Quality Value Rotation

What a dizzying turnaround for value.

After a severe drawdown in early 2020, the long-anticipated reversal in favor for lower-multiple stocks finally took hold last fall.

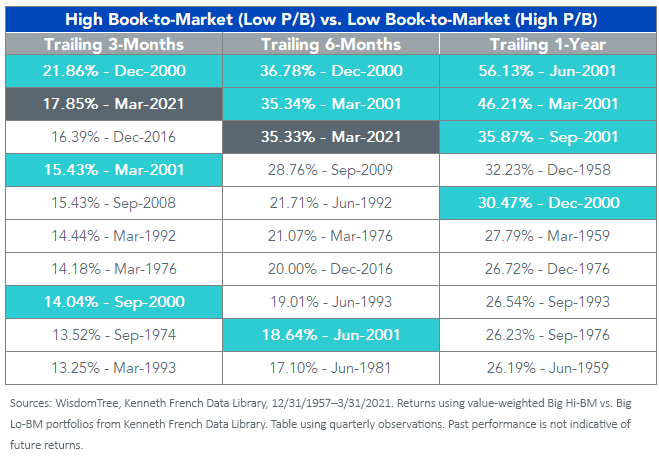

For historical context, only the bursting of the tech bubble ushered in such a profitable cycle for value over trailing three-month and six-month time frames.

Top 10 Periods for Value: Value (High Book-to-Market) vs. Growth (Low Book-to-Market)

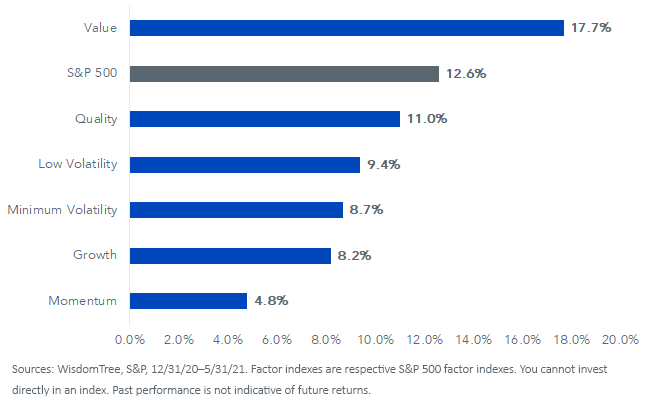

The growth-versus-value story attracts the bulk of the attention. But for many factor investors, the question going forward is how long the underperformance of quality, low vol/min vol and momentum will persist.

Year-to-Date Factor Returns

Improving economic conditions, rising interest rates and a significant decline in market volatility have all coalesced to buoy the riskiest, most depressed value shares. The Cboe Volatility Index recently touched a post-pandemic low of 15.65 on June 11.

Volatility modestly picked up following the conclusion of last week’s Federal Reserve meeting, and value has been giving way to growth for the past several weeks now. However, it is still too early to call whether that seems like a start of a trend.

Cboe Volatiliy Index (VIX) – 3/2/20–6/18/21

One narrative gathering attention—and that we recently discussed on our blog—is the notion that there are two distinct types of value companies.

In the recent run-up in value, the most distressed/riskiest/junkiest names have been the strongest market leaders. In the next phase of the cycle, we believe quality value companies are more likely to lead as investors become more discerning about profitability and balance sheets.

According to a recently published Citi Research report1, this shift was seen in prior instances of value outperformance following the global financial crisis and the tech bubble. The change in leadership occurred approximately six months into value’s bull run. We are about six-to-nine months into the current cycle, depending on how you track it.

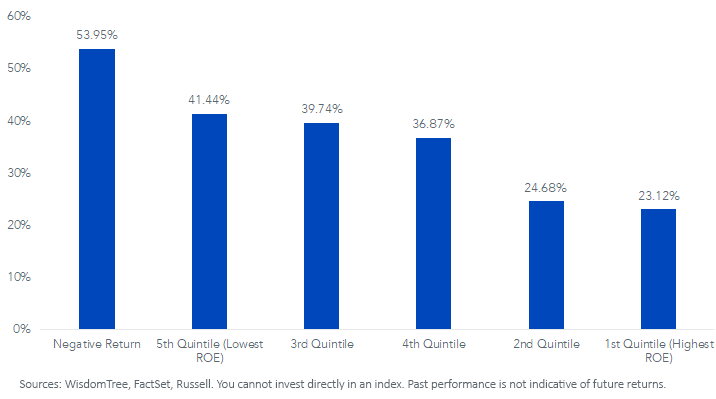

Low Profitability Leading

There are still many factors in favor of value relative to growth, including historically attractive relative valuations and mean reversion after more than a decade of value underperformance.

