Time to Review Asset Allocations

This article is relevant to financial professionals and is not relevant to an individual investor. Individual investors should speak with a financial professional about their investing questions.

In December 2019, WisdomTree completed a comprehensive research study examining the mindsets of almost 2,000 consumers¹ as part of a broader study on asset allocation model portfolio usage. At that time, investors were extremely confident as they continued to ride the wave of a more-than-decade-long bull market. Since the market collapse, sentiments have changed. Consumers today are shaken and fearful.

Don’t Be Afraid to Reposition Portfolios

In the study, more than 50% of investors said they hadn’t made many changes in their portfolios other than slight rebalancing over the past three years. We also found the average advisor has not meaningfully changed client portfolios in more than 10 years.²

If we believe markets are going to recover from recent losses, what questions can advisors help their clients answer to best position?

Here are a few.

1. Is the investment policy still reflective of the current risk profile?

It’s a good idea for advisors to review their client’s allocation to make sure it’s still appropriate for their goals and determine if any circumstances have changed that will alter their investment plan. During large sell-offs we often find risk tolerances may not be as aggressive as we once thought.

2. Is the allocation in line with the investment policy?

As the bull market ran in the U.S., many investors became over-weight in U.S. stocks. Advisors, if your clients have cash on the sideline, you can consider advising dollar-cost averaging³ to rebalance back to their investment policy allocation.

It’s not possible to time the market or know when the market will bottom. Dollar-cost averaging can help to smooth purchase prices over time and ensure that your clients are not buying all their shares at the highs or the lows of the market.

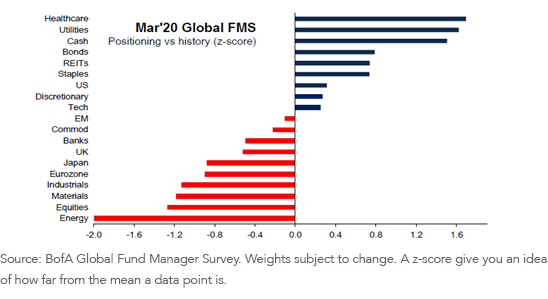

Look for under-weight and undervalued areas in the market to re-establish positions back to investment policies. As shown below in the Global Fund Manager Survey chart, which examines fund managers’ positioning of several asset classes and sectors, investors are generally under-weight in international and emerging markets relative to history.

FMS: Positioning vs. History

Today the valuations on the MSCI EAFE and MSCI Emerging Markets Indexes are trading at more than 20% discounts relative to their average over history, signaling a potential entry point for long-term investors.

Own quality overseas: When markets are volatile, exposure to the quality factor can help mitigate volatility while maintaining broach exposure to the markets. Companies that exhibit higher profitability and low leverage can potentially give investors a cushion in times of market stress.

3. How to reposition to potentially generate income in a low-yield environment?

The largest risk for retirees is the risk of outliving their money. The traditional 60% equity/40% fixed income (60/40) portfolio approach may no longer be optimal for retirees in the current global investment market.

In today’s low-yield environment, we believe quality dividend-paying value stocks need to be the foundation of income-producing portfolios. For example, today our U.S. LargeCap Dividend Fund (DLN) has a current dividend yield⁴ of 3.76% versus .60 for the 10-year Treasury bond. For standardized performance of DLN, please click here.

As retirees rethink the old 60/40 model, WisdomTree believes they will need to allocate more toward equities over fixed income and tilt toward factors such as dividend yield to seek potentially higher income generation. WisdomTree is an industry leader in dividend ETFs and recently launched the Siegel-WisdomTree Longevity Model Portfolio to address the shortcomings in the traditional 60/40 allocation.

4. Are there tax loss harvesting opportunities?

Many positions may currently be “underwater.” Rather than “wait it out,” actively seek to tax loss harvest by swapping out of existing losing positions and into similar ETF positions. The losses may be pocketed for offsetting future gains in a portfolio, and the investor remains fully invested. If appropriate for your situation, you could use this as an opportunity to sell declining, relatively expensive mutual fund positions and move into more tax-efficient, transparent and lower-cost ETFs.

As the saying goes, “Never let a good crisis go to waste.” With markets facing heavy volatility, now could be a great time for advisors to speak with their clients about refreshing their allocation.

1The results have a +/- 2% margin of error.

22020 WisdomTree Model Portfolio Research Study.

3Dollar-cost averaging is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase.

4Dividend yield refers to a stock’s annual dividend payments to shareholders, expressed as a percentage of the stock’s current price.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is at wisdomtree.com

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Dollar-cost averaging neither guarantees a profit nor protects against a loss in a prolonged declining market. Because dollar-cost averaging involves continuous investment regardless of fluctuating price levels, investors should carefully consider their financial ability to continue investing through periods of low prices.

Prior to joining WisdomTree, Alisa was Vice President and Regional Sales Manager at Van Kampen Investments. Her responsibilities included strategic planning, organization and oversight for the division and management of 20 sales consultants. She began her career at Morgan Stanley Investment Management.

Ms. Maute is a Certified Investment Management Analyst and Chartered Alternative Investment Analyst. She holds a Masters of Business Administration from DePaul University, where she graduated with honors, and a Bachelor’s of Business Administration from The University of Iowa. She is the co-head of marketing for the Chicago chapter of Women in ETFs, and a member of the Investment Management Consultants Association and the Chartered Alternative Investment Analyst Association.