Celebrating One Year of Longevity with the Siegel-WisdomTree Model Portfolios

This article is relevant to financial professionals interested in model portfolios. WisdomTree ETF Model Portfolios are directly accessible only by financial professionals, through the WisdomTree website and various model portfolio platforms.

Many of you probably know that Dr. Jeremy Siegel, Professor of Finance at Wharton School, serves as a Senior Investment Strategy Advisor to WisdomTree and has been involved with our firm since its formative stages.

What you might not realize is that Professor Siegel is a member of our Model Portfolio Investment Committee and collaborated with us on the Siegel-WisdomTree Longevity and the Siegel-WisdomTree Global Equity Model Portfolios.

These strategies were designed to challenge the traditional 60/40 portfolio approach that we believe may no longer be optimal in the current global investment market regime.

This exciting collaboration with Professor Siegel brings a unique solution to investors with mid- to long-range time horizons who are trying to balance current income needs with longevity risk.

With 2020 behind us, we now have a full year of live performance to explore. But before we dive in, there are a few key characteristics about the Siegel-WisdomTree Longevity and the Siegel-WisdomTree Global Equity Model Portfolios worth highlighting.

First, the Global Equity strategy provides a diversified exposure to U.S. and International stocks and tilts toward factors such as dividend yield and low price-to-earnings (P/E) ratios to seek higher income generation and outperformance potential. Due to its valuation-driven approach and investment philosophy, the comparative equity index for benchmarking purposes is the MSCI ACWI Value Index (ACWI Value).

Second, the Longevity strategy attempts to overcome the potential future challenges of the traditional 60/40 portfolio approach by structurally allocating more to equities relative to fixed income. As the model targets 75% exposure to equities, we compare the Longevity Model Portfolio’s performance to both a 75/25 and a 60/40 ACWI Value/Bloomberg Barclays U.S. Aggregate Bond Index (AGG) allocation blend.

So how did the Siegel-WisdomTree strategies perform relative to expectations during such an unprecedented 12 months?

Quite well! While it is only a short time frame, the Siegel-WisdomTree Global Equity Model Portfolio has outperformed the ACWI Value by almost 450 basis points (bps)1.

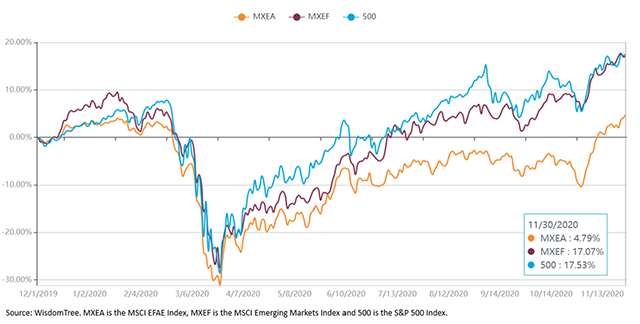

A main contributor to the outperformance has been WisdomTree’s Model Portfolio Investment Committee’s conscious decisions to overweight U.S. and emerging markets equities, relative to developed international equities. The chart below illustrates just how much a difference in returns these regions experienced during the strategy’s live performance period2.

Cumulative Total Returns

Past performance is not indicative of future results. You cannot invest directly in an index. For definitions of indexes in the chart, please visit our glossary.

A second main contributor to the Global Equity strategy’s outperformance has been security selection. Value as a factor has lagged growth by a wide margin since the Models’ launch, despite a resurgence over the past three months. Nonetheless, we have seen a strong positive impact from security selection, as both the WisdomTree and non-WisdomTree fundamentally-focused ETFs have outperformed their respective regional value benchmarks. Financial professionals can visit WisdomTree's Fund Comparison tool to dig deeper into the individual line items of the strategy.

The “WisdomTree and non-WisdomTree fundamentally-focused ETFs” aspect is key. A major differentiator of WisdomTree’s Models is the commitment to managing open architecture portfolios. The different fund families, fundamental tilts and investment philosophies are important inputs into our allocation because they provide us with both potential income and total returns in a diversified and risk-conscious manner.

In fact, the Global Equity strategy was able to generate excess return in both up and down markets. In the Q1 2020 sell-off sparked by the coronavirus, the Model outperformed its benchmark by 170 bps on the downside. In the sharp bounce back since the end of March, the Model has generated another 285 bps of outperformance on the upside.

