Investing in the Future: The WisdomTree Artificial Intelligence and Innovation Fund

When people hear “AI,” their minds frequently jump to the ominous image Hollywood has painted through films like The Terminator and The Matrix—entertaining but not necessarily an accurate portrayal of AI.

Something more realistic and familiar might be the chatbot you encountered when trying to return an order to an online retailer. Or it could be your phone recognizing your face when it unlocks, or maybe your car preemptively applying the brakes when the car in front of you slows down quickly. These are a few real-world examples of areas where AI influences our lives for the better today.

As exciting innovations in AI continue to be made and applied in novel ways, industries will be revolutionized to reach new horizons. Some of the greatest progress we have seen over the last few years has been in areas like drug discovery, autonomous driving and language translation.

What Is AI Today? Software and Semiconductors

Software

One recent area of focus for AI has been drug discovery, which is utilizing AI with the explicit goal of helping an expert researcher achieve a faster solution.

- Natural Language Processing: It is possible for today’s software applications to recognize and process text, creating a searchable database of all relevant research published on a particular topic. In drug discovery, all prior published clinical research could be processed quickly, and important notations flagged for a human researcher, mitigating the risk of wasted attempts going down paths already trodden.

- Generative Design: There could be billions of ways to attempt to arrange different molecules. With AI, the rules of chemistry can be “learned” by an algorithm through observations of molecular data, and arrays of solutions can be suggested within the given parameters set by the researcher.

Drug discovery is not at a point where the software alone can instantly develop new drugs. But it can be used to augment the efforts of human experts, potentially allowing the research phase to conclude faster. Augmenting the capabilities of strong human skills is a big theme within AI.

Semiconductors

The key to semiconductors is understanding their function—data collection, storage, transfer and computation—all necessities for AI. Grasping their ultimate placement and purpose offers additional context for their important role in the AI ecosystem.

- At the Edge: Within AI, the term “edge” means data is collected at a peripheral location, and the AI model can be run without the need to send the data elsewhere. These chips are specialized for their use case in the sense that if a chip is in a drone for navigation, it is constrained to a limited size and weight, as well as power consumption rate, so it can fly without burning through its battery life.

- In the Cloud: OpenAI put out its GPT3 language model—a model with 175 billion parameters. Training models of this size require immense computational resources, most likely within the cloud. The chips here can be manufactured with a single thought in mind: maximum performance.

One must recognize that semiconductors are designed to serve a specific function, and the industry is moving toward more highly customized chips fit for individualized purposes—like how Apple started developing its own semiconductors for its products recently, bypassing the services of Intel.

How Does WisdomTree Capture This Unique Opportunity? Enter WTAI

To offer unique access to the AI investment domain, we introduce the WisdomTree Artificial Intelligence and Innovation Fund (WTAI), the fund that seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Artificial Intelligence & Innovation Index (WAII).

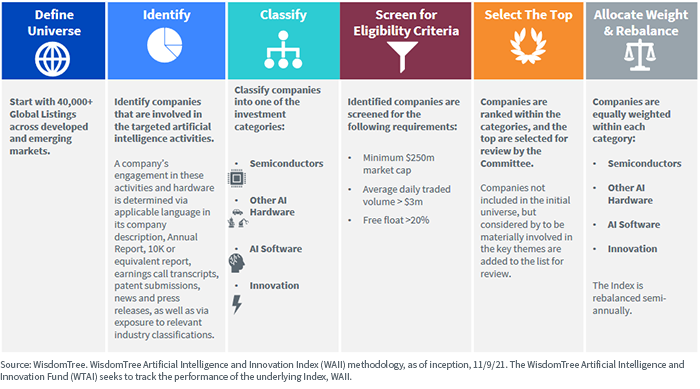

In reviewing the competition, WisdomTree concluded two things:

- Pure rules-based approaches, like screening for the number of patents or revenue based on certain business activities, may be too broad to focus on companies more precisely exposed to AI. It is also difficult to rank these criteria: are more AI patents better than fewer AI patents? It’s hard to say without knowing more about the company or the competitive advantage offered by a specific patent.

- Approaches that loosely define AI and select the obvious players may be too broad for the needs of many investors, or investors may already inherently own the companies through existing exposure to the broad-based benchmarks such as the Nasdaq 100 Index or S&P 500 Index Information Technology Sector.

We created a more flexible and comprehensive approach to the AI investment process, focused on an appropriate mix of quantitative and qualitative research.

By blending technical capabilities such as natural language processing and fundamental analysis with human intervention, the index construction process focuses on the specific functionality that each constituent is contributing to the development and deployment of AI, which provides precise access to this megatrend.

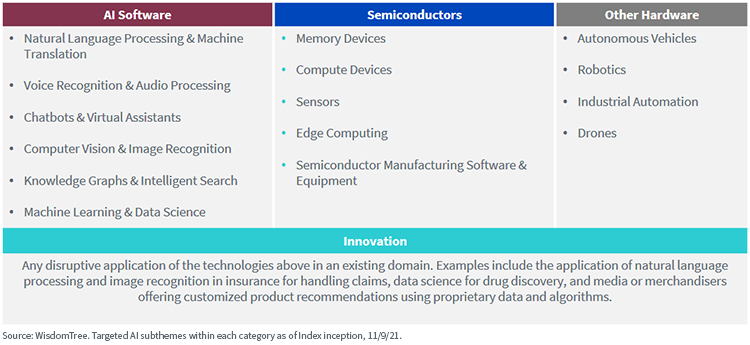

The WisdomTree Artificial Intelligence and Innovation Index identifies companies that are involved in targeted AI subthemes within each of the following categories:

- Software

- Semiconductors

- Other AI Hardware

- Innovation

The constituents identified are then ranked and weighted to determine the final allocation within the Index and rebalanced semi-annually.

