Why Quality for the Long Run

High-quality companies—companies with strong profitability metrics, low debt and low variability in earnings—represent one of the better opportunities in the market today.

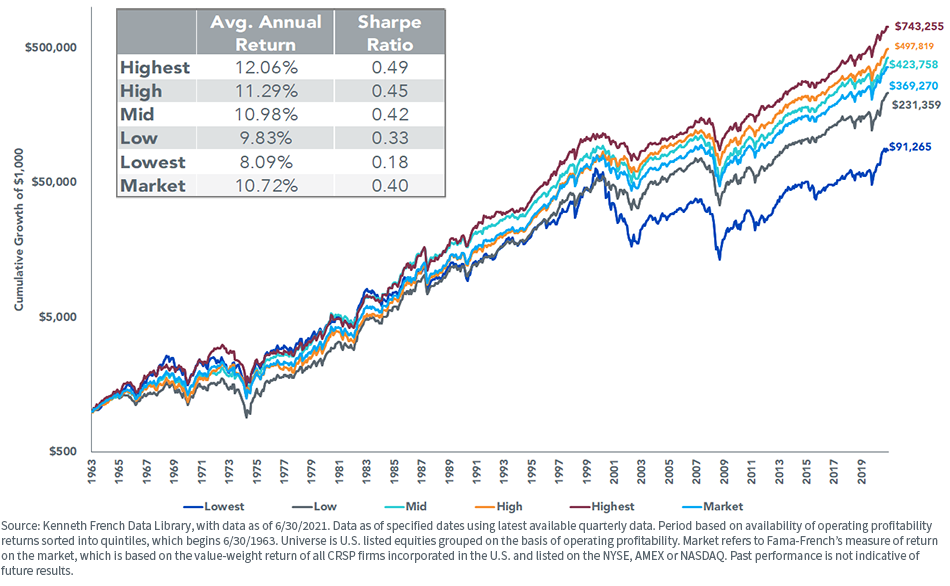

Academic research shows that a very simple sort of the market by a profitability metric known as return on equity (ROE) has delivered strong long-term returns. The return spread between the highest and lowest ROE companies has been approximately 4% a year going back almost 60 years.

Looking over more recent history, we see over the last 15 years that high-ROE stocks have even expanded their lead over low and negative ROE stocks. But over the last year, there has been a large “junk rally” taking place, with the market propelled by firms with negative ROE or the lowest ROE.

WisdomTree believes fundamentals are going to start to matter again as we get later into the bull market cycle and have a return to the longer-term trends of profitability and ROE driving performance.

WisdomTree launched a family of quality Indexes in 2013 that shifts the weight to high-ROE stocks—as well as stocks with low leverage and positive expected earnings growth trends. It manages valuations of this basket by incorporating a rebalancing process back to dividends and the underlying cash flows once a year.

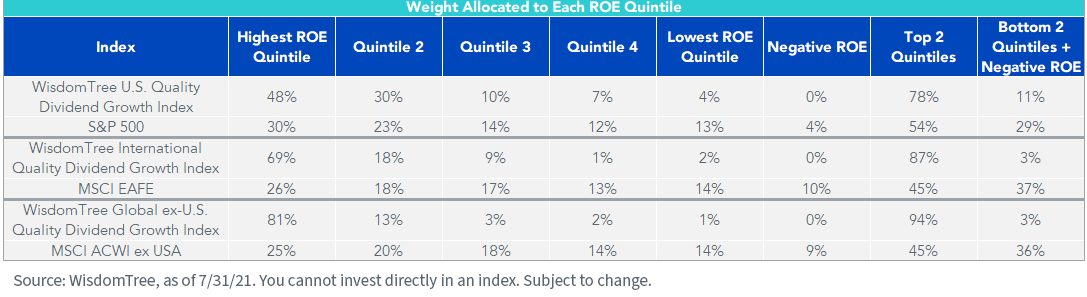

The following table shows the weight to the various ROE quintiles across the U.S., developed international and global ex-U.S. quality Indexes.

While the U.S. market sees more than 75% of its weight in the two highest ROE quintiles—a full 24 points higher than the S&P 500—the international versions of the strategy see 87% and 94% of their weight allocated to the top two quintiles, essentially doubling the weight of the international MSCI benchmarks.

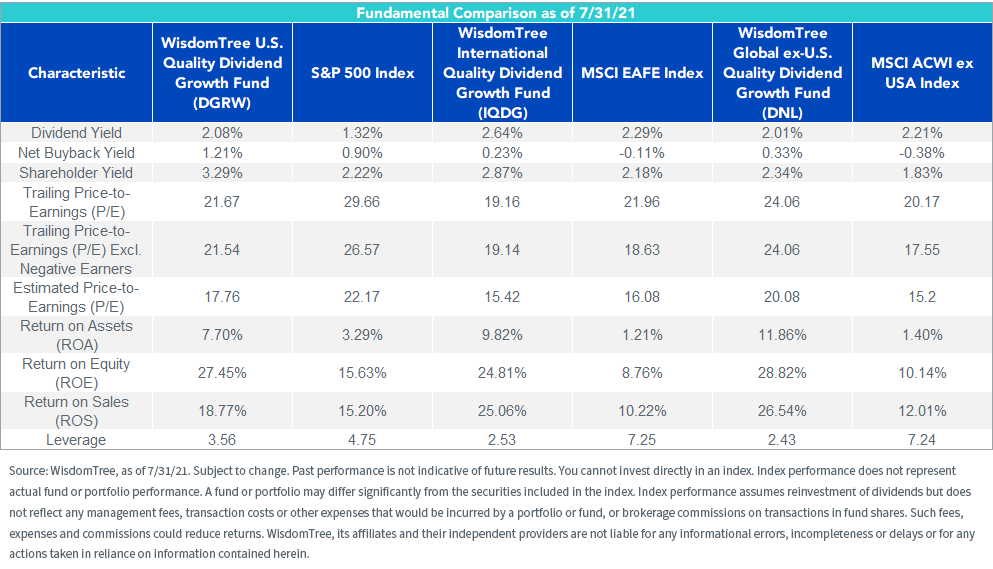

International stocks have a reputation of being cheaper than U.S. markets for good reason. That is because they tend to have lower profitability and lower growth prospects. The MSCI EAFE Index, for instance, has an ROE of just 8.8%, while the S&P 500 has 15.6% ROE.

International stocks have a reputation of being cheaper than U.S. markets for good reason. That is because they tend to have lower profitability and lower growth prospects. The MSCI EAFE Index, for instance, has an ROE of just 8.8%, while the S&P 500 has 15.6% ROE.

Yet when you employ a quality discipline in these foreign markets, you can get ROEs at significant premiums even to U.S. markets while retaining a valuation discount.

Overall, we believe that there is an opportunity in the current quality market that should not be overlooked. Markets may have dislocated from longer-term quality trends over the past year, but we think they’ll restore their preference for higher-quality companies soon.

Overall, we believe that there is an opportunity in the current quality market that should not be overlooked. Markets may have dislocated from longer-term quality trends over the past year, but we think they’ll restore their preference for higher-quality companies soon.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.