Seeking Exposure to More Sustainable Dividends

In a year when most plans went off the rails, WisdomTree recently completed its regularly scheduled 2020 Domestic Equity Index reconstitutions.

As the pandemic raged on, it seemed like we’d experience a drop in dividend payouts greater than the all-time worst decline that took place during the financial crisis.

But with the full scorecard complete, remarkably, 2020 S&P 500 Index dividends were up for the year—increasing a modest 0.07% from 2019 levels.1

Let’s take a look at key changes for the WisdomTree U.S. LargeCap Dividend Index after the December reconstitution.

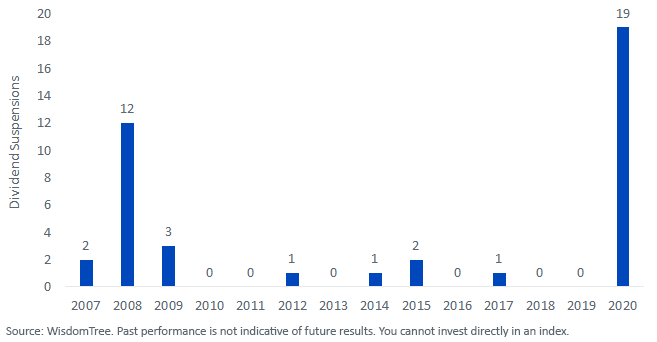

Dividend Suspensions

WisdomTree’s dividend Indexes remove companies when dividend suspensions are announced.

During normal times, a large-cap index will have very few, if any, dividend suspensions. Boeing’s dividend suspension in March 2020 was the first for an S&P 500 company since December 2017.

Nineteen companies were removed from the WisdomTree U.S. LargeCap Dividend Index for dividend suspensions in 2020—the highest of any year since its inception.

In a sign of improving economic prospects, 4 of the 19 (TJX, Weyerhaeuser, Estee Lauder and Darden Restaurants) reinitiated their dividends before the end of the year, making them eligible for inclusion at reconstitution.

WisdomTree U.S. LargeCap Dividend Index – Dividend Suspensions

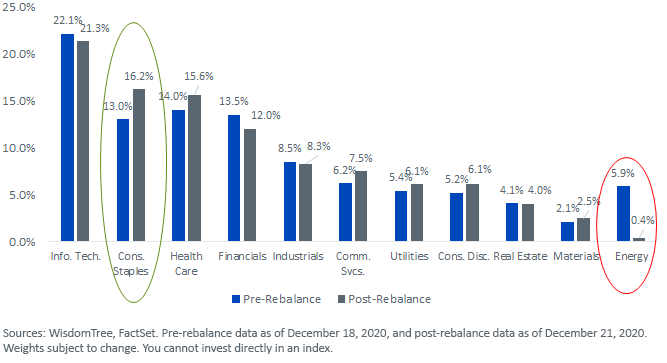

Sector Changes

Unlike in 2008, when the biggest banks were the biggest dividend payers and the epicenter of the crisis, this time around the biggest dividend-paying sector was Information Technology, a sector that has directly benefited from the COVID-19 pandemic.

Three of the four largest dividend-paying sectors—Information Technology, Health Care and Consumer Staples—had dividend growth throughout the year. Financials, the second biggest dividend-paying sector in 2019, saw dividends reduced slightly in 2020, primarily attributable to the sector’s biggest payer—Wells Fargo— trimming its dividend by 80%.

The most notable sector changes in the reconstitution were the increased weight to Consumer Staples (+3.2%) and the reduced weight to Energy (-5.5%).

The two U.S. oil majors—ExxonMobil (1.97% weight) and Chevron (1.44% weight)—were both removed from the Index by the new composite risk screening included in this year’s reconstitution that aims to mitigate exposure to the riskiest dividend payers.

