Ain’t Talking ’bout Love

The rapidity and magnitude of the recent market decline may have some folks thinking of the lyrics to Van Halen’s Ain’t Talking ’bout Love:

(You know) I been to the edge

And there I stood and looked down

You know I lost a lot of friends there, baby

I got no time to mess around…

Ain’t talkin’ ’bout love

My love is rotten to the core

Ain’t talkin’ ’bout love

Just like I told you before, before, before

In a recent blog, we suggested, “The market disruption has left market valuations, especially in the most beat up areas—small- and mid-cap stocks, value and quality stocks and dividend-paying stocks—at far more attractive levels than even just one month ago.”

How might we take this idea, that certain parts of the market have been oversold and/or poised for relative outperformance, and translate that into ideas for investment or portfolio reallocation?

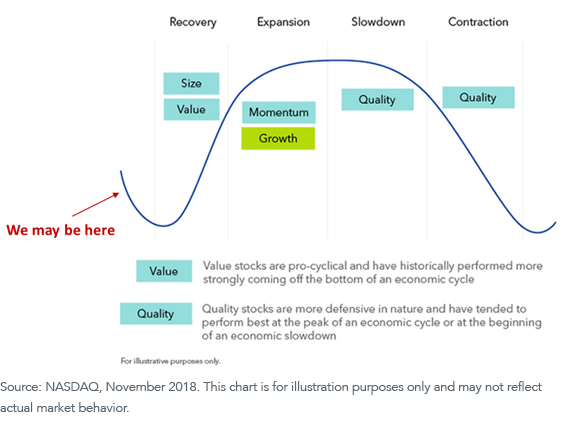

First, let’s examine typical market behavior over a full economic cycle. As we’ve suggested, we may not be at the bottom of the current market decline, but we believe we are approaching it (especially now that Congress finally passed its highly anticipated fiscal stimulus bill):

Typical Behavior of Global Business Cycle

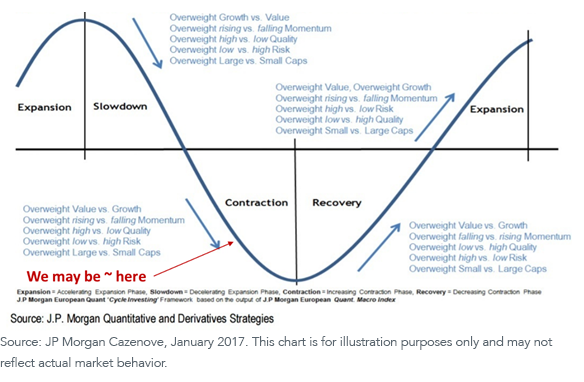

A more detailed illustration of this idea might look like this:

JPM Quant "Cycle Investing"–Linking the Economic Cycle with Style Returns

How do some of these investment style suggestions play out in real time?

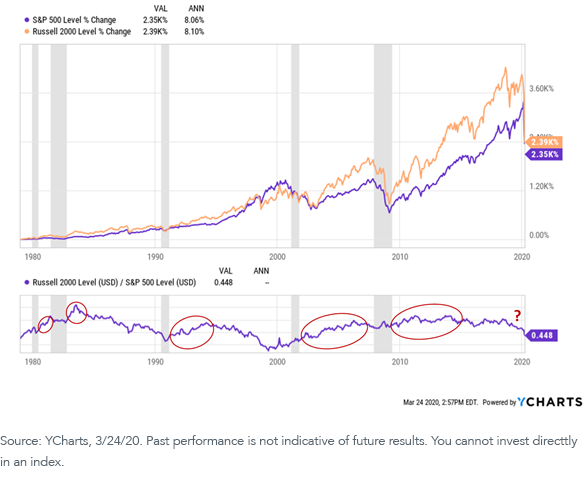

Here is a performance comparison of U.S. large-cap versus small-cap stocks over the past 40 years (with recessions marked by the gray bars). As you see from the small-cap/large-cap performance ratio chart at the bottom, small cap has outperformed every time the economy entered recovery mode:

