A Quality Opportunity for Quality

Something interesting is happening in the international quality market.

As my colleague Matt Wagner explained in a recent blog post, traditional finance theory posits that higher quality stocks should trade at a premium to the broader market (which contains both high- and low-quality companies) due to the perception and expectation of safety.

This premium is reflected in common valuation metrics like the price-to-earnings (P/E), price-to-book (P/B) and forward P/E ratios—a high-quality collection of companies would have higher measures than those of the broader equity market.

Put the opposite way, lower-quality stocks should trade at a valuation discount to the broader market because they’re assumed to be riskier. Therefore, they should offer more compensation from a total return perspective to entice investors to own them.

But there’s often a disconnect between the way financial markets should work versus how they’re working in the real world.

An Historic Opportunity for International Quality

One such disconnect is currently unfolding within the quality market for developed international equities.

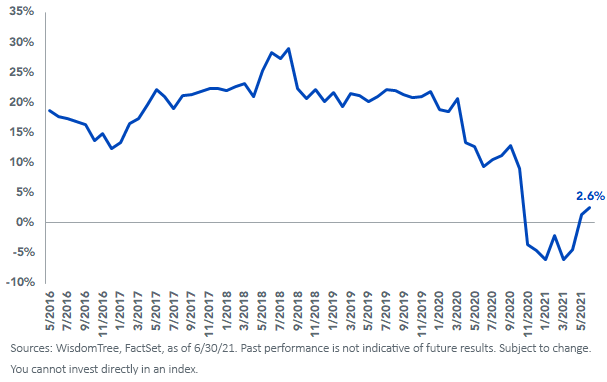

Our barometer for international quality is the WisdomTree International Quality Dividend Growth Fund (IQDG), which launched in 2016 and has traded at a premium to the MSCI EAFE Index on a forward P/E basis since day one. However, beginning in the third quarter of 2018, this relationship began to slowly break down as lower-quality stocks rallied relative to higher-quality ones.

IQDG Forward P/E Premium/Discount Relative to MSCI EAFE

Fast-forward to late 2020, when IQDG’s forward P/E ratio began trading at a discount to the MSCI EAFE for the first time ever, where it remained until just recently.

This was fundamentally at odds with the academic finance lessons we’ve been taught. Suddenly, there was a risk premium available to investors for owning (presumably) less risky and higher-quality stocks. Theoretically, there should have been higher expected return compensation in exchange for being more risk averse.

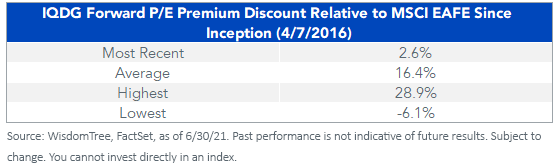

As of June, IQDG has been restored to a premium, albeit a modest one. It is trading almost in line with the MSCI EAFE, with a forward P/E premium of about 2%.

This is still impressively low by historical standards. Since inception, IQDG has traded at an average 16% premium to the MSCI EAFE, so its current reading is negligible.

What about Trailing Earnings?

Let’s look at the affordability of international quality from another perspective.

After all, we are exiting a global pandemic where the revenues and profits of many cyclical companies with weaker balance sheets may have disproportionately suffered compared to peers on more stable financial footing. As we return to an environment of global economic growth, prices for lower-quality stocks may be buoyed by investors’ renewed optimism.

Through this lens, perhaps it makes sense that lower-quality companies are enjoying a tailwind, thereby reducing the valuation premium that high-quality stocks have traditionally commanded over the broader market.

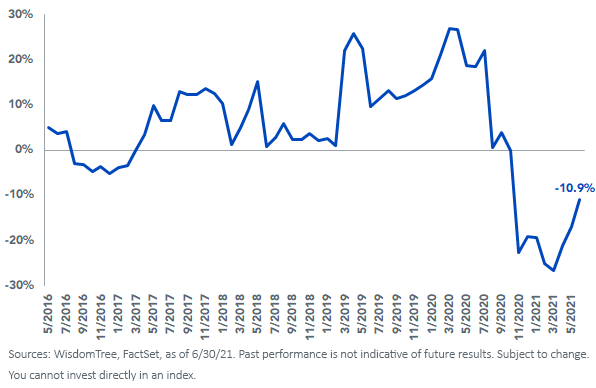

But the thesis is even stronger if we use the P/E ratio with trailing earnings instead of estimated earnings. That way, we capture at least six months of last year, when the pandemic and its economic ramifications were in full force.

IQDG P/E Premium/Discount Relative to MSCI EAFE

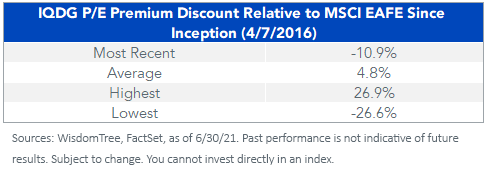

Using trailing earnings, IQDG remains at a deep discount relative to MSCI EAFE. Not only is the magnitude of the discount (about 11%) impressive, but it’s notable that it has almost always traded at a premium since inception as well.

Historically, it has averaged a premium of about 5%. Though it has recovered from its deepest discount in March 2021, it still remains underpriced relative to the broader developed equity market.

What about Fundamentals?

Given the valuation gap, an astute investor might think there’s sufficient reason for it to exist in the first place. Perhaps the underlying “quality” companies must not be as high-quality as we’re led to believe. Right?

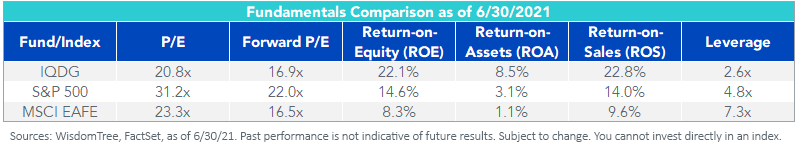

Wrong. IQDG still manages to deliver nearly three times as much return on equity (ROE) and over 7% more return on assets (ROA) than broad developed markets, resulting in about one-third as much leverage as well.

It even manages to deliver higher-quality characteristics compared to U.S. markets, proxied by the S&P 500 Index. Traditionally, developed markets have traded at a discount to the U.S. since their economies tend to be more cyclical in nature with reduced profitability metrics.

Nonetheless, IQDG outshines even the mighty, Information Technology-laden S&P 500 in a test of quality, offering 1.5 times ROE, nearly three times ROA and about half as much leverage.

…But What about Performance?

The affordable opportunity to own international quality is not a result of poor performance either.

On a year-to-date basis (as of June 30, 2021), both IQDG and its currency-hedged twin (IHDG—WisdomTree International Hedged Quality Dividend Growth Fund) are in the top quartile of funds in the Morningstar Foreign Large Growth category based on NAV performance. IHDG is number two overall, while IQDG stands at #16 out of more than 450 funds.

An Opportunity Reminiscent of Value

At WisdomTree, we’ve preached the merits of quality exposure through U.S. markets for a long time. For once, however, there’s an opportunity to access quality in developed international markets, which we have not been as optimistic about until this year.

The relative valuations described above remind us of WisdomTree’s value investing ethos. But this time, the “value” opportunity is in the quality factor, which we’ve always believed in for the long term.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent that IHDG invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. IHDG and IQDG invest in the securities included in, or representative of, their Index regardless of their investment merit and the Funds do not attempt to outperform their Index or take defensive positions in declining markets. Due to the investment strategy of the Funds, they may make higher capital gain distributions than other ETFs. Heightened sector exposure increases IQDG’s vulnerability to any single economic, regulatory or other development impacting that sector. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.