I Can See Clearly Now

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

I can see clearly now the rain is gone

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It's gonna be a bright (bright)

Bright (bright) sunshiny day

It's gonna be a bright (bright)

Bright (bright) sunshiny day…

(From “I Can See Clearly Now” by Johnny Nash, 1972)

Investment Themes for 2021

This blog post represents the last in our series on the alignment between WisdomTree’s Model Portfolios and our primary investment themes for 2021.

Previously, we’ve posted about disruptive growth, reflation, cyclical rotation, and quality and income. In this blog post we will tackle the last (but not least) of our themes—emerging markets (EM).

The Case for Emerging Markets

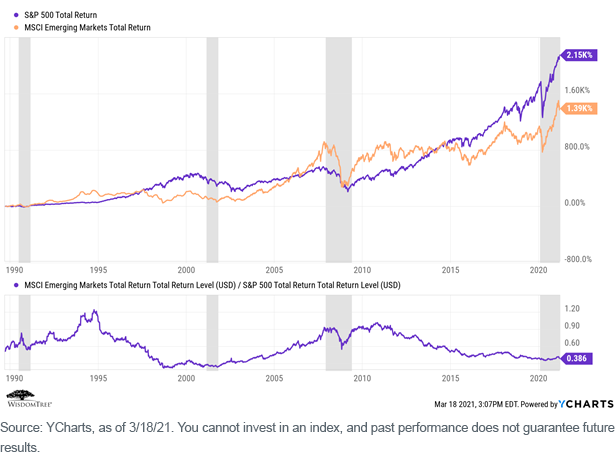

As we’ve argued previously, emerging markets historically tend to outperform as the U.S. comes out of recession (indicated by the gray bars), and that outperformance can last for an extended period:

If we blow up recent performance, we see a nice run by EM since the beginning of Q3 2020 (though it has faded a bit in the past few weeks as U.S. interest rates have spiked).

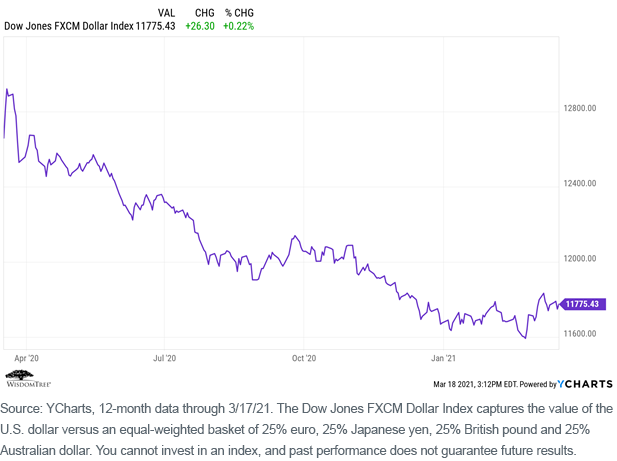

Another of the foundations for our positive EM outlook is that we believe there will be continued weakness in the U.S. dollar (which provides a tailwind to non-U.S. risk asset performance in U.S.-dollar terms)—a weakness that began roughly at the nadir of the Covid-19 pandemic last year.

Note the recent bump up in the dollar over the past one to two months, a reflection of the increase in U.S. interest rates and a recovering U.S. economy. The “short dollar” trade (i.e., betting on a weakening dollar) was very crowded heading into 2021, so another possible explanation of the recent bump is simply profit-taking. Regardless, we view the longer-term path for the dollar as downward (weaker).

