program, followed by the potential for two to three rate hikes next year.