Sector Composition

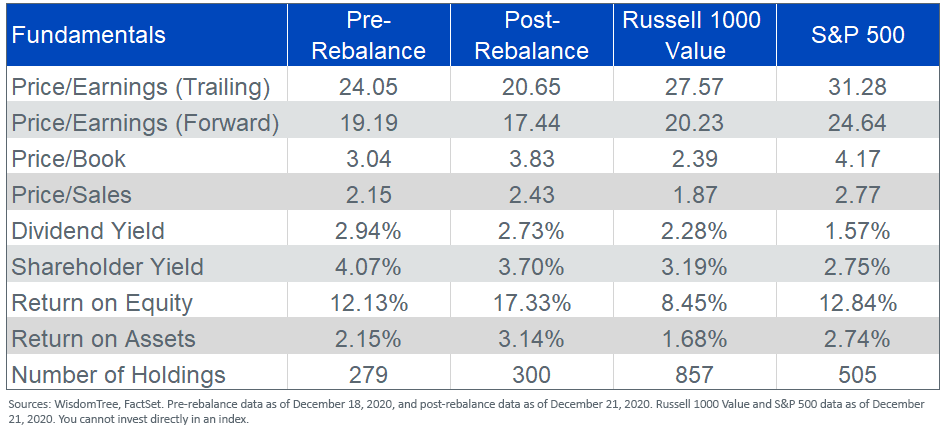

Improved Quality = More Sustainable Dividends

WisdomTree’s annual rebalance typically results in lower valuations and a higher dividend yield. This year’s reconstitution incorporated a new enhanced risk screen that eliminated high yielders deemed to be at risk.

The two oil majors and Wells Fargo were screened out of the Index, and companies with the best risk scores were given increased weight relative to their Dividend Stream® weights.

- Dividend yield: Our enhanced risk screen aims to avoid companies with ultra-high dividend yields that also have poor quality and price momentum. These high-yield companies are most at risk of cutting dividends and almost certainly less likely to grow them. As a result, we see a slightly reduced dividend yield post-rebalance (2.94% vs. 2.73%)—a trade-off for potentially more sustainable dividends—but it’s key to note that this yield advantage compared to the S&P 500 is in the top quintile of yield premium over the past decade.

- Other valuations: As a by-product of our fundamentals-based weighting and from our screen on the riskiest dividend payers, we see significantly lower earnings multiples (P/E ratios) from prior to the rebalance that are also significantly lower than the S&P 500 and also, notably, the Russell 1000 Value Index. As a result of removing “distressed” value companies from the risk screens, our price-to-book ratio rose from prior to rebalance, but it is still below that of the S&P 500.

- Quality: There is a clear improvement in quality metrics for the post-rebalance Index. Aggregate return on equity improved from 12.13% to 17.33%, and return on assets increased from 2.15% to 3.14%. These quality metrics are a substantial improvement as compared to the Russell 1000 Value Index, without sacrificing on valuations as seen by lower P/E multiples.

Fundamentals Comparison

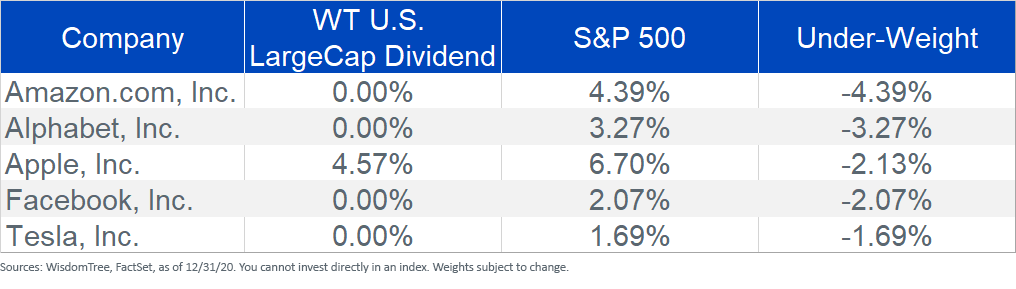

Bubbles Brewing and Market Rotation?

Many investors have concerns over market concentration in a handful of names that have performed extremely well over the past several years and dominate the cap-weighted S&P 500.

Some of these companies pay no dividends, making them significant active under-weights for this Index.

Index Weights – Top 5 Under-Weights

The significant weight that these non-payers receive, combined with overall strong performance of the market, has significantly reduced the aggregate dividend yield on the S&P 500 Index to 1.54%—its lowest level since 2004.

The yield advantage for the WisdomTree U.S. LargeCap Dividend Index is now 116 basis points2—nearly the greatest it has been in its 14-year history—all while new risk screens have made this yield advantage more sustainable, in our view.

1Source: S&P Global, 1/6/21.

2Sources: WisdomTree, FactSet, as of 12/31/20.