Dusting Off the Inflation Playbook

Coming into the year, WisdomTree’s Model Portfolio Investment Committee was positive on economic growth and risk assets. The Committee believes a number of factors could drive global growth—and inflation—higher in 2021:

- A massive fiscal stimulus bill from the Biden administration, targeted at those with a higher marginal propensity to consume (with an additional infrastructure bill possibly in the pipeline).

- A vaccine rollout that is accelerating with new pharmaceutical solutions and distribution improvements.

- The Federal Reserve’s new policy framework to let inflation run above its target, letting the economy ‘run hot.’

As economic activity rebounds, many global supply chains face disruptions from COVID-19-induced capacity constraints. Inflation expectations are rising, as seen in the breakeven inflation rates shooting higher in recent months.

An Inflation Inflection

Rising inflation would be a new phenomenon for anyone who entered the industry in the last decade. Nine of the past 11 years saw Consumer Price Index (CPI) growth end the year either lower than or flat relative to the level at which it started the year. The Fed failed to achieve its 2% inflation target, despite some innovative policies.

From a multi-asset portfolio standpoint the deflationary playbook was simple, in hindsight—own growth. Companies that could sustain revenue growth on their own without the cyclical leverage to the global economy saw massive price appreciation in the post-financial crisis era.

Now that the Fed is implementing its new policy framework, we believe investors need to dust off a completely different playbook: how to position portfolios for rising inflation.

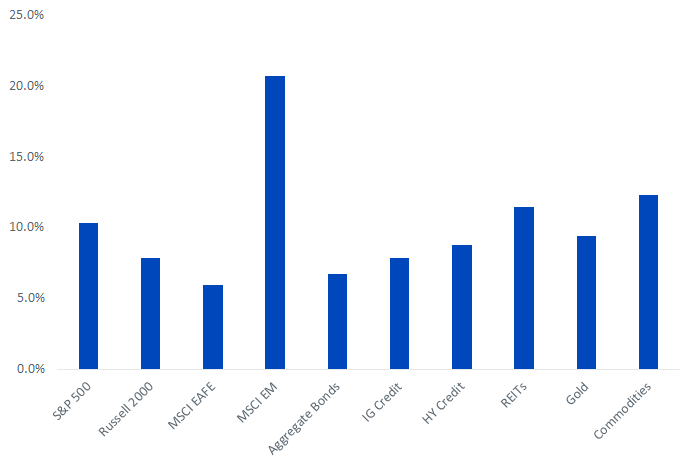

Top Asset Classes: Commodities and Emerging Markets

Commodities have been the poster-child beneficiaries of rising inflation. Their trailing performance clearly shows how much they struggle when inflation disappoints. Commodities were a great way to lose money for the better part of a decade, with the Bloomberg Commodity Index returning a jarring cumulative -52% over the last 10 years.1

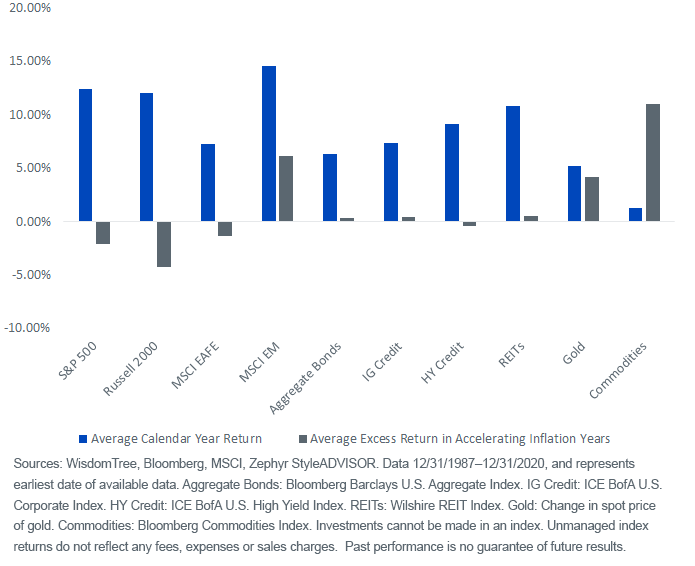

Many investors gave up on the asset class but now find themselves reexamining it, for good reason. Dating back to 1987, during years when inflation accelerated, commodities averaged a 12.3% return—bested only by emerging markets (EM) equities.