Moving on to the Siegel-WisdomTree Longevity Model, this strategy has outperformed both of its blended benchmarks. Since launching, the Model has outperformed the 75/25 ACWI Value/AGG benchmark by more than 250 bps and the 60/40 benchmark by more than 100 bps3.

The outperformance against the 60/40 benchmark is particularly notable. Global value equities have lagged aggregate bonds by more than 8% since our Model launched. Despite owning significantly more equities relative to the benchmark, the Siegel-WisdomTree Longevity Model still managed to overcome that sizeable headwind and outperform. We believe this is a testament to the impressive security selection at work.

On the fixed income side, the yield-focused funds collectively hold a higher exposure to credit than the AGG. This exposure was detrimental to relative performance during the pandemic sell-off in March; however, these strategies have since rebounded. In fact, performance of the fixed income portion is nearly dead even to its benchmark as of November 30, 2020, despite commanding a favorable advantage in yield4.

These strategies are strategic in nature. Annual turnover in holdings is expected to be low. Our Model Portfolio Investment Committee does, however, reserve the right to make tactical tilts based on market conditions.

Following the fiscal response to the COVID-19 pandemic, Professor Siegel became more sanguine on the potential for higher growth and inflation in 2021 and beyond. As a result of this thesis, an allocation to gold was implemented—a major change for a longtime gold skeptic. The position in gold had been additive to the portfolio until the sharp risk-on rally in November, but Professor Siegel believes gold can serve as an important position to combat the expectation of inflation rising over the next few years.

That brings us to our outlook.

With a potential revival in reflationary assets, we feel that these value-leaning portfolios are well positioned for a pickup in economic growth. A hopefully successful deployment of vaccines, along with continued support from monetary and fiscal authorities, should be bullish for stocks. Bondholders, on the other hand, may face negative real returns under this scenario.

If our outlook is correct, advisors should consider the Siegel-WisdomTree Longevity or the Siegel-WisdomTree Global Equity Model Portfolios for their clients. The strategies have proven their ability to generate positive relative returns in a multitude of environments. With a potential value tailwind behind them, we believe now could be a very opportune time for these strategies.

1Financial professionals can view standardized performance of the Siegel-WisdomTree Global Equity Model Portfolio here.

2Financial professionals can compare funds and indexes across different time periods by visiting the Fund Comparison tool page on our website here.

3Financial professionals can view standardized performance of the Siegel-WisdomTree Longevity Model Portfolio here.

4The performance references the fixed income portfolio of the Siegel-WisdomTree Longevity Model Portfolio compared to the AGG from 12/31/19 to 11/30/20.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. All Model Portfolio performance quoted is at NAV. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. For the standardized performance of the models and the underlying ETFs click here.

For month-end performance go to wisdomtree.com

The Model Portfolio performance results shown are theoretical and do not reflect any investor’s actual experience with owning, trading or managing an actual investment. Thus, the performance shown does not reflect the impact that economic and market factors had or might have had on decision-making if actual investor money had been managed and allocated per the Model Portfolio. Actual performance achieved in seeking to follow the Model Portfolio may differ from the theoretical performance shown for a number of reasons, including the timing of implementation of trades (including rebalancing trades to adjust to Model Portfolio changes), market conditions, fees and expenses (e.g., brokerage commissions, deduction of advisory or other fees or expenses charged by advisors or other third parties to investors, strategist fees and/or platform fees), contributions, withdrawals, account restrictions, tax consequences and/or other factors, any or all of which may lower returns. While Model Portfolio performance may have performed better than the benchmark for some or all periods shown, the performance during any other period may not have, and there is no assurance that Model Portfolio performance will perform better than the benchmark in the future. Model Portfolio performance calculations assume reinvestment of dividends, are pre-tax and net of fund expenses.

ETF shares are bought and sold at market price (not NAV) and are not individually redeemable from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Asset Allocation Committee of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as a consultant to WisdomTree in such roles, Professor Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.

The WisdomTree Model Portfolio Investment Committee is also sometimes referred to as the Asset Allocation Committee.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client, and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses, or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Model Portfolios, any related information and any digital tools made available by WisdomTree should not be considered or relied upon as a recommendation by WisdomTree regarding the use or suitability of any Model Portfolio, any particular security or any strategy. The Model Portfolios, any related information and any digital tools are intended for use only by financial advisors as an educational resource among other resources deemed appropriate by such advisors.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.