Value and Dividends: A Rising Tide

A rising tide of improving economic growth expectations has lifted all sectors this year.

The companies getting the greatest boost in recent months were some of the most unloved and distressed in the first half of 2020.

After this sharp reversal, waters may get choppier ahead. The lower-quality, more-distressed value companies may have a tougher road ahead as investors get more discriminating about which value names have solid long-term prospects and which are just beneficiaries of a short-term relief rally.

Reopening the Economy = Historic Value Outperformance

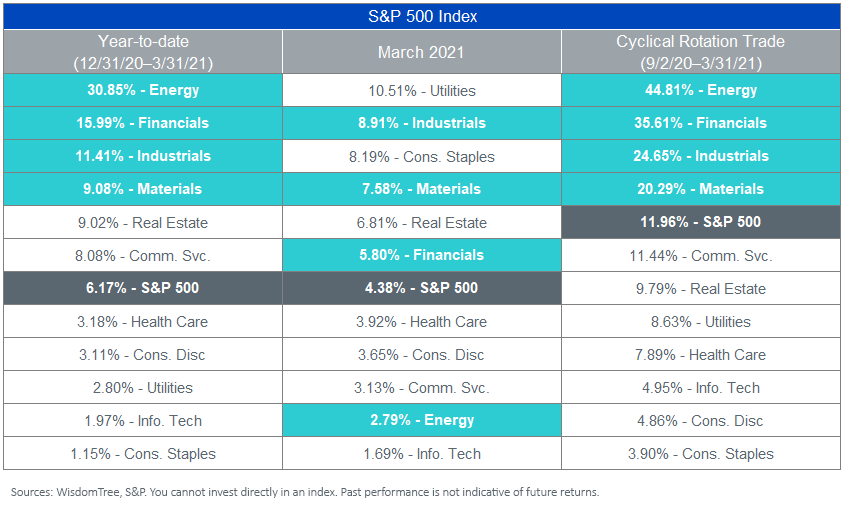

All 11 S&P 500 sectors were up in Q1 2021. The best performers were the traditional cyclical sectors—Energy, Financials, Industrials and Materials.

The outperformance of cyclicals has been underway since early September—one of the longest stretches of such outperformance in a decade.

Sector Returns

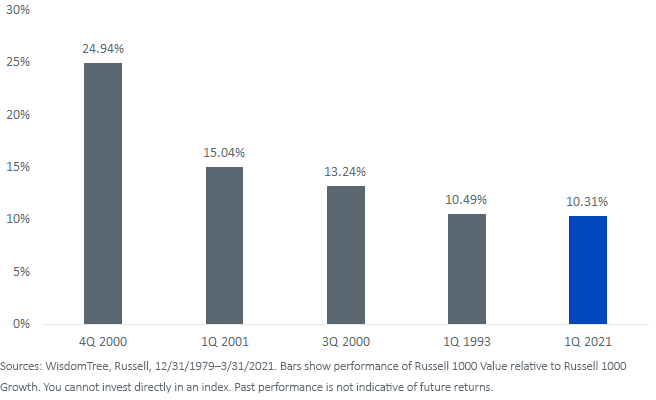

The first quarter’s outperformance of value relative to growth was historic. The Russell 1000 Value Index bested the Russell 1000 Growth Index by 10.31%—the fifth-best quarterly relative performance in history.

Top Five Value Outperformance

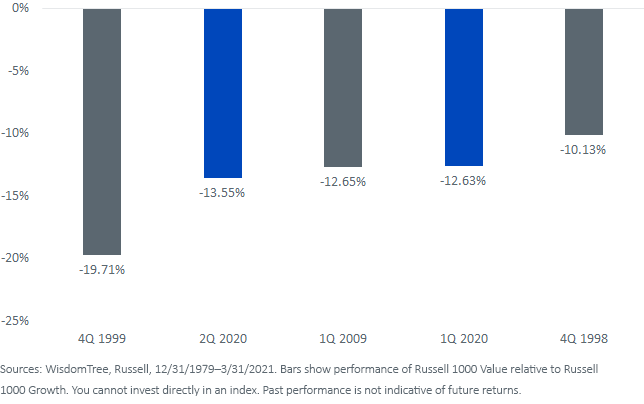

However, this outperformance comes on the heels of a decade of value underperformance and two historic quarters of growth outperformance in the first half of 2020.

Top Five Value Underperformance

Interestingly, one of the highest beta sectors to value generally and the re-opening of the economy specifically—Energy—was the second-worst performing sector for the month of March.

After a year of punishingly low oil prices, Energy is one of the least-profitable and lowest-quality sectors in the S&P 500. For the month of March, investors started to refocus on higher-quality and lower-volatility companies, potentially signaling a shift from the acute rebound of distressed value to more quality value names.