With that in mind, we think investors should focus on higher-quality value names. Recent returns have favored companies with low (or no) profits—the distressed value names—but history suggests profitability is an important factor for long-run returns.

Russell 1000 Value Index: Return on Equity Quintile Returns (8/31/20–5/28/21)

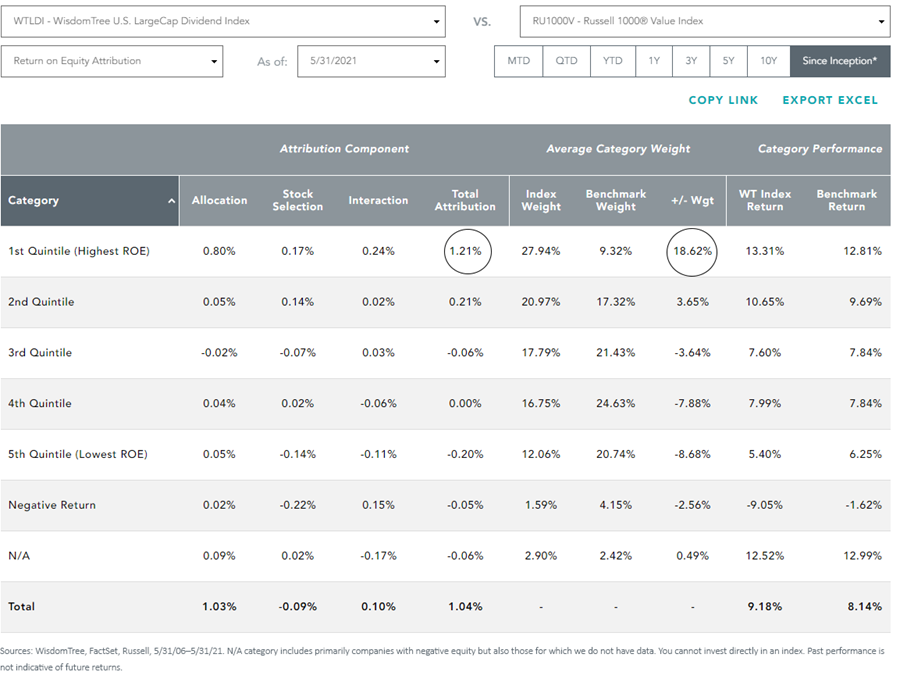

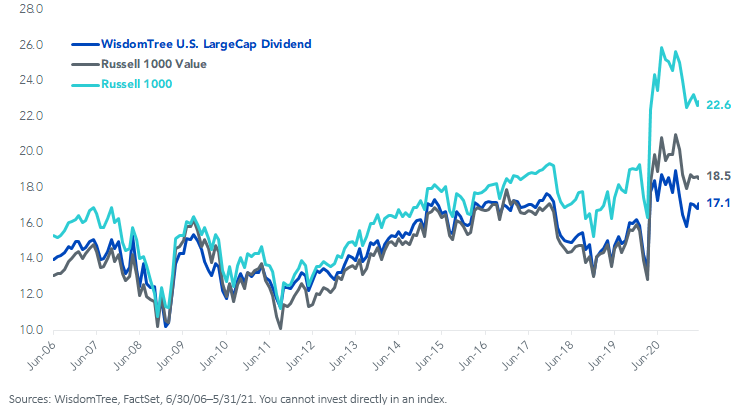

For example, the WisdomTree U.S. LargeCap Dividend Index—a value-tilted Index that selects and weights constituents based on dividends—has historically been over-weight in the most profitable quintile by over 18%. This over-weight allocation has contributed 121 basis points of annualized outperformance relative to the Russell 1000 Value Index going back to June 2006.

In addition to having higher profitability than the Russell 1000 Value Index, the WisdomTree U.S. LargeCap Dividend Index is at a discount on forward price-to-earnings (P/E) valuations.

Index Forward P/E Ratios

The Bottom Line: For investors who believe there’s more room to run for value, but also that the junk rally is soon to run out of steam, consider a higher-quality value basket.