European Banks: The ECB’s Conduit for Kicking the Can

We’re fielding a lot of inquiries about how the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) has held up better than the MSCI EAFE Index during the COVID-19 panic.

Much of it can be explained by the post-global financial crisis setup: when you screen for high-quality companies by using return on equity (ROE), the result is often very light exposure to the beleaguered Financials sector.

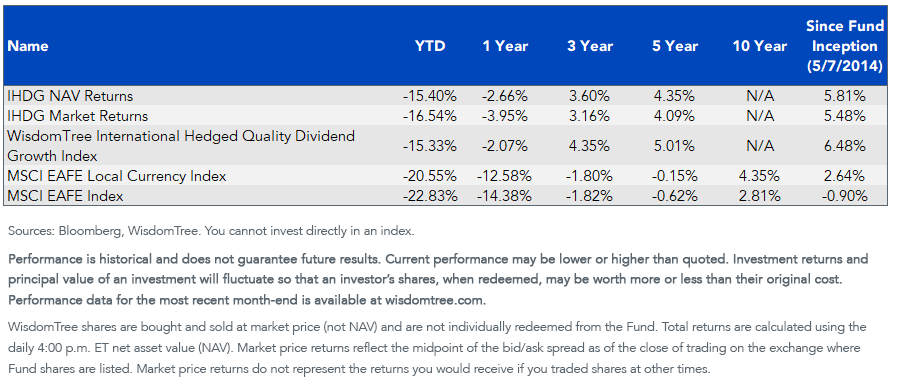

Skewing away from value in the direction of growth has proven fortuitous for international developed economy stocks in the COVID-19 crash. Figure 1 shows standardized performance, which is reported on a quarterly basis.

Figure 1: Average Annual Total Returns to 3/31/20

The Banks

Pay the dividends before the workers take notice and go on strike. That’s the European way.

Last year, companies in the MSCI Europe Index made sure to follow the rulebook, so much so that 71 cents of every dollar earned by its underlying companies was returned as dividends, a fundamentally different picture than the 38% of earnings paid out by S&P 500 companies.

Industrial actions, CEO kidnappings, stopped trains, maybe a Molotov cocktail or three. These are the headlines of European industry, of manufacturing, of airlines. With a little bit of bad luck, you can find this type of thing in a city like Paris at any given time.

But while labor strife is the threat for industrial companies, European banks have a bugbear of a different variety: European Central Bank (ECB) directives.

The ECB’s March 27 decree was predictable:

The European Central Bank (ECB) today (recommends that banks)…should not pay dividends for the financial years 2019 and 2020 until at least 1 October 2020. Banks should also refrain from share buy-backs aimed at remunerating shareholders.

The ECB expects banks’ shareholders to join this collective effort. In this vein, capital conserved by refraining from dividend distributions and share buy-backs can also be used to support households, small businesses and corporate borrowers and/or to absorb losses on existing exposures to such borrowers.

This raises two questions:

- Are European banks really “for profit” or are they functioning as conduits for ECB policy?

- Are there now parallels between European banks and China’s notorious state-owned financial institutions, where the state and the central bank is the boss?