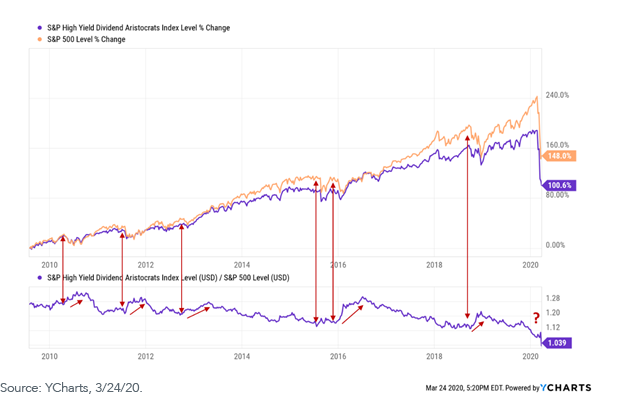

Likewise, dividend-paying stocks show a good track record of outperforming the core market index during recovery periods following market downturns:

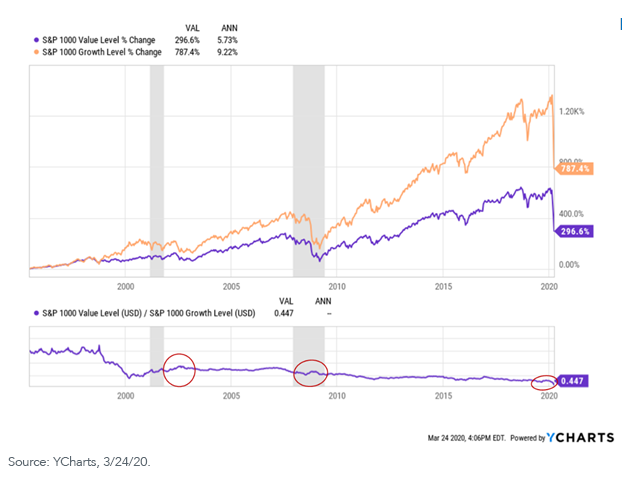

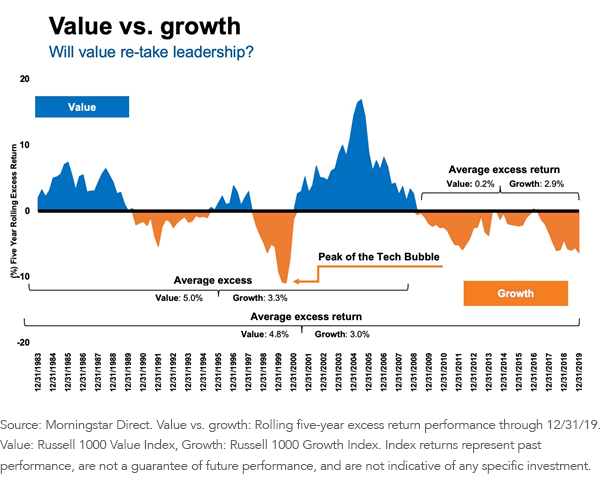

There are less dramatic results when examining the performance of value stocks compared to growth stocks:

We see outperformance by value stocks following the collapse of the tech bubble in 2000, then a slight bump in relative performance during the global financial crisis of 2007–2008. There’s another bump in Q4 of 2019 (a factor rotation that was still in place in early 2020, but which disappeared almost instantly when the virus-induced market decline began in late January).

However, when viewed in terms of relative valuation, as well as an anticipated mean reversion basis, it remains an interesting time to consider leaning back into value1.

[Note: There are multiple potential reasons for the consistent underperformance of value stocks since the market recovery began in 2009, but that is a topic for a different time and blog.]

We understand how difficult the current market conditions are, and how difficult it can be to look past the volatility, stress and anxiety, and take a longer-term perspective on portfolio allocation. But, as we have suggested before, we do believe this will end, and the market will recover. We don’t know when, and we accept that we may have further down to go. But the current crisis will end, and the market will recover.

In anticipation of that time, we believe now is an excellent opportunity to think about and plan how to lean back into the markets. History suggests that there are certain investment styles, strategies and risk factors that will lead the way once the recovery begins.

In closing, we can’t help but wonder how Revolutionary War patriot Tom Paine might have rewritten his opening paragraphs to Common Sense had he been writing about the current market environment.

With respect and apologies to Mr. Paine, it might have gone something like this (poetic license is underlined):

THESE are the times that try investors’ souls. The summer soldier and the sunshine patriot will, in this crisis, shrink from market disruptions; but he that stands by it now (and seeks attractive re-entry points), deserves the love and thanks of man and woman.

Market fear, like hell, is not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph.

What we obtain too cheap, we esteem too lightly (though it tends to maximize long-term performance): it is dearness only that gives everything its value. Heaven (and a functioning market) knows how to put a proper price upon its goods; and it would be strange indeed if so celestial an article as RECOVERY should not be highly rated.