Yen Weakness Looms Large in '22

Pluto is a planet. That was a fact as sure as night followed day when I was learning about the solar system in the 1980s. But information changed. Evidence changed. In 2006, the International Astronomical Union declared that our little friend across the Milky Way is in fact just a “dwarf planet.”

The textbooks had it wrong.

I think finance textbooks also goof up with the drivers of currency moves. The books say that if one country catches an inflation shock while another does not, the currency of the former should weaken.

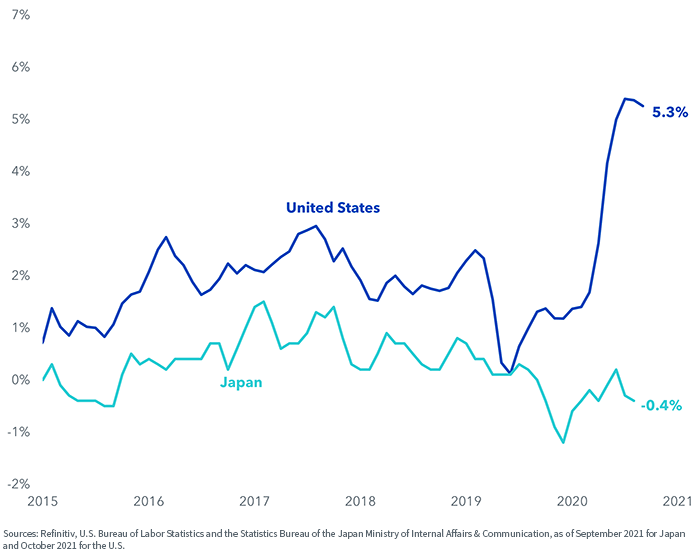

Yet with U.S. Consumer Price Inflation (CPI) rising 6.2% in the year through October—more, notably, than the 0.2% rise in Japan’s inflation rate (figure 1)—the market has chosen to respond with dollar strength relative to the Japanese yen.

Figure 1: Year-over-Year (YoY) Consumer Price Inflation

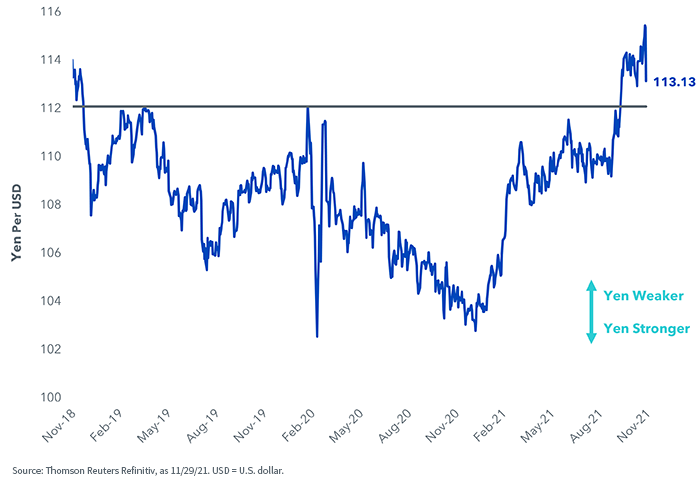

There are several explanations for the greenback’s advance relative to the yen (figure 2).

Figure 2: Japanese Yen per Dollar

For one, if you asked almost anyone a year ago which country—the U.S. or Japan—was more likely to have a big inflation surprise, I suspect most of us would have picked the former.

Additionally, it’s not like the November 10 release of the October U.S. CPI data was some new revelation; inflation has been on many minds for months. The most recent report was the sixth in a row to witness year-over-year inflation above 5%.

The dollar is rallying against the yen because the market is getting in front of a scenario that has the Fed tightening monetary policy more than Chair Jay Powell is insinuating.

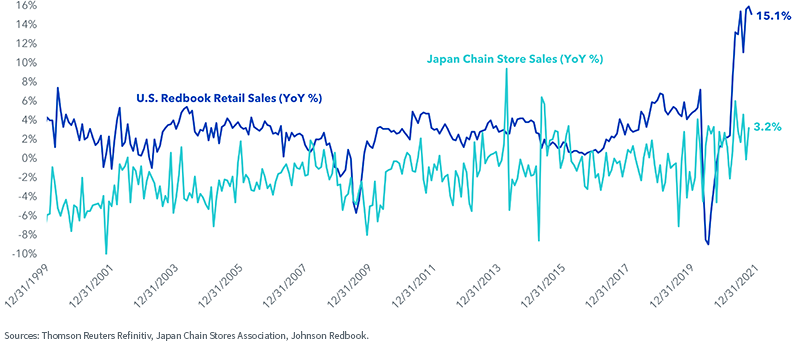

Particularly noteworthy is the stark contrast between consumers’ spending impulse in the U.S. versus in Japan.

The Johnson Redbook gauge of U.S. chain store retail sales jumped 15.1% from this time last October (figure 3), corroborating our view that a big U.S. holiday shopping season looms. That sets up a non-zero probability that Powell will sweat an overheating economy in 2022, or at least one where inflation is smoldering to such an extent that investors are fielding rate hikes with some frequency.

Figure 3: YoY Change, Chain Store Sales

Now think about the calculus of Haruhiko Kuroda, head of the Bank of Japan (BoJ). Inflation is nowhere near hot on the streets of Tokyo; the consumer is lethargic. A 2022 rate hike by the BoJ is about as likely as you and me going to the astronomers and successfully lobbying to get the Pluto decision overturned.

The yen isn’t sitting around and waiting for U.S. monetary authorities to surprise the market with something more than just one or two rate hikes next year. It is weakening right now, busting up through the ¥112 level a few weeks ago and is currently trading around ¥115. Maybe the yen is telling us the Fed may be forced to do something like a hike at every meeting, or every other meeting. Maybe it’s even something more benign—a quicker end to the Fed’s $120 billion per month bond purchase program that is currently running at “only” $105 billion.

For more on Japan, take a look at this piece from October. If you anticipate the yen chart will keep running higher as Japan’s currency weakens, our two ETFs that hedge it are the WisdomTree Japan Hedged Equity Fund (DXJ) and the WisdomTree Japan Hedged SmallCap Equity Fund (DXJS).

Important Risks Related to this Article

DXJ: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DXJS: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DFJ: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on smaller companies or certain sectors increase their vulnerability to any single economic or regulatory development. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.