How to Use Quality to Seek to Reduce Drawdowns in EM

This blog has been updated with data as of March 31, 2020.

There are important differences in emerging market (EM) companies, especially when it comes to those with significant government ownership (state-owned enterprises, or SOEs) and those without it (non-SOEs).

Government ownership may lead to corporate governance issues that arise from the inherent principal-agent problem and cause operational inefficiencies and weaker levels of profitability.

The predominant industries among non-SOEs are those associated with strong earnings and revenue growth potential, such as consumer and technology companies. Non-SOEs also have higher aggregate profitability metrics than the broad index, MSCI Emerging Markets (EM) Index, and provide a significant tilt to the quality factor—companies with clean balance sheets and high profits.

When markets are volatile, exposure to the quality factor can help mitigate volatility while maintaining broad exposure to the markets.

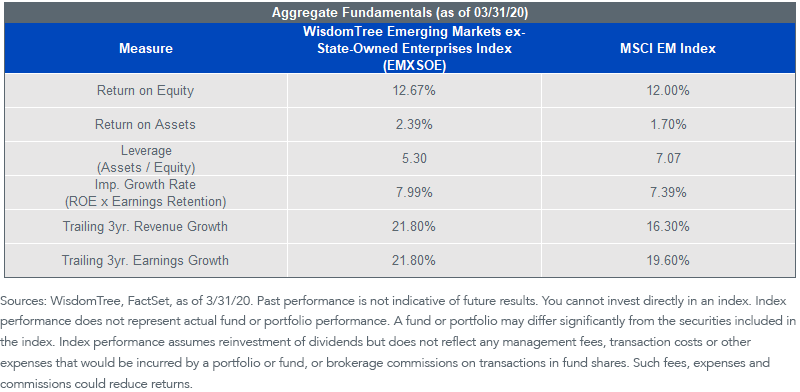

As shown in the chart below, the WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE), which excludes companies with significant government ownership, has had higher profitability, lower leverage and faster revenue and earnings growth rates than the MSCI EM Index.

During times of market stress, investors tend to favor the cushion of high profitability and low leverage as well as the potential for stronger growth.

For definitions of terms in the chart, please visit our glossary.

Quality Instead of Low Volatility in EM

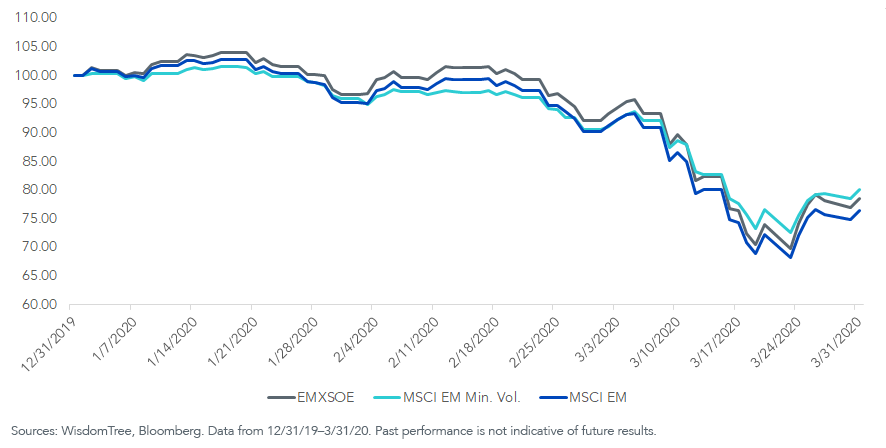

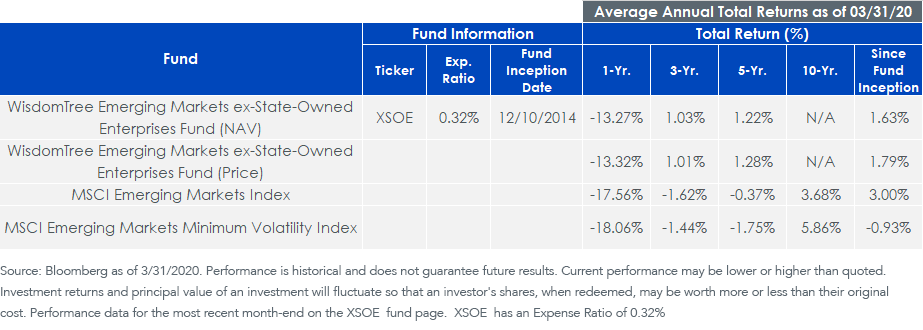

As shown below, the WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE) has outperformed the broad MSCI EM Index similar to the MSCI EM Minimum Volatility Index (MSCI EM Min. Vol. Index) during recent volatility.

