Modern Alpha® ETF Model Portfolios

You want to provide your clients with the best possible investment solutions for their needs while running your practice in the most efficient and profitable manner. Efficiency means doing what you do best, add value to your clients’ lives by providing them with valuable advice.

Even with the most sophisticated in-house tools and expertise, building and analyzing portfolios takes a lot of your firm’s time and effort. WisdomTree’s portfolio solutions and digital experience may allow you to focus your time and attention on factors that can drive your business forward, allowing you to be there for your clients. You can do this in-house, but is this where you want to focus your firm’s resources? Let us be your resource to help you in managing your clients’ portfolios.

RETHINKING THE 60/40 APPROACH

Introducing

Siegel-WisdomTree

Model Portfolios

Our Siegel-WisdomTree Model Portfolios were designed to challenge the traditional 60/40 portfolio approach that may no longer be optimal for long-term investors.

Our Modern Alpha® ETF model portfolios are built differently so they perform differently in today’s dynamic market environment. They are designed to give investors a smart way to access the global markets based on the distinct perspective of an investment innovator—while giving advisors the ability to effectively meet client needs.

We go beyond basic market cap-weighted indexes. Our modular solutions offer a tailored investing approach that helps manage risk in today’s ever-changing environment.

Simplify Your Client Conversations

Differentiate Your Practice with a Clearly Defined Investment Process

Model Portfolios Designed to Serve the Full Spectrum of Client Needs

Our model portfolios are designed to meet the needs of:

• Newer and fee-conscious investors

• Investors who are retired or close to it

• Sophisticated and high-net-worth investors

• Investors who may be interested in a thematic approach

Scale Your Business to Meet a Challenging Client Demographic

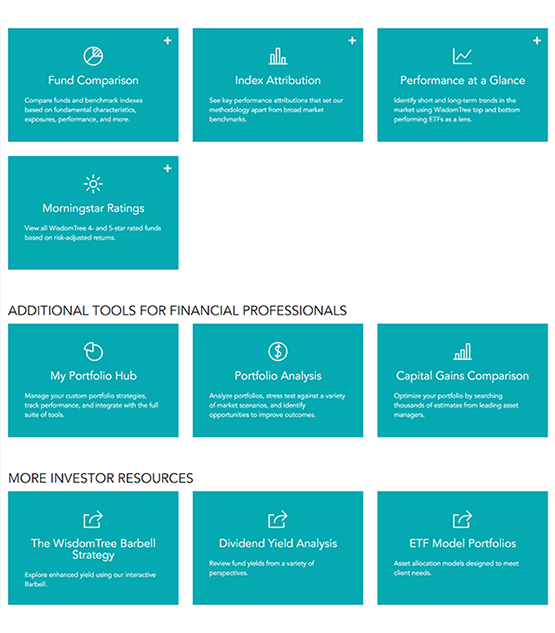

Download reports and presentations, sign up for model portfolio alerts and connect with asset allocation strategists all from the same destination on the site. This allows you to focus your time on serving your clients and building your practice.

• Monthly performance updates and market commentary

• Quarterly tactical trade notifications

• Quarterly market consensus calls with the asset allocation strategists

Want to put your own stamp on your client portfolios, but still have access to cutting-edge products, investment thought leadership and technology? See how using WisdomTree model portfolios for your client’s portfolios with our portfolio construction services can help.