European Small Caps Are Revving Their Engines

For the first time in a while, we’re growing more optimistic on the European economy.

My colleague Aneeka Gupta from WisdomTree Europe recently provided some commentary on European macroeconomics that outlined a few valuable insights.

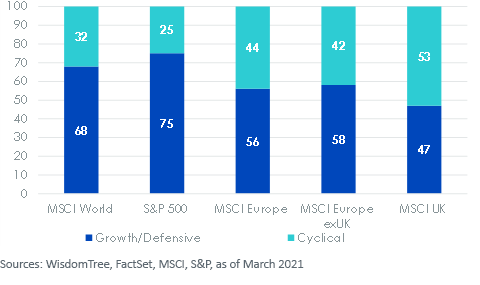

One of her most intriguing points related to the weight concentration of cyclically sensitive stocks in Europe versus other equity indexes from around the world. Europe has the second-highest concentration at 44%, nearly 20% more than the U.S.:

European Stock Market Consists of Higher Proportion of Cyclically Sensitive Stocks

She wrote:

Europe’s higher exposure to financials and cyclically sensitive sectors such as industrials, materials and energy are likely to benefit from pent-up domestic demand as the lockdown measures ease.

This got us excited about European equities, small caps and the WisdomTree Europe SmallCap Dividend Fund (DFE) in particular, because it reinforced an important distinction that we’ve been writing about recently: The reopening trade isn’t over. We believe it’s just getting started.

A Tale of Two Pandemics

Our excitement is a bit ironic, since it’s partially inspired by Europe’s struggle to suppress the coronavirus and vaccinate its citizens. We believe there’s a unique opportunity buried among the headlines about new lockdowns in the U.K., France and Germany, along with the bloc’s difficulty to approve, secure and distribute vaccines.

Europe’s expectations for both an economic and equity market recovery have been tempered by these difficulties, unlike the roaring equity rally that began in the U.S. late last year. That signals to us that the European economy is still slightly behind in the fight against COVID-19.

More importantly, for equity markets, that reiterates that there may still be time to pile into the European recovery trade, of which small caps are a major component.

Global Small Caps Are Patiently Waiting

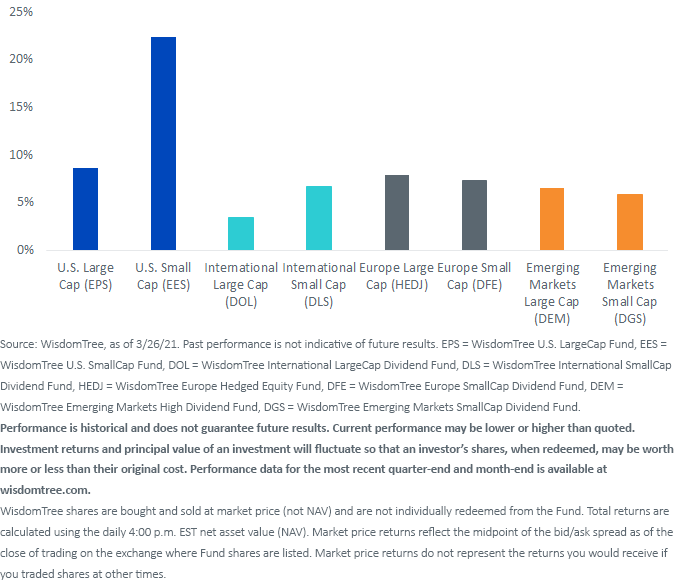

Let’s compare the year-to-date performance of small- and large-cap equities in various regions around the world, using WisdomTree’s product suite as a barometer.

YTD Performance of Large & Small Caps by Region

For standardized performance and the SEC-30 Day Yield of the Funds in the chart, please click here.

Despite the fervor surrounding small caps this year, the excitement has been isolated to the U.S. In Europe, they’re performing in line with the broader region, suggesting that are still preparing for a potential takeoff.