The targeted subthemes within each of the four major categories are highlighted below for additional detail into the pinpointed exposures in the Index.

By selecting companies with a direct focus in these areas, WAII seeks to provide a diversified but what we believe to be pure-play AI investment option with robustness not yet seen in the ETF marketplace.

Index Characteristics

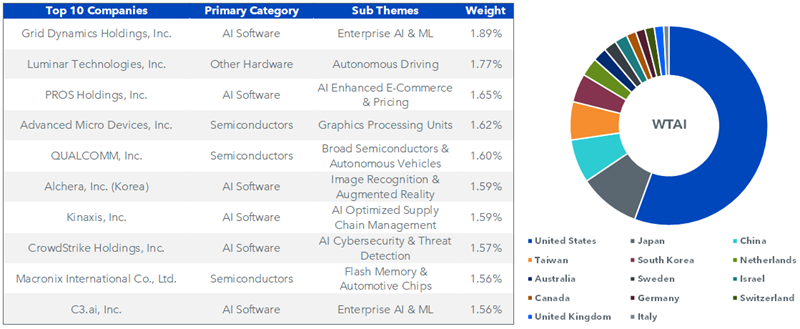

The top holdings, geographic exposures, category and sub industry classifications, market capitalizations and aggregate growth and valuation statistics can be found below.

As of Index inception on November 9, 2021, the Index had 75 companies that ranged in weight from <1% to approximately 2%.

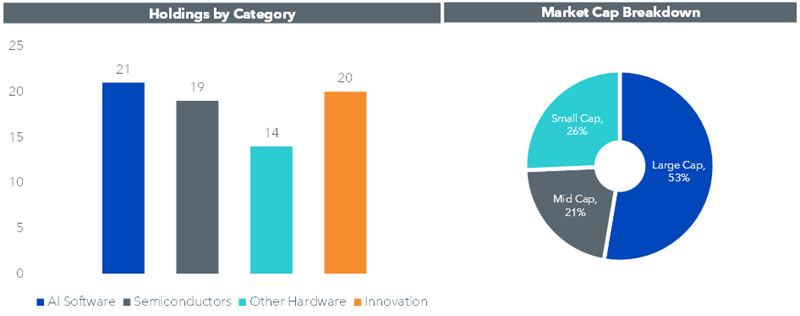

The allocations across the four major categories were the following: 30% AI Software, 30% Semiconductors, 20% Other AI Hardware and 20% Innovation.

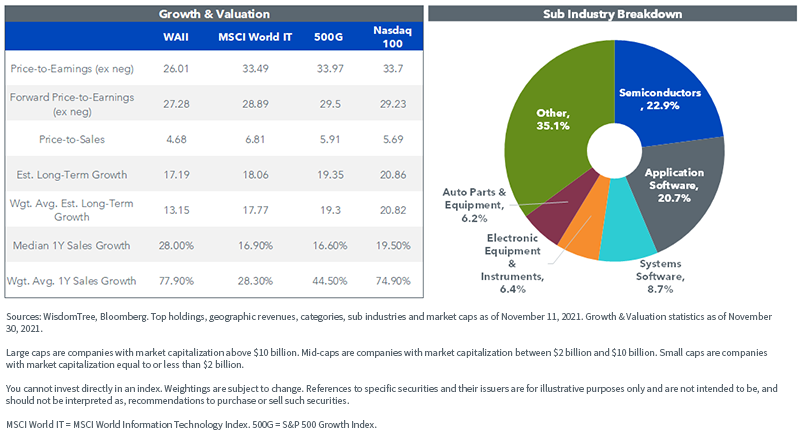

Each constituent is approximately equal weighted within each category, with slight adjustments based on liquidity. The Index has a tilt toward large cap, partially due to the majority of company selections within Semiconductors having sizeable market capitalizations, as the industry is quite consolidated. When breaking things down by GICs Sub Industry Classification, we see broad diversification with the largest weight to Semiconductors and Application Software, accounting for a little more than 40% of the Index.

Geographically, the Index covers the global investment landscape, with approximately 55% allocation to the U.S., 10% to Japan, 7% to each of China and Taiwan, 5% to Korea and the remainder spread out among other developed market countries. The exposure to Asia is largely attributed to the Semiconductors allocation, as many of the top manufacturers are domiciled in this region.

Lastly, on a price-to-sales valuation, WAII offers less expensive growth characteristics compared to the benchmarks, with significant contribution from the AI Software category. Details are shown below and on the Fund page.

For definitions of terms/indexes in the charts, please visit the glossary.

The WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

To offer investors access to key areas of innovation in AI, WisdomTree created WTAI, which seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Artificial Intelligence and Innovation Index. With diversified* exposure to what we believe to be the fastest-growing and most exciting opportunities in the AI value chain, WTAI can be an option within a portfolio’s growth allocation.

*The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. Diversified in this context refers to the fund investing in multiple AI themes.

Important Risks Related to this Article

The Fund invests in companies primarily involved in the investment themes of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Blake Heimann is a Senior Associate on the Quantitative Research & Multi Asset Solutions team at WisdomTree, based in Europe. He initially joined WisdomTree in 2020 as an Analyst on the Research team in the U.S. In his current role, he is responsible for supporting the creation, maintenance, and reconstitution of equity and digital asset indices.

Blake's finance career began in 2017 at TD Ameritrade, where he started as an Analyst before transitioning to a role as a Quantitative Analyst. During this time, he focused on research and development of machine learning applications in finance. Blake holds bachelor's degrees in Mathematics and Economics from Iowa State University, and he has completed his Master's in Computer Science with a specialization in Machine Learning at Georgia Tech.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.