International Quality

Value’s outperformance this year has not been an exclusively U.S. phenomenon.

U.S. investors’ focus has been on the collapse of tech favorites—companies like Netflix and Meta, each down more than 50% from peak market caps—and the resurgence of “old economy” sectors like Energy and Utilities.

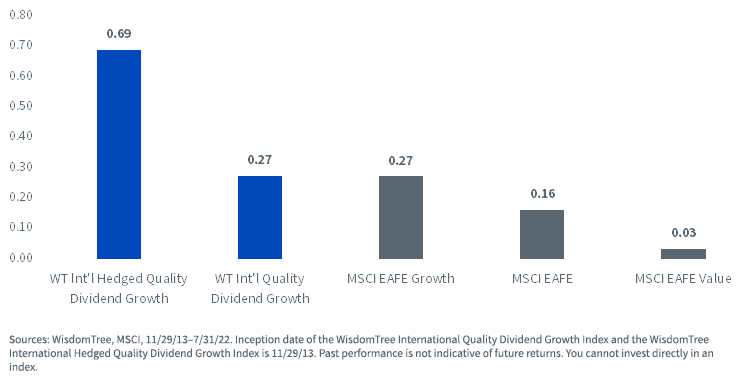

In the developed international markets, value has similarly bested growth across large, mid- and small caps.

MSCI EAFE Style Indexes as of 8/15/22

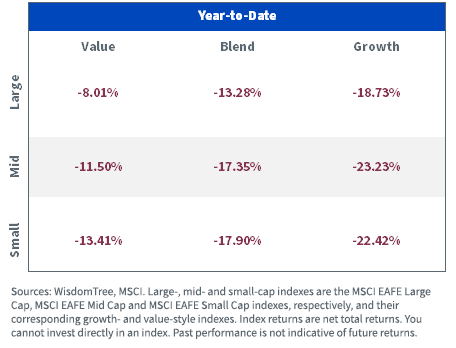

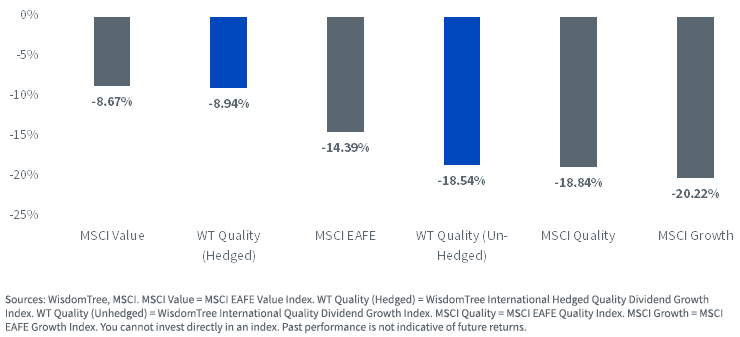

Quality indexes, particularly those focused on profitability, tend to tilt toward growth.

A growth bias has contributed to developed international quality lagging more value-tilted factors like high dividends.

Year-to-Date Developed International Index Performance as of 8/15/22

Defining Quality

Each index provider defines quality slightly differently.

WisdomTree’s definition of quality includes metrics associated with dividend growth—the existence of a regular cash dividend, high return on equity and return on assets and high growth expectations.

The intention of including dividends as an element of quality was to combine a profitability and growth screen with an element of valuation discipline—Dividend Stream® weighting—that would better balance the risk of overpaying for high-growth/quality companies.

A rolling three-year tracking error of the WisdomTree International Quality Dividend Growth Index versus the broad market MSCI EAFE Index and its value and growth counterparts shows that the Index’s performance does track most closely to the MSCI EAFE Growth Index.

WisdomTree International Quality Dividend Growth Index Rolling Three-Year Tracking Error

![]()

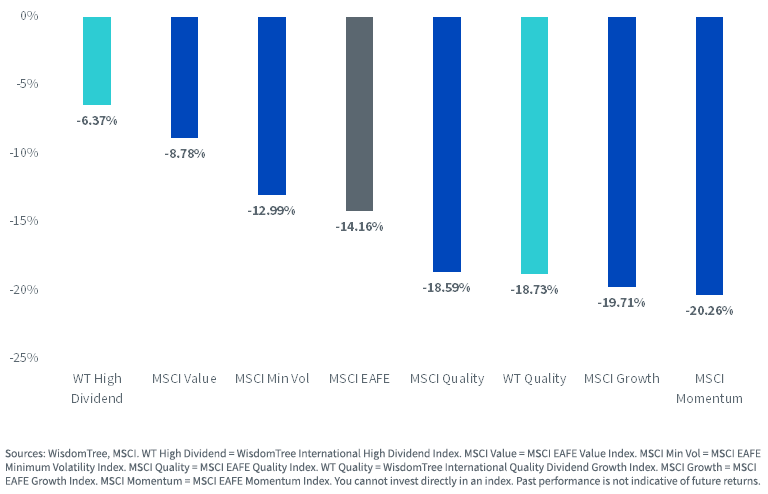

However, the dividend-weighting process results in a quality index that has valuations more in line with the broad MSCI EAFE Index than with the MSCI EAFE Growth Index, and with premium return on equity and return on assets.