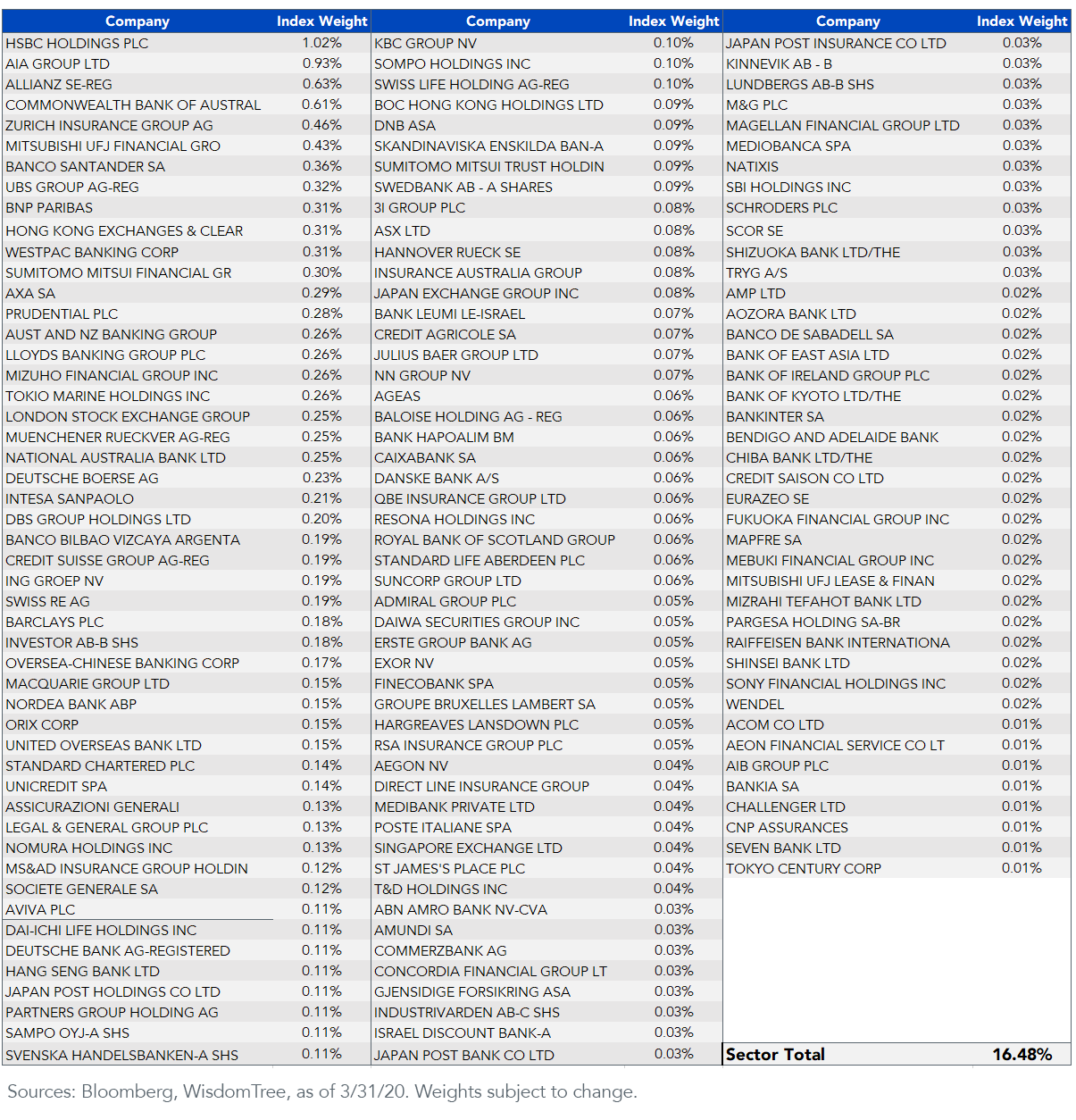

We believe The MSCI EAFE Index—the oft-cited basket of non-U.S. developed economy stocks—has a problem. Its 166 Financials companies are one-sixth of the index’s weight, even after the crash. Granted, the eurozone is just part of “EAFE,” which stands for Europe, Australasia and the Far East. But no-dividend directives are going global:

New Zealand’s Central Bank Orders Lenders to Pay No Dividends or Redeem Capital Notes – Reuters, 4/1/20

Switzerland’s financial regulator urged dividend curbs last week, saying “acting to preserve strength is not a sign of weakness.” – Wall Street Journal, 3/31/20

Along with other UK banks, HSBC decided to scrap dividend payments after urging from UK regulators. – Singapore Straits Times, 3/31/20

Here are the 166 Financials firms in the MSCI EAFE.

Figure 2: MSCI EAFE Financial Sector Companies

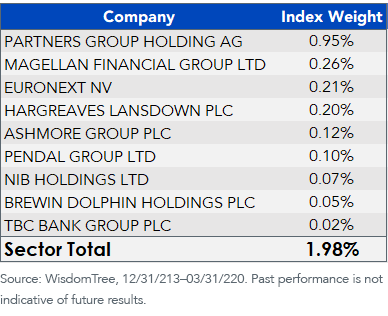

In contrast, the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH)1 has just 2% in Financials right now. No Deutsche Bank, no BNP Paribas, no Banco Santander, no tiny font needed to show them all (figure 3).

Figure 3: Financials Components, WisdomTree International Hedged Quality Dividend Growth Index

The MSCI EAFE Financials Index’s ROE is 7.6%, so its large weight pulls the ROE of the broader index down to less than half that of WTIDGH (figure 3). If rocky markets continue, it may be wise to focus away from stocks that score poorly on profitability.

Figure 4: Return on Equity ROE

Unless otherwise stated, all performance is Bloomberg as of 4/7/20.

1IHDG seeks to track the price and yield performance of the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH) before fees and expenses.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.