How to Buy Quality

This correction has been fast and deep. The markets and economy were booming in January. Now the S&P 500 Index has suffered its fastest ever drop into a bear market. As of March 31, it sits approximately 23% below recent highs. It is virtually certain a U.S. recession is upon us.

This leaves us with many questions. How long will the recession last? How deep will it get? What type of recovery will we have?

And given our limited information, how can investors position their portfolios?

One answer to the last question is: consider buying quality.

Look to the balance sheet

Imagine that each region—the U.S., international developed and emerging markets—were individual companies. Which would have the best balance sheet?

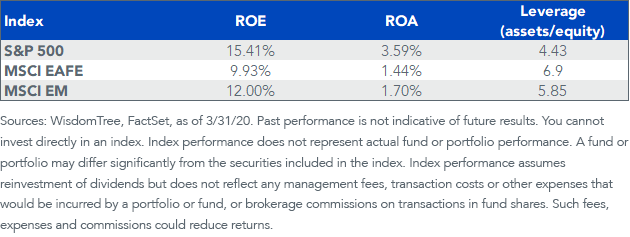

The chart below compares the S&P 500, MSCI EAFE and MSCI Emerging Markets indexes on key quality metrics: return on equity (ROE), return on assets (ROA) and leverage measured by assets/equity.

The S&P 500—a proxy for the U.S. equity market—is a standout with a strong balance sheet relative to the rest of the world. It has the highest profitability (ROE), the highest ROA and lower leverage than the other regions.

In times of uncertainty, we believe investors should position their portfolios toward regions and companies with strong balance sheets. And, right now, the U.S. is where you can find balance sheet strength.

Amplifying Quality in the U.S.

If the U.S. has the strongest balance sheet, how can you raise the quality of the S&P 500 further?

We launched the WisdomTree U.S. Quality Dividend Growth Fund (DGRW) in 2013 with quality metrics in mind for times like these.

DGRW uses a forward-looking methodology that focuses on ROE and ROA—two measures of quality used by Warren Buffett—to identify companies with high-quality balance sheets and strong potential for dividend growth. Companies must have a dividend coverage ratio (earnings per share over dividends per share) greater than 1 to be included, which is important in a time when many firms may be forced to cut their payouts.

Since its inception, this strategy has worked well for DGRW. As of March 31, 2020, it has outperformed the S&P 500 at NAV without owning any of the high-flying FAANG stocks that don’t pay dividends1.

Why consider DGRW now?

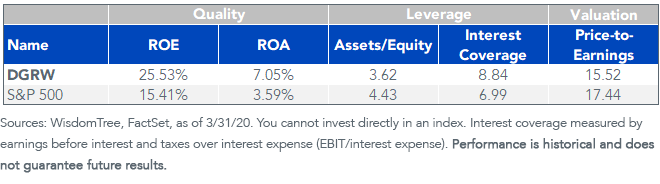

Comparing DGRW to the S&P 500 even further we find that:

- DGRW’s ROE is 65% higher than that of the S&P 500 and its ROA is nearly double.

- DGRW exhibits favorable leverage metrics relative to the S&P 500, as shown by lower assets/equity (an indicator of less debt) and higher interest coverage (higher earnings relative to interest payments).

- Today, DGRW has better quality metrics than the S&P 500 at a lower valuation. DGRW is trading at a 15.52 price-to-earnings (P/E) ratio which is at a discount relative to the S&P 500’s 17.44.

Key Metrics

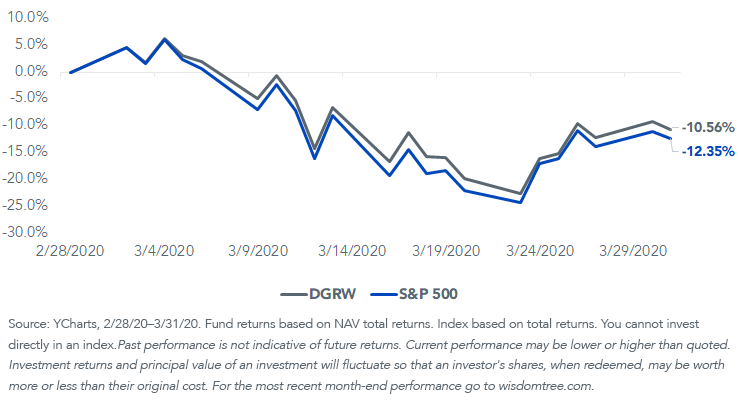

The quality factor can help mitigate volatility while maintaining broad market exposure. We’ve seen this benefit investors in real time during the recent Covid-19 decline. According to Bank of America equity research2, the highest ROE quintile of the S&P 500 outperformed the lowest ROE quintile by 10.4% during March’s sell-off.

Sure enough, DGRW outperformed the S&P 500 by 180 basis points at NAV in March. Note that outperformance does not imply positive results.

Cumulative Performance

For standardized performance of DGRW, please click here.

We don’t know how deep or long the recession will be, but we do know it makes sense to own companies with strong balance sheets that generate cash flow. In times of market stress, consider buying quality.

1Source BofA US Equity and US Quant Strategy

2Source Ycharts

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Prior to joining WisdomTree, Alisa was Vice President and Regional Sales Manager at Van Kampen Investments. Her responsibilities included strategic planning, organization and oversight for the division and management of 20 sales consultants. She began her career at Morgan Stanley Investment Management.

Ms. Maute is a Certified Investment Management Analyst and Chartered Alternative Investment Analyst. She holds a Masters of Business Administration from DePaul University, where she graduated with honors, and a Bachelor’s of Business Administration from The University of Iowa. She is the co-head of marketing for the Chicago chapter of Women in ETFs, and a member of the Investment Management Consultants Association and the Chartered Alternative Investment Analyst Association.