Small Caps Clear the Runway for Large Caps

There are two more key reasons for our optimism on European small caps.

Similar to Aneeka’s point about European equities benefitting from pent-up demand as lockdowns begin to ease, we’re longtime believers in the importance of small-cap interlinkages within the global economy. Smaller companies are integral to global supply chains and are highly levered to overall levels of economic activity, even if they seldom deliver blockbuster results during earnings season.

Given that we just completed a full year with subdued economic activity, it’s hard to argue that even a modest revival may be a potential catalyst for small-cap outperformance.

If history is any indication, we may be correct. The historical beta since inception of DFE relative to the MSCI Europe Index is a strong 1.25, meaning any secular economic recovery in Europe may be felt even more by its smaller companies.

Diversified Factor Exposures

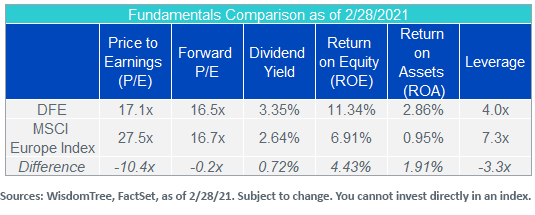

Second, we’re confident that DFE has the ability to deliver beneficial factor exposures in today’s market. Besides size exposure, which is expected in a small-cap Fund, DFE seeks to deliver two other important factors: quality and value.

We would argue that the former is important in any market environment, since it targets companies with efficient operations, strong balance sheets and healthy fundamentals. Quality is evidenced below by the 4.43% and 1.91% advantage in return on equity (ROE) and return on assets (ROA), respectively, against the MSCI Europe Index.

We feel value investing, however, is experiencing a renaissance after living in the shadow of growth investing for the last decade. DFE’s emphasis on dividends, and weighting companies by their contribution to the Dividend Stream®, seeks to deliver value characteristics through income generation and controlled valuations.

That’s exhibited by the 72 basis points (bps) pickup in dividend yield.

Bargain Buying

Moreover, we believe DFE also brings an attractive valuation profile to the table. In fact, the extent of its valuation discount reinforces our belief that U.S. small-cap excitement that has not spread overseas just yet.

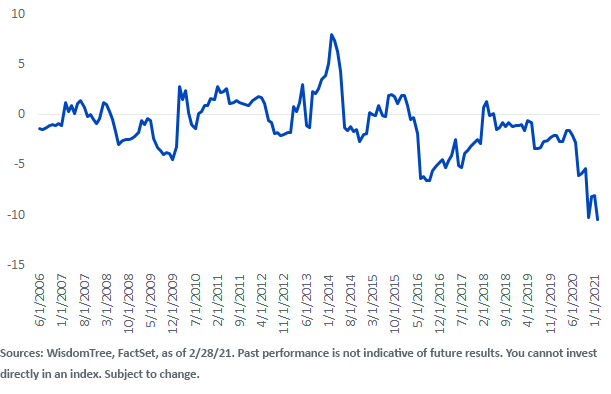

DFE is trading at an all-time discount on a price-to-earnings (P/E) ratio basis compared to broader Europe. Since inception in June 2006, it maintained a one-point average discount to Europe in what became a difficult decade-plus for European equities.

At the end of February, however, this discount was the largest it’s ever been—a staggering 10 points—signaling that European small caps are still a bargain relative to their larger brethren.

P/E Spread Between DFE & MSCI Europe Index

A Perfect Storm for a Small-Cap Rally

We’ve written extensively about our excitement for small caps this year, but European small caps are almost in a league of their own.

While the U.S. seems to have already embraced small-cap optimism as a preferred market narrative for 2021, we believe there is still time to enter the trade overseas.

In our view, there is a unique opportunity today to ride the economic recovery in Europe that has yet to find its footing. Our preferred way to access it is the WisdomTree Europe SmallCap Dividend Fund (DFE).

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.