Quality: The All-Weather Factor for Your Equity Portfolio

A little bit more than a year ago, President Biden was elected, and the cyclical recovery rally kicked into gear. Low-quality stocks (lower profitability, higher debt), which had particularly suffered earlier in 2020, benefited the most and outperformed all other parts of the market. However, with the Fed starting to taper, hinting at a more hawkish stand, and with increasing fear of a rebound of the coronavirus this winter, investors may start to be more selective with their investments. Such mid-cycle behaviors tend to favor high-quality stocks (high profitability, low debt). After a period when they took a back seat to their lower-quality counterparts, such stocks may now benefit from their high pricing power and stronger balance sheets to help them face rising costs and compressing margins and outperform.

Market Timing the All-Weather Factor

At WisdomTree, we believe that quality stocks are the cornerstone of an equity portfolio. We have often described quality as the all-weather factor that can help investors build wealth over the long term and withstand the inevitable storms along the way:

- Since quality companies generate high revenues, they have the potential to grow and compound wealth in the future.

- Thanks to their solid business models and financial strength, they generally can withstand unexpected events such as an economic downturn or a pandemic.

Of course, no factor strategy is perfect and outperforms every day and in all market environments. Quality stands out among all factors because its periods of underperformance are relatively easy to identify and because this underperformance tends to remain pretty contained. Most factors can post double-digit underperformance in a short period of time, which has been less the case historically for quality.

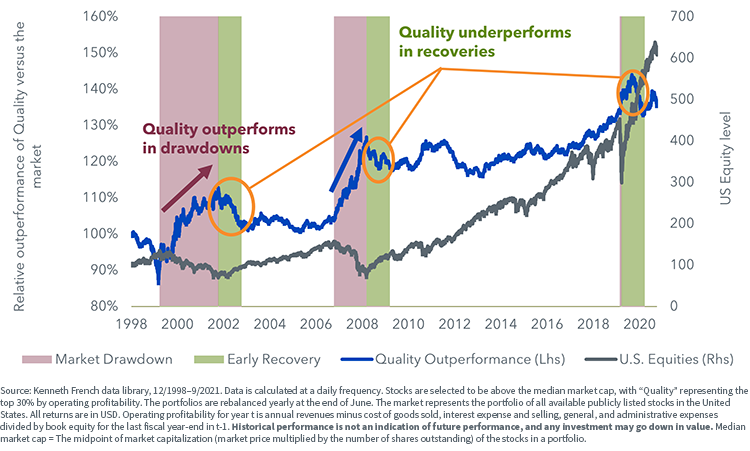

Figure 1 shows the relative performance of the 30% most profitable U.S. equities compared to the full U.S. equity universe. Market drawdowns (in red) are periods of consistent, large outperformance. The relative outperformance line (in blue) increases, highlighting that quality stocks are performing better than the market as a whole. However, during the subsequent market recoveries (in green), low-quality stocks tended to recover faster than high-quality stocks, leading to some underperformance for the quality factor. The blue line goes down, meaning that the market is outperforming quality stocks. Outside of early recoveries and drawdowns, quality also outperforms quite nicely (the blue line creeps up), even if more slowly and usually toward the middle to the end of the business cycle.

Figure 1: Historical Outperformance of Quality vs. U.S. Equities over Time

A statistical analysis of the returns over the same period highlights the same pattern. High-quality stocks outperform:

- 56% of business days during market drawdowns

- 45% of the time in the first 12 months of the recovery (i.e., the 12 months following the bear market low)

When Investors Get Picky, Quality Companies Benefit

“A rising tide lifts all boats” is a famous aphorism that applies very well to the market behavior in the first month of the economic expansion. Following a recession and a market drawdown, fiscal and monetary policy end up pretty loose, and liquidity flows to all corners of the economy. This pushes the prices of all companies up, in particular those of the companies that suffered the most in the crisis. This phenomenon usually leads to a low-quality rally at the beginning of the expansion cycle. However, at some point, central banks turn hawkish, liquidity dries up, volatility starts to reappear and investors start to get pickier when it comes to their investment. Investors start to look for solid companies with solid earnings and safe business models. High-quality stocks tend to benefit and see their price rise with increased demand at that point of the cycle.

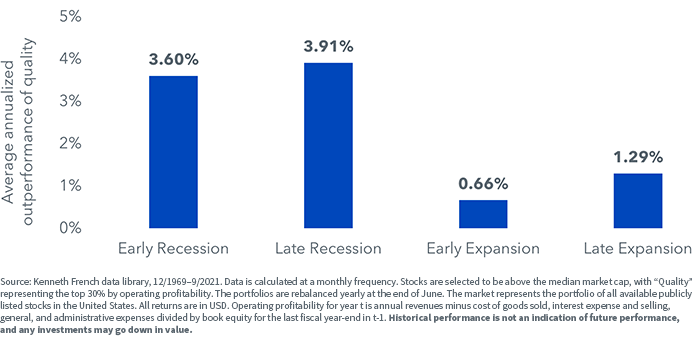

Figure 2 exhibits the average annualized outperformance of high-quality stocks (defined as the top 30% by operating profitability in the U.S. equity universe) versus the market over four distinct parts of the cycle. The National Bureau of Economic Research defines recession and expansion periods. Then each of those periods is split into two halves of equal duration. Clearly, the quality factor’s outperformance is the largest during recessions. However, its outperformance in late expansion is also very strong—significantly better than in early expansion.

Figure 2: Quality Outperformance over the Business Cycle vs. U.S. Equities

The latest two years fit that pattern to a T. Quality performed very strongly at the end of the previous cycle, i.e., in 2019 and in the early part of the COVID-19 crisis in early 2020. Since the election of President Biden and the rollout of the vaccine, the low-quality rally has kicked into gear, and high-quality stocks have taken a bit of a back seat to the rest of the market. However, as we approach the first anniversary of the Biden presidency, and with the Fed starting to taper and hinting at a more hawkish stand, it appears that the early recovery phase may be ending, especially in the U.S.

Important Risks and Information Related to this Article

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company WisdomTree Investments, Inc.