Warren Harding’s Fiscal Restriction Is Not Coming Back; Play It with Commodities

Please see part 1 of this two-part blog series, which discusses a coming “Roaring ’20s” and asks if one of the few things that "roars” will be inflation. We recently completed the reorganization of the WisdomTree Continuous Commodity Index Fund (CCIF) into and with the WisdomTree Enhanced Commodity Strategy Fund (GCC). GCC is organized under the Investment Company Act of 1940, as amended, with no Schedule K-1 and an expense ratio of 0.55%.

Many on Wall Street are laying out post-COVID-19 “Roaring ’20s” theses, whereby I suppose we all start dancing and frolicking, reenacting The Great Gatsby as the economy booms for a decade on end.

Just one problem: The U.S. government entered the 1920s with very little debt by today’s standards—and this was after the devastation wrought by the Spanish Flu and World War I.

This is where the relatively obscure 29th U.S. President, Warren Harding, comes in.

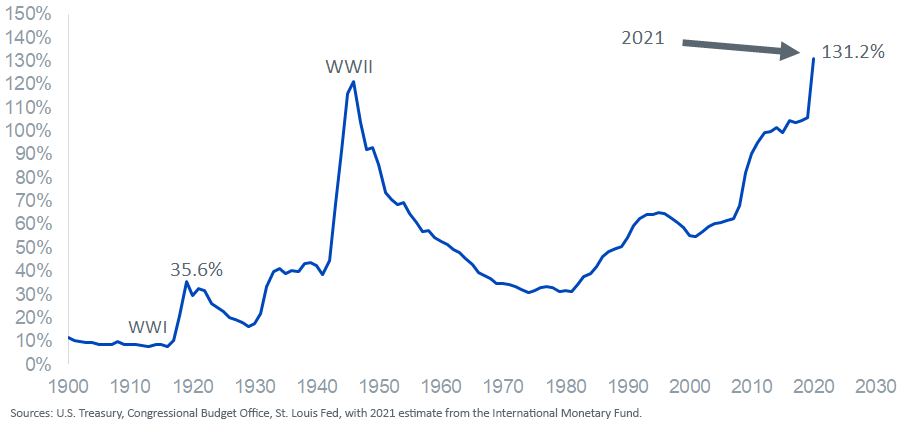

On the eve of the 1920s, the federal government’s debt-to-GDP ratio hit a high that today we could only dream of: 35.6% (figure 1). To the sensibilities of the time, that was an outlandishly high figure. Enter Harding, who engaged deep fiscal austerity, which set up the deep but short-lived 1921 Depression. The groundwork was laid for a boom that by and large lasted until 1929; one that occurred “despite” an austere vibe from both the Harding and Coolidge Administrations.

Figure 1: U.S. Debt-to-GDP Ratio

Warren Harding is gone; the budget hawks have flown back to their nests. We are told, nearly universally, that any whiff of inflation will be a 2021 phenomenon that will fizzle, so there is nothing to be too concerned about. After all, the demographics assure it.

You know what Mark Twain said?

“What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so.”

If there is anything in this market that fits the bill for the Twain quote, it is the certainty with which the “permanent disinflation” camp lasers in on demographics—to the exclusion of money supply.

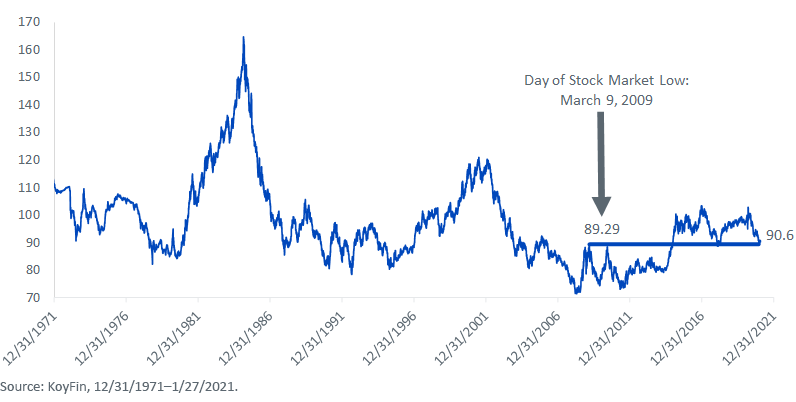

The U.S. Dollar Index is in a world of hurt right now, owing to the 26% year-over-year increase in M2 money supply—the highest on record, by the way. After having an upset stomach since May, the dollar is suddenly flirting with levels witnessed the day the stock market bottomed in the global financial crisis, March 9, 2009.

Continued dollar weakness benefits GCC, as commodities move inversely to the world’s reserve currency.

Figure 2: U.S. Dollar Index

If investors want to get bulled up on stocks for 2021 on a post-COVID-19 reopening thesis, that is fine, but there needs to be more to the story for 2022 and beyond than just the smooth sound of a catchy phrase like “The Roaring Twenties.” An economy that moves on from COVID-19 may be met with trouble if regular people have to pay $5 for a gallon of store-brand milk.

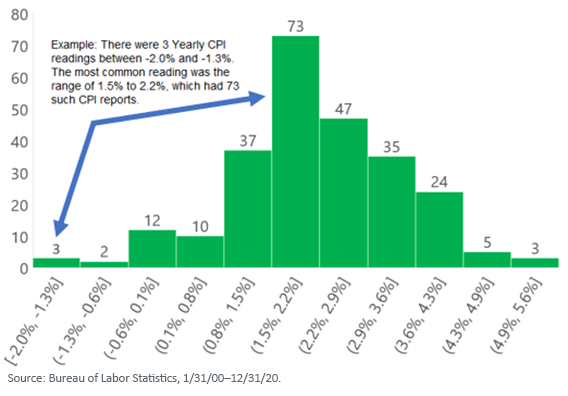

The inflation consensus right now is decidedly narrow. For calendar 2021, Citi anticipates consumer price inflation of 2.0%. What about Credit Suisse? 2.0%. Barclays? 2.0%. Both JPMorgan Chase and Bank of America Merrill Lynch are forecasting “more”: 2.1%. Get the point?

Check out the histogram for the last 20 years. You know what? Inflation could be negative 2.0%. Then again, it could be +5%. Neither outcome should surprise anyone who is paying attention to the historic record.

Warren Harding’s fiscal caution is not on the calendar. And the dollar is not happy about it.

For investors interested in owning commodities, consider our Enhanced Commodity Strategy Fund (GCC).

Here is something that may be noteworthy: We recently began incorporating GCC in our Endowment Model Portfolios, which are available for financial professionals only. Please take a look to see how we work the strategy into an asset allocation.

Important Risks Related to this Article

There are risks associated with investing including possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor's entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund's performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.