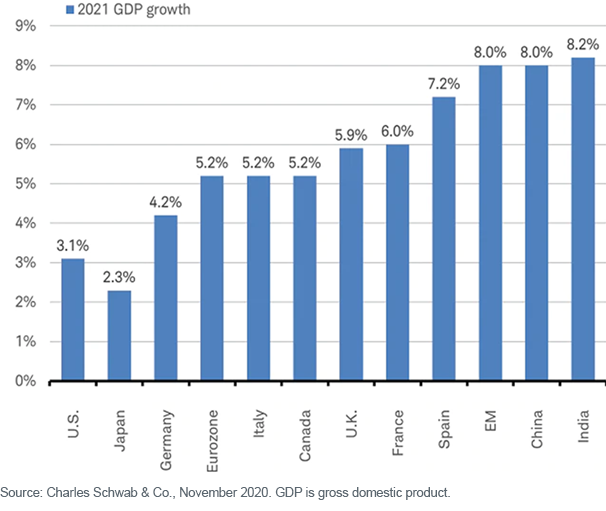

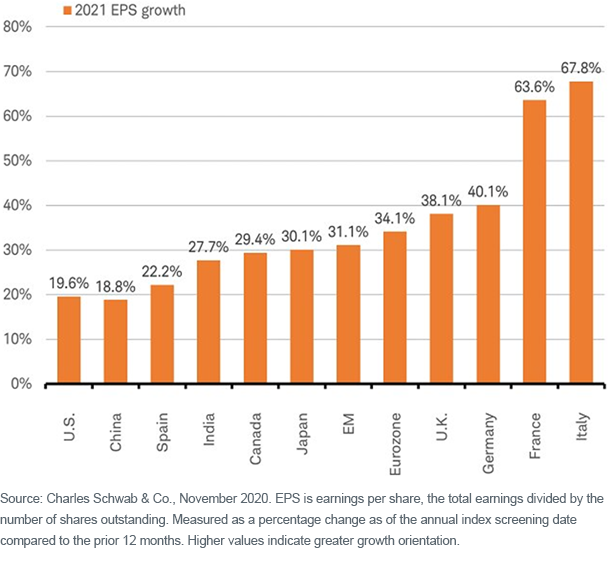

A final argument for our EM investment thesis is a recovering global economy, in which non-U.S. economies and earnings are expected to grow faster than the U.S.1

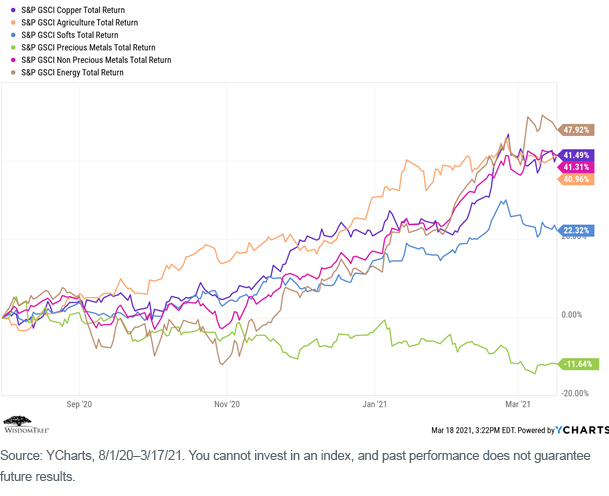

A corollary to this is that, if the economic forecasts are correct, it should lead to rising commodity prices as global demand picks up. We’ve already seen this trend taking place since the beginning of Q3 2020 (excluding precious metals), and if it continues it will benefit the many commodity-exporting EM countries:

Model Portfolio Implications

At a strategic level, the WisdomTree Core Equity Model Portfolio (which is the building block to many of our multi-asset models) is overweight the U.S. and EM, and underweight developed international (EAFE) versus our MSCI ACWI benchmark. At the security level, our core EM position in the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) has been particularly helpful:

For standardized performance of XSOE, please click here.

In addition, at our December Model Portfolio Investment Committee meeting, we agreed to make a small allocation to our WisdomTree Emerging Markets Local Debt Fund (ELD), in our Core Fixed Income Model Portfolio. We made this reallocation in an attempt to improve the overall diversification of our fixed income Model Portfolio and add in an additional potential return driver.

Finally, for those advisors seeking to access an explicit EM exposure while potentially improving the factor diversification of their clients’ overall portfolios, we manage an EM Multifactor Model Portfolio, which can be used AS a stand-alone portfolio or, more frequently, as a complementary sleeve in a broader overall portfolio.

This EM Multifactor Model Portfolio builds from the core holding in XSOE, as does our Core Equity Model Portfolio, but it complements that core with diversifying strategies that take factor tilts toward small-cap dividend payers, quality growth, deeper value and diversified multifactors.

Conclusion

We believe the EM investment theme still has room to run, and our Model Portfolios are positioned accordingly. We believe “we can see clearly now” into an extended period of solid performance in our explicit EM Model Portfolio and in the EM allocations within our broader equity and fixed income Model Portfolios. We invite advisors who agree with our thesis to take a closer look as we attempt to help them deliver a differentiated end client investment experience.

For definitions of indexes in the blog, please visit our glossary.

1Note that this forecast was prepared prior to the recent passage in the U.S. of a $1.9 trillion fiscal stimulus package, which may result in higher U.S. growth rates than projected here.

Important Risks Related to this Article

For retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment adviser may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment adviser, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment adviser and may differ from information provided by your investment adviser. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.