Combining the Innovative Siegel-WisdomTree Longevity Model with Managed Futures

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Today’s market environment presents a strong case for an asset allocation approach beyond the traditional 60/40 allocation.

While interest rates are on the rise recently, they are still at historic lows, forcing investors to lean on equities for yield.

We believe the Siegel-WisdomTree Longevity Model, currently with a 72% allocation to predominantly high-dividend equity ETFs, is in an excellent position to take advantage of today’s market environment.

In an inflationary regime, there is a strong case for incorporating alternative asset classes such as commodities to hedge against rising prices. The Siegel-WisdomTree Longevity Model currently includes a 3% allocation to the WisdomTree Enhanced Commodity Strategy Fund (GCC), which provides long-only exposure to a wide variety of commodities. Gold has been a relatively poor inflation hedge this year—this month, we replaced our 3% allocation in a gold ETF with our WisdomTree Managed Futures Strategy Fund (WTMF). There are several reasons why we believe managed futures is an excellent complement to GCC in our alternative basket.

The Case for Managed Futures in the Siegel-WisdomTree Longevity Model

Earlier this year we made significant changes to our managed futures product, aiming to boost risk-adjusted returns. WTMF now provides exposure to a variety of asset classes including commodities, currencies, rates and equities through futures contracts.

A benefit of the wide exposure to various risk factors is reduced beta and correlation to equity markets. Another key feature of a managed futures strategy is the ability to systematically take long or short positions, with the goal of taking advantage of prolonged market trends.

For example, historically, when commodities have trended upward, managed futures have tended to go long commodities. Similarly, when commodities have experienced a sustained pullback, managed futures have historically tended to start taking short positions in commodities. This complements GCC well in instances when commodities may be on the downswing. More broadly, the dynamic long/short nature of WTMF allows it to seek to take advantage of both inflationary and deflationary regimes.

Observing the below graph, we can see why there is a strong case for incorporating WTMF as a volatility dampener. Since being restructured, WTMF has outperformed gold while exhibiting significantly less volatility.

Growth of $100 Since WTMF Restructure

Please click each Funds’ respective tickers for standardized performance data for the most recent quarter- and month-end data: GCC, WTMF.

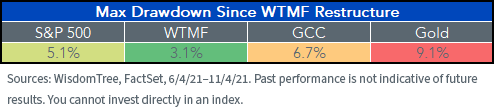

Although it has only been a brief period since the WTMF restructure, we can see various instances when both GCC and gold have pulled back while WTMF has remained relatively stable. We observe that WTMF has had the lowest maximum drawdown following the restructure, which aligns with our view that one of the main purposes of alternatives should be to enhance the risk-adjusted return of a portfolio.

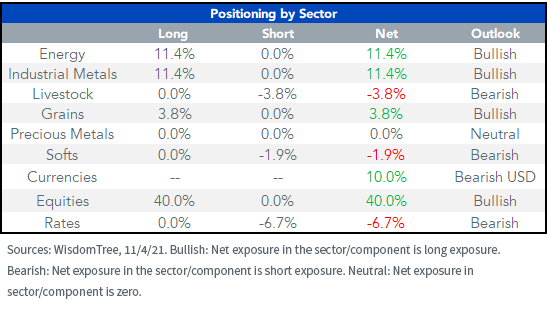

Following its recent rebalance, we can see that WTMF has systematically positioned itself to resemble an inflation hedge.

Not surprisingly, given this year’s trends, WTMF has taken a significant long position in commodities, which complements our position in GCC. Since the restructure, WTMF has a correlation of approximately 0.8 with GCC, which is another indication that WTMF and GCC are working together to harvest the uptrend in commodities. WTMF is currently short rates contracts for November and has also taken advantage of equity returns this year.

Conclusions

Given the current market, we believe WTMF is an excellent complement to GCC in our Longevity Model’s alternative allocation.

This year we’ve seen that WTMF has exhibited significantly less volatility and downside risk than gold, while providing superior returns. The ability for WTMF to go long or short various asset classes may also help provide protection should a particular asset class enter a downturn.

Overall, we believe the Siegel-WisdomTree Longevity Model Portfolio is in an excellent position to take advantage of the current market environment.

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advis0r and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on, for tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client, and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses, or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree's Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.

GCC: There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor's entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover.

WTMF: There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long only (or short only) positions in commodities or currencies. The Fund could lose significant value during periods when long only indexes rise (or short only) indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw” the Fund may suffer significant losses. The Fund is actively managed thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Matt Aydemir began his career at WisdomTree as a Research Analyst in January 2020. He is responsible for quantitative research on WisdomTree’s products, as well as the maintenance and reconstitution of WisdomTree’s indexes. Prior to joining WisdomTree full-time, Matt worked in the research team as an intern, where he developed tools for portfolio analytics. Matt received his Master’s in Financial Engineering degree from Columbia University in 2020, and his Bachelor’s in Chemical Engineering degree from the University of Waterloo in 2016.