Growth of $100

While providing defensive characteristics in periods of volatility, over a longer time frame as shown below, EMXSOE has been able to also capture the upside and outperform both the MSCI EM and MSCI EM Min. Vol. Indexes.

The low volatility factor has become a favored strategy for investors seeking to reduce volatility in their EM exposure. But there are several drawbacks to low volatility strategies:

- Higher tracking error: Potential for high deviation from the broad market’s returns over a full market cycle

- Significant sector and country tilts: Over-weights to defensive sectors and countries that may dampen returns in up-markets

- Higher valuations with lower growth: Because of the popularity of low volatility strategies, and the low interest rate environment, these strategies offer premium valuations with lower earnings growth.

Full-Cycle Characteristics

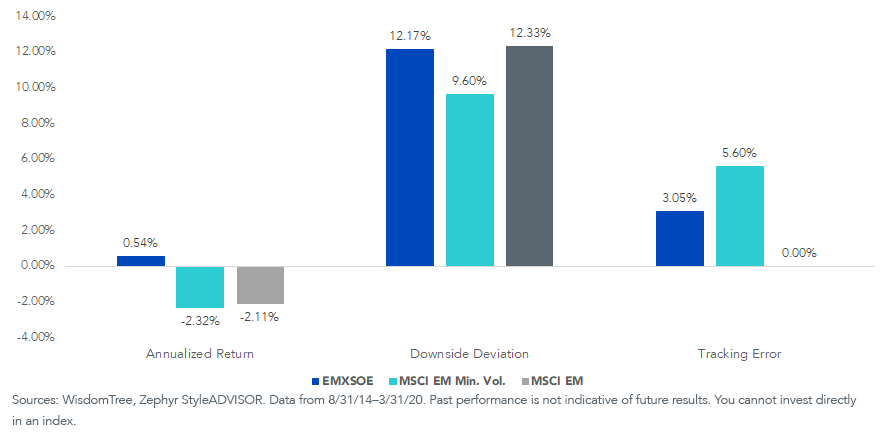

As shown below, since EMXSOE’s inception in August 2014, the strategy’s balance of growth and quality has helped it outperform an almost flat MSCI EM Index.

Despite a slightly higher standard deviation, EMXSOE shows a lower downside deviation1 compared to the broad market. EMXSOE’s tracking error to MSCI EM over the period has been 3.05%, significantly less than MSCI EM Min. Vol.’s 5.60%.

EMXSOE’s Sortino ratio2—which measures excess return adjusted for downside deviation—is also higher than MSCI EM Min. Vol as of March 31, 20202. This means that EMXSOE has provided 4 basis points (bps) of excess return for every unit of downside deviation1, while MSCI EM Min. Vol. has a -0.24 ratio. So, despite showing lower downside volatility, it hasn’t provided excess returns.

Performance and Growth Characteristics

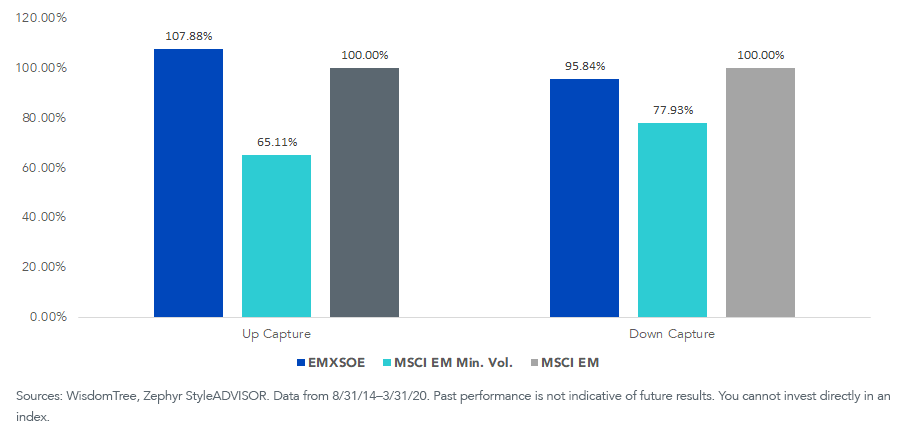

Looking at up- and down-capture validates the idea of EMXSOE’s balance of growth potential and quality to seek to manage drawdowns.

