Diversifying Income Streams

Treasury yields setting new all-time lows is starting to feel like an everyday occurrence. With markets signaling that a jolt of stimulus was expected from the Federal Reserve (Fed), the Fed delivered with an emergency 50 basis point (bps) cut this week.

Taking a step back from recent coronavirus induced volatility, rates have been trending lower since the late 2018 market correction. This has led many investors to seek income from higher-yielding equities. The 30-Year yield now sits comfortably below the post-sell-off 2% dividend yield on the S&P 500 Index.1

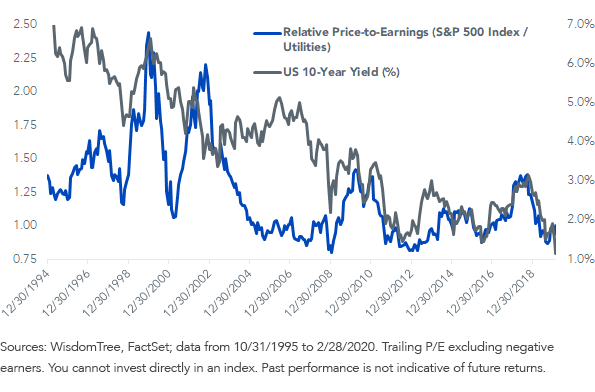

A reach for yield in equities is clear from the run-up in Utilities valuations. The bond-proxy sector has been trading at a price-to-earnings (P/E) premium to the S&P 500 Index since mid-2019.

Utilities Valuations and Interest Rates

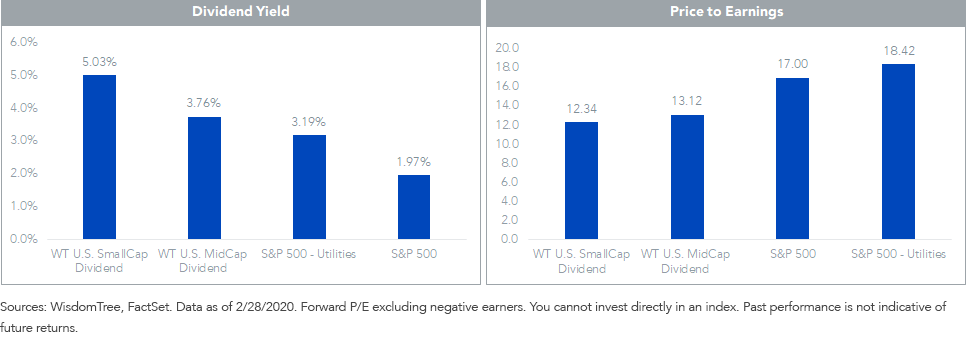

At WisdomTree, we have long argued for investors to build equity portfolios with diversified income streams. The S&P 500 Index has a higher dividend yield than U.S. Treasuries, but its valuations are near 20-year highs—albeit discounted from levels of two weeks ago—with Utilities valuations even higher.

WisdomTree’s dividend-weighted mid- and small-cap Indexes offer diversification from richly valued large caps, and more growth potential than Utilities. Because smaller companies are typically priced at discounts to their larger peers to compensate for additional risk, investors can obtain higher yields by allocating down the size spectrum for yield.

WisdomTree’s Indexes have lower earnings multiples and higher yields than both the broad large-cap index and the Utilities sector.

Yield and Valuation

Small-/Mid-Cap Dividend Universe

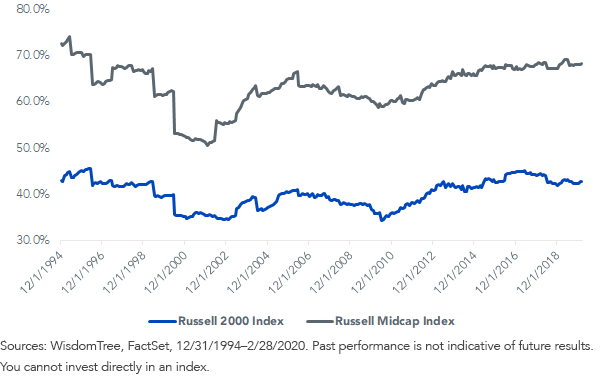

While the universe of mid- and small-cap dividend payers is smaller than it is for large caps, a broad universe of 68% of the Russell Midcap Index and 43% of the Russell 2000 Index constituents do pay dividends. This percentage has steadily increased over the past decade.