This performance is all the more impressive when you consider the context of typical returns for commodities, which averaged just a 1.3% annual calendar year return.

This spread, between performance during an average year and an inflationary year, is far and away the best of the major asset classes outlined below.2

Additionally, EM equities look compelling in an accelerating inflationary environment as well. While EM equities have impressive historical performance over most extended time frames, the performance has been particularly strong during years of accelerating inflation.

EM equities and commodities have long been linked due to their similar reliance on a weak dollar and positive investor risk appetite, along with the historical composition of the MSCI EM Index.

But today’s EM equity asset class, led by Asian technology heavyweights, looks very different from the last time we experienced a meaningful inflationary period, during the commodity ‘supercycle’ of the early 2000s.

Admittedly, the sample size, imperfect CPI inputs and arbitrary calendar-year end points make this an inexact science. But look no further than the performance of both commodities and EM to start 2021 for validation of these trends playing out once again.

Through February, commodities are having the best start to a year since 2008, and EM is outperforming the MSCI World Index by 2.3%.3

Average Performance During Years of Accelerating Inflation

Emerging Markets Stand Out With and Without Inflation

For definitions of indexes in the charts, please visit our glossary.

How to Reposition Portfolios Today

WisdomTree has positioned for this rebound in our Model Portfolios for some time. Many of our equity Models have been overweight EM equities for the last several quarters.

Additionally, in the Siegel-WisdomTree Longevity Model, we increased exposure to commodities at the expense of fixed income during our December rebalance.

How do we obtain these exposures?

The anchor EM allocation in our Model Portfolios is the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE). The approach of removing state-owned enterprises (SOEs) has historically led to superior performance, alignment with ESG (environmental, social and governance) objectives and has minimized risk of the political malfeasance common in many EM countries.

For commodities, we use the WisdomTree Enhanced Commodity Strategy Fund (GCC). The Fund employs an intelligent approach to contract commodity selection in order to increase carry, and seeks to be more diversified than other commodity funds that are heavily correlated to oil prices.

Lastly, the WisdomTree Emerging Markets High Dividend Fund (DEM) may offer the best of both worlds. Relative to the MSCI Emerging Markets Index, DEM has a combined 14.6% overweight to the energy and materials sectors and a higher correlation to commodities.4 For anyone looking for commodities within emerging markets, we believe DEM should be well positioned for the inflationary acceleration that we anticipate in the near future.

1Bloomberg, as of 12/31/20.

2Bloomberg, MSCI, Zephyr StyleADVISOR, as of 12/31/20.

3Bloomberg, as of 2/28/21.

4FactSet, Bloomberg, as of 12/31/21.

Important Risks Related to this Article

Prior to 12/21/20, the ticker symbol “GCC” was used for an exchange-traded commodity pool trading under a different name and strategy.

There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares.

GCC will not be invested in physical commodities. Futures may be affected by backwardation and contango. Backwardation: A market condition in which a futures price is lower in the distant delivery months than in the near delivery months. As a result, the Fund may benefit because it would be selling more expensive contracts and buying less expensive ones on an ongoing basis. Contango: A condition in which distant delivery prices for futures exceeds spot prices, often due to costs of storing and inuring the underlying commodity; opposite of backwardation. As a result, the Fund’s total return may be lower than might otherwise be the case because it would be selling less expensive contracts and buying more expensive ones.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets.

Please read each Funds’ prospectus for specific details regarding the Fund’s risk profile.