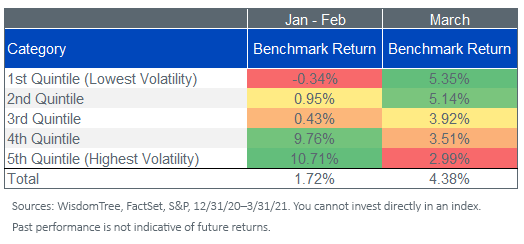

For the first two months of the year, the least-volatile stocks in the S&P 500 significantly lagged the most volatile. In March, that trend reversed, with the highest-volatile stocks becoming the laggards.

Volatility Quintiles – S&P 500 Index

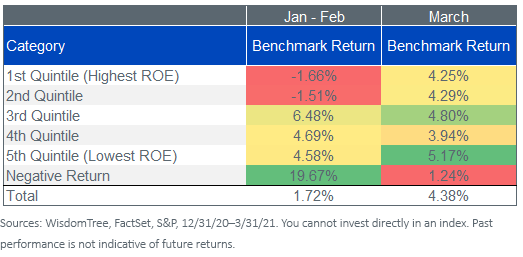

From a return-on-equity (ROE) perspective, companies with negative earnings were by far the best performers to start the year. In March, this trend too was reversed, with the negative-return companies lagging.

Return-on-Equity Quintiles – S&P 500 Index

March Factor Reversal

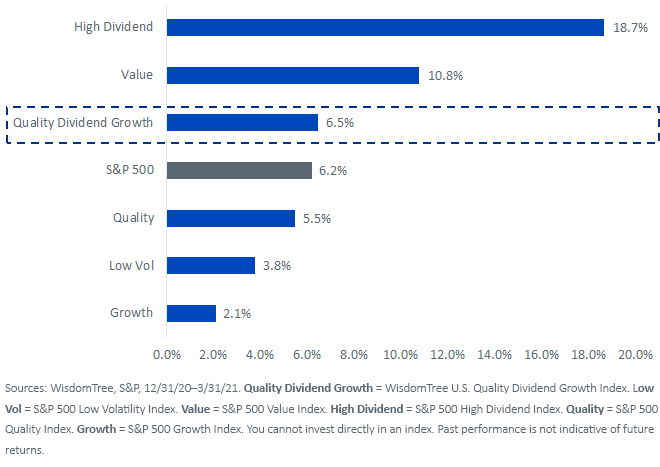

In a far cry from 12 months ago when the highest-dividend payers were slashing dividend payments and severely lagging, high-dividend yielders had a remarkable first quarter.

Quality dividend growers—those companies that don’t sport the highest yields but have more sustainable payouts—had much more modest outperformance. The WisdomTree U.S. Quality Dividend Growth Index outperformed the S&P 500 by just 30 basis points.

Index Total Returns – 1Q 2021

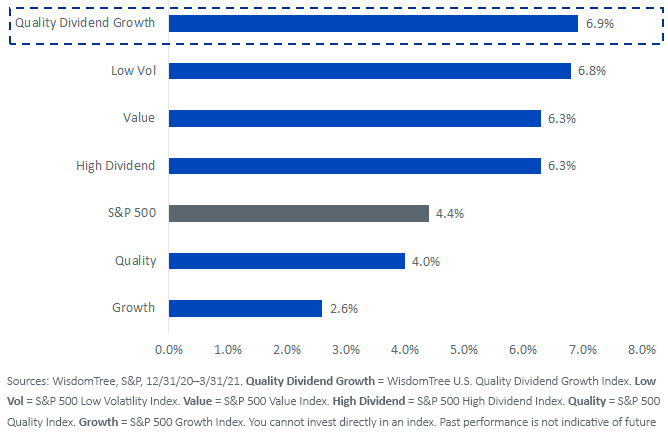

But as we saw with quintile performance, there was a dramatic reversal in factor performance in the month of March. While value and high dividend still outperformed, low vol and quality dividend growth were the two best-performing factors.

Index Total Returns – March 2021

For investors who think value and dividend payers still have room to run—which seems reasonable after about a decade of underperformance—but that some of the easier gains have been made from distressed value companies, now may be a time to consider an allocation to higher-quality dividend payers.

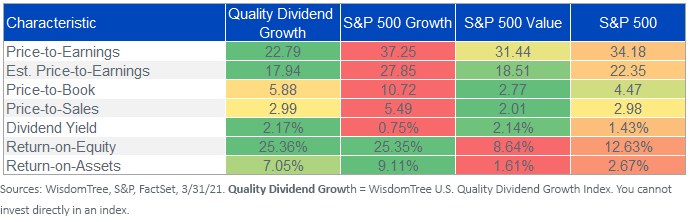

Index Fundamentals