Since August 2014, EMXSOE has managed to capture close to 108% of the broad market’s upside while also capturing less than 100% of the downside.

Up- & Down-Capture

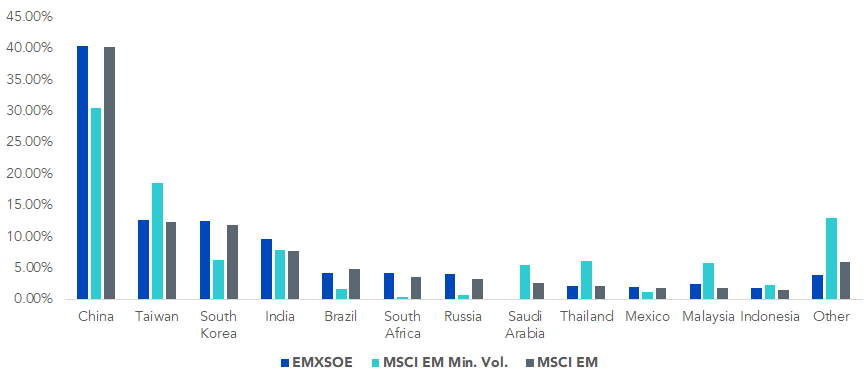

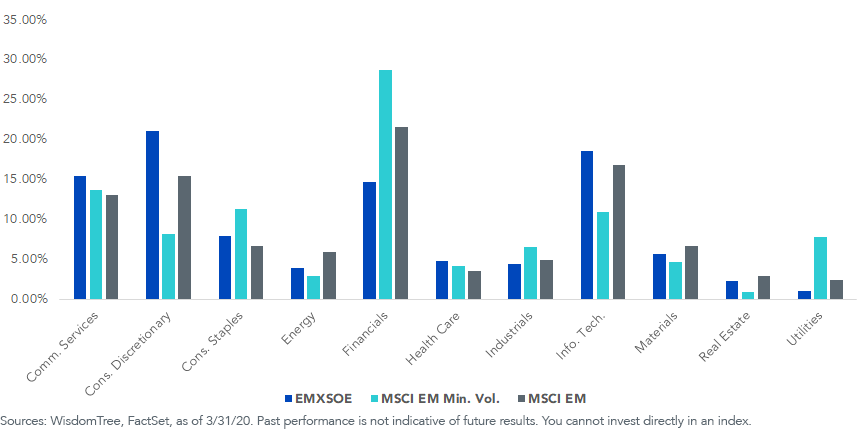

Country & Sector Exposures

Thanks to constraints embedded in its methodology, EMXSOE has more consistent country and sector exposures compared to the MSCI EM, with modest over-weights in the Information Technology and Consumer Discretionary sectors while being under-weight in Financials and Energy.

On the other hand, the constraints for the MSCI EM Min. Vol. Index allow it to deviate more from the broad market index.

As other traditional low volatility strategies, MSCI EM Min. Vol. index is over-weight in the defensive sectors and under-weight in cyclical sectors, while also being under-weight in China, South Korea and Brazil in favor of Taiwan, Thailand and Malaysia.

Country Exposure

Sector Exposure

Conclusion

In periods of market volatility, having the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE)—which seeks to track the price and yield performance, before fees and expenses, of the EMXSOE index—within your portfolio’s EM exposure can help on several levels.

XSOE historically has better aggregate quality (profitability) than the broad market and can help mitigate drawdowns.

XSOE aims to provide investors with a broad exposure to the EM space, avoiding significant country and sector tilts that come from targeting the low volatility factor.

XSOE seeks to achieve a balance between higher growth potential while reducing downside risk compared to the broad market.

1 Downside deviation measures volatility in periods of negative return, addresses a shortcoming of standard deviation which makes no distinction between upside deviations and downside deviations.

2 Sortino ratios: 0.04 for EMXSOE, -0.24 for MSCI EM Min. Vol and -0.17 for MSCI EM.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.