Percent Index Constituents Dividend Payers

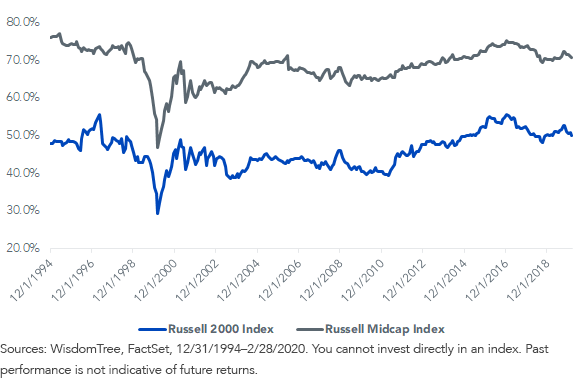

As a percentage weight of each index, dividend payers comprise 71% of the weight of the Russell Midcap Index and 50% of the Russell 2000 Index.

Percent Index Weight Dividend Payers

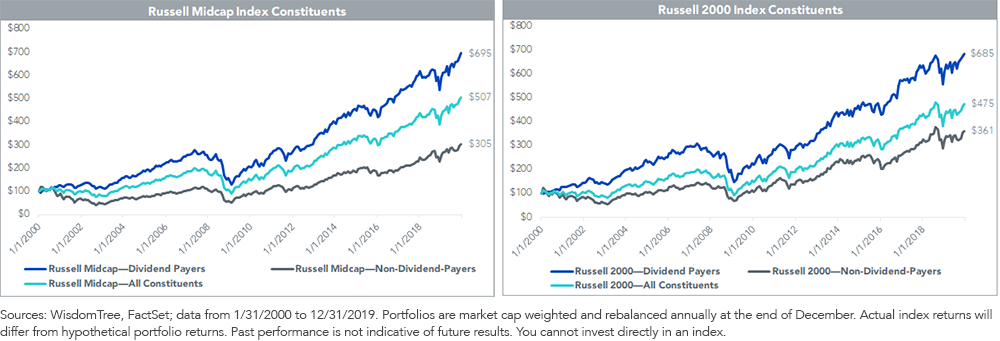

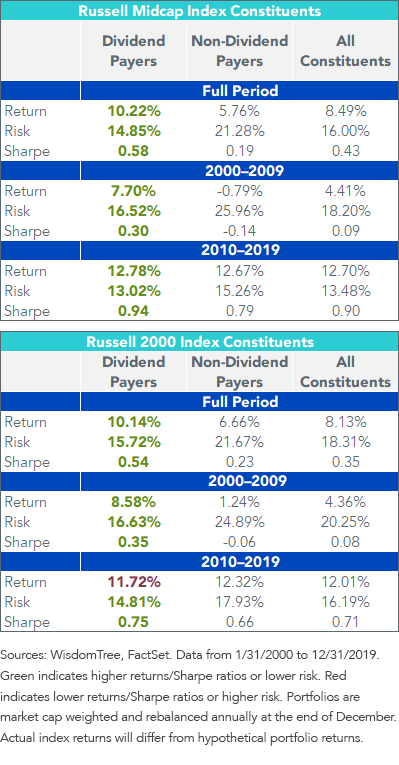

Over the past 20 years, using market cap weighting, non-dividend payers within the Russell Midcap have underperformed dividend payers by 4.46% annualized. Within the Russell 2000, the non-dividend payers have underperformed by 3.48% annualized.

During certain periods where growth significantly outperforms value, non-dividend payers—highly correlated to small-growth—tend to outperform. Over the long run, these small-growth companies have lagged their dividend-paying peers and have done so with higher risk (standard deviation).

Performance Impact of Excluding Non-Dividend Payers

Most of the excess returns of dividend payers for this period came from the early 2000s, immediately following the tech bubble. The portfolio of mid-cap dividend payers slightly outperformed non-dividend payers over the growth-led rally of the 2010s. But the small-cap dividend payers lagged by about 60 bps annualized. Because of the significant risk reduction, the small-cap dividend payers had a higher Sharpe ratio.

Summary Return Statistics

Balancing Risks and Yield

Should the coronavirus tilt the U.S. economy into recession—a scenario that is too early to predict—small caps will certainly be punished more than large caps, and some dividend payers will be forced to cut their payouts. A diversified basket of companies helps mitigate that threat.

Elevated valuations of large-cap equities and historically low yields in fixed income create unprecedented challenges for asset allocators. As illustrated, mid- and small-cap dividend payers may be one way to help lower overall portfolio valuations and increase income—thus helping to solve for valuation risks and shortfall risks.

Investing in smaller companies involves incremental risk as measured by the volatility of returns. But focusing on dividend payers can help lower that risk, as well as adding diversification to portfolios—an important consideration, given the tech-heavy concentration of many U.S. large-cap portfolios today.

1Sources: WisdomTree, FactSet, as of 2/28/20.