The return on equity for WisdomTree’s quality index is more than twice that of the MSCI EAFE Growth Index, and even a material improvement over the S&P 500 despite lower P/E multiples.

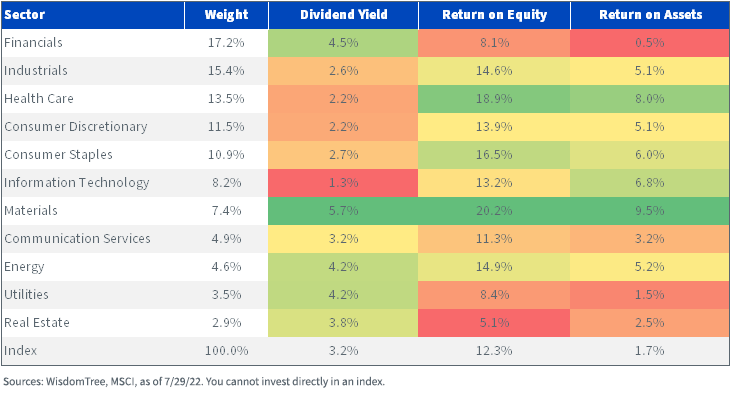

Index Characteristics

Sector and Country Allocations

Unlike indexes that constrain sectors and countries to be close (or neutral) to a benchmark, WisdomTree’s international quality index has sector and country caps of 20%. This allows for material deviation compared to the broad developed international universe with guardrails to prevent any country or sector from dominating the portfolio.

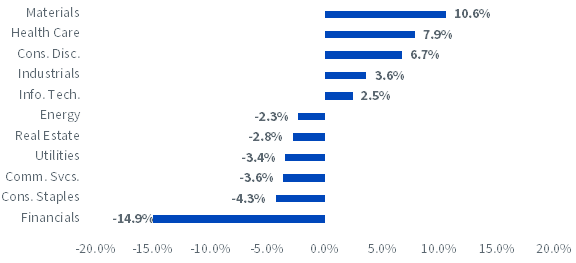

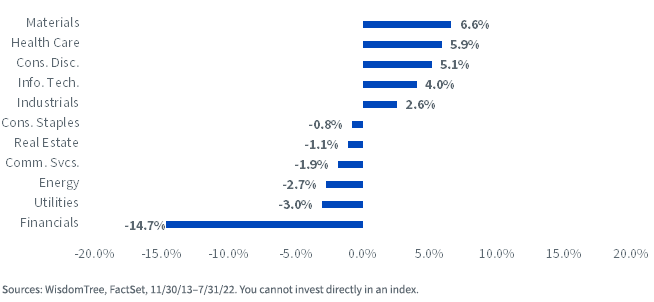

Historically, the Index has been over-weight Materials, Health Care and Consumer Discretionary, and heavily under-weight Financials.

Sector Differential vs. MSCI EAFE Index as of 7/31/22

Average Sector Differential vs. MSCI EAFE Index

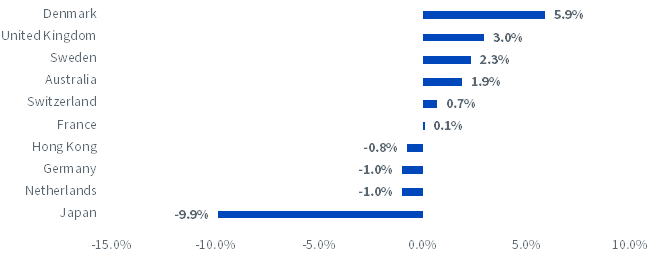

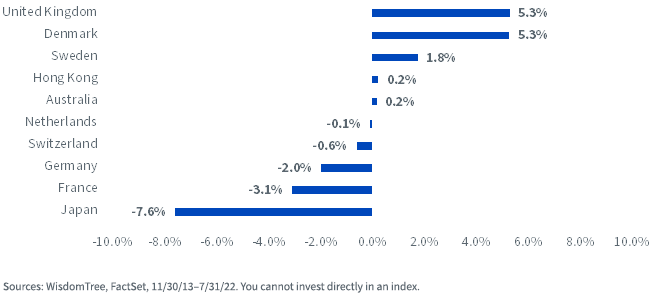

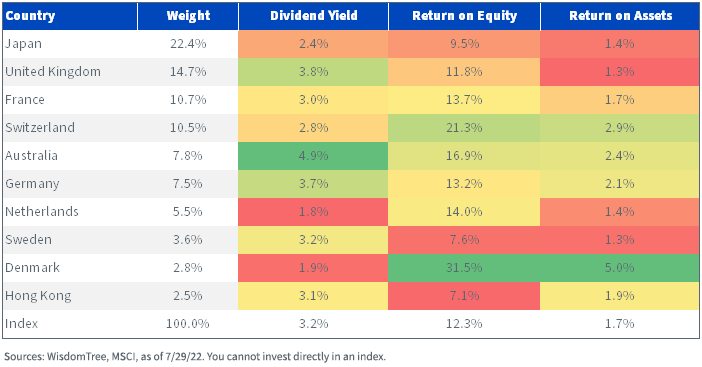

From a country perspective, the Index has been persistently under-weight Japan (-8% on average) and over-weight Denmark and the United Kingdom.

Country Differential vs. MSCI EAFE Index as of 7/31/22

Average Country Differential vs. MSCI EAFE Index

The MSCI EAFE Index is skewed toward value sectors like Financials and Industrials, in some ways the opposite of the growth-heavy S&P 500, which is dominated by mega-cap tech names.

While Financials has the second-highest dividend yield, the sector has below-average ROE and ROA, which causes the persistent under-weight in the WisdomTree quality index.

Materials and Health Care have the highest ROE and ROA, driving the over-weights to those two sectors.

MSCI EAFE Sector Characteristics

Japan has low dividend payout ratios—although they have been increasing in recent years. Its combination of a low dividend yield and weak profitability has caused the Index to be under-weight the largest country in MSCI EAFE.

The high ROE/ROA from Denmark and the high dividend payouts from the United Kingdom help explain the over-weights to those two countries.

Top 10 Country Characteristics

Currency Risk

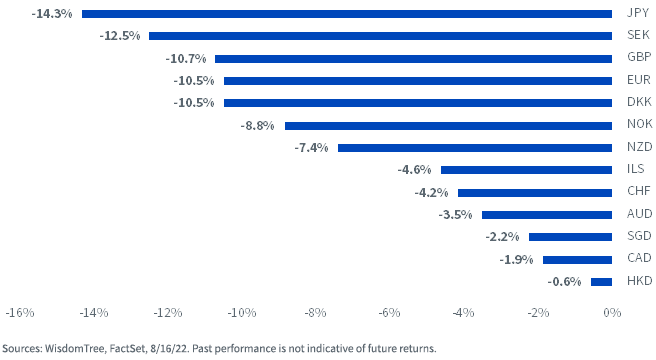

In addition to the value versus growth theme, another major market theme of 2022 has been the strength of the U.S. dollar.

In local currency terms, without the impact of currency movements, the MSCI EAFE Index is down just 5.15%, more than 300 basis points better than the S&P 500 Index return of -8.8%.

With the dollar strengthening more than 10% against the euro and the yen, the unhedged MSCI EAFE Index is down more than 14%.

Year-to-Date Developed Market Currency Change vs. USD

In our view, currency risk—and the potential currency headwind—is an underappreciated factor when investors allocate overseas.

The WisdomTree International Hedged Quality Dividend Growth Index has the same equity basket as the WisdomTree International Quality Dividend Growth Index but aims to neutralize the impact of currency moves on performance.

Year-to-Date Index Return as of 8/16/22

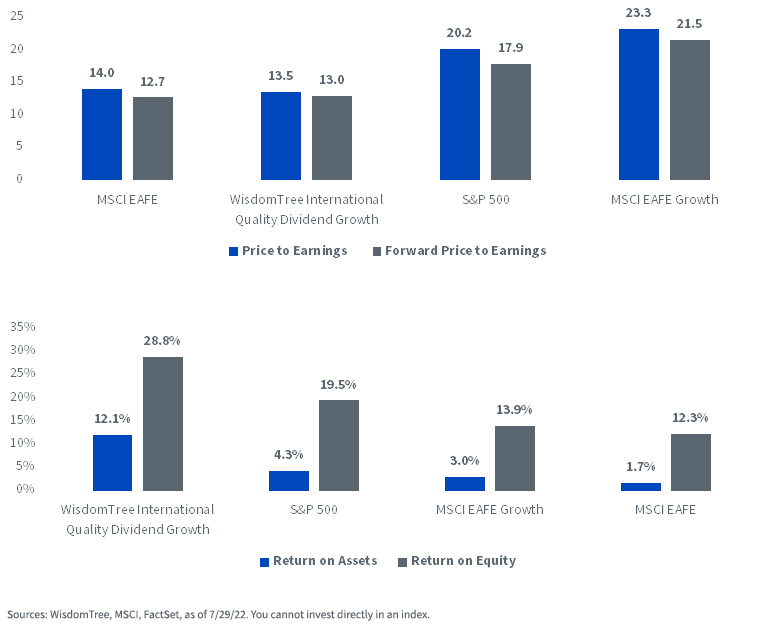

Over the long run, mitigating the incremental risk of the currency exposure—along with a period of general dollar strength—has contributed to the higher risk-adjusted returns for the currency-hedged index compared to the unhedged MSCI EAFE indexes.

Index Sharpe Ratio